ICE Futures Singapore Monthly Report

May 2025

Gain a deeper understanding of emerging market trends, risks and opportunities with bitcoin, FX, equity and energy markets analysis. The Research Team at Traddictiv shares their views in this monthly report, including statistics for active or passive traders and hedgers.

Our global infrastructure is engineered to provide markets and clearing houses in the time zones and regulatory jurisdictions where our customers do business.

MACRO COMMENTARY

The MINI U.S. DOLLAR INDEX ® FUTURES (SDX) closed with a modest gain of 0.07% for the month at 99.53, bucking the broader trend as the U.S. Dollar Index ® fell for a fifth consecutive month. This relative resilience in the Mini U.S. Dollar Index ® futures came amid persistent economic uncertainty and volatility triggered by newly proposed U.S. trade tariffs, which continued to weigh on investor sentiment and global market confidence.

- Nonfarm Payrolls for April rose by 177,000 jobs, exceeding market expectations of 130,000 but reflecting a slowdown from March’s downwardly revised total of 185,000. The unemployment rate held steady at 4.2% in April, unchanged from March. Average hourly earnings increased by 0.2% for the month, with annual wage growth at 3.8%, matching the pace seen in March. The SDX closed at 99.69, with a 0.42% loss on the day.

- The Federal Reserve kept the federal funds rate unchanged at 4.25% - 4.50% for a third consecutive meeting, as the Fed maintained its cautious, data-dependent stance due to the continued economic uncertainty and ongoing developments in trade policy. The SDX closed higher at 99.70, up 0.31% on the day.

- Annual Core Inflation, excluding food and energy, remained steady at 2.8% for the 12 months ending in April, matching the March figure and aligning with market expectations. The Consumer Price Index (CPI) for the same period eased to 2.3%, down from 2.4% in March and below the anticipated 2.4% rise. These continued signs of subdued inflation contributed to the SDX closing at 100.90, with a 0.50% loss on the day.

The MINI BRENT CRUDE FUTURES (BM) retested the prior low set on April 9th, reaching $58.50 on May 5th before rebounding to an intra-month high of $66.81 on May 13th. The contract closed the month at $62.78, near the 50% Fibonacci retracement level between the intra-month high and low, recording an overall gain of 2.8% compared to the previous month’s close.

- The International Energy Agency (IEA) forecasted a slowdown in global oil demand growth, easing from 990,000 barrels per day (bpd) in the first quarter to 650,000 bpd for the remainder of the year. This moderation was driven by persistent economic challenges and a surge in electric vehicle adoption. Market volatility was further heightened by trade tensions, including new U.S. tariffs.

- On the supply front, oil output is scheduled to rise by 411,000 bpd in July, marking the third straight monthly increase as part of the phased reversal of the 2.2 million bpd in voluntary cuts. The goal is to fully restore production by September 2026. Originally, the plan called for more gradual monthly hikes of approximately 138,000 bpd over 18 months. The higher adjustment level reflects OPEC+ efforts to reclaim market share and enforce compliance among members exceeding their quotas, notably Iraq and Kazakhstan.

The MICRO COINDESK BITCOIN FUTURES (MCB) ascent to $111,202 marked a new all-time high in the contract, driven by institutional investments and favorable regulatory developments toward bitcoin. The price traded past the $100,000 level and prior all-time-high of $108,772, closing the month at $105,980, marking an 11.0% gain.

- Institutional demand for bitcoin surged as the U.S. government activated its Strategic Bitcoin Reserve, following President Trump's March Executive Order, officially recognizing bitcoin as a reserve asset. Strategy (formerly MicroStrategy) acquired over 4,000 additional bitcoin, raising its total to 580,250 and reaffirming its position as a corporate pioneer in bitcoin adoption. Trump Media also announced plans to raise $2.5 billion to build a bitcoin treasury, underscoring a growing trend of corporations integrating bitcoin into their financial infrastructure. These moves signaled a deepening institutional commitment supported by favorable regulatory momentum.

The MICRO ASIA TECH 30 INDEX FUTURES (ATI) closed higher in May, finishing the month at $4,520, up 6.0% from April. The technology sector attracted strong inflows, bolstered by better-than-expected earnings from key semiconductor firms such as TSMC and Samsung. Additionally, increased capital expenditure by major technology companies on artificial intelligence (AI) infrastructure was viewed as a positive catalyst for future growth in the sector.

- Taiwanese stocks delivered strong results. Quanta Computer outperformed with a gain of 13.80%. Delta Electronics advanced 12.10%, while Hon Hai Precision rose 10.20%. TSMC climbed 6.50%, ASE Technology edged up 1.80%, but MediaTek declined 6.70%.

- Japanese stocks broadly gained. Advantest led the rally with a surge of 25.70%, followed by DISCO up 19.00% and FUJIFILM Holdings rising 11.90%. Lasertec added 9.90%, while Tokyo Electron rose 8.40% and Renesas Electronics gained 6.60%. Fujitsu increased 5.30%, Keyence rose 1.50%, and Sony inched up 1.00%. Canon gained 0.60%, Nintendo was flat, and Murata Manufacturing declined 3.70%.

- Chinese stocks showed mixed performance. NetEase climbed 14.20%, Meituan gained 5.90%, and Tencent advanced 4.40%. Kuaishou added 3.30%, Xiaomi rose 2.00%, and JD.com edged up 0.80%. Meanwhile, Alibaba fell 3.10% and Baidu declined 5.60%.

- South Korean stocks were divided. SK hynix surged 15.20%, Samsung Electronics rose 1.30%, but LG Energy Solution tumbled 11.90%.

- Australian shares saw strong gains, with Wisetech Global jumping 21.00% on solid software demand.

MINI U.S. DOLLAR INDEX ® FUTURES

The month opened with the SDX extending its bullish momentum from late April, breaking above the midpoint of the daily Bollinger Bands and closing with a 0.85% gain, aided by stronger-than-expected ISM Manufacturing PMI data. However, sentiment shifted the following day after the Nonfarm Payrolls report, which, although it surpassed expectations, revealed a decline in job growth. This led to a reversal, and the SDX closed lower on the day, although it still managed to finish the week up 0.29% at 99.69. The following week, the SDX dipped to a low of 99.00 before reversing and rallying, closing the week at 100.14 after retreating from the upper boundary of the daily Bollinger Bands. The rally was supported by the Federal Reserve’s decision to keep interest rates steady at 4.25% - 4.50%, which matched market expectations and provided short-term stability. In addition, President Trump announced the finalization of the U.S.-U.K. Trade Agreement, which helped boost demand for the U.S. Dollar. The week ended with SDX closing at 100.14 with a gain of 0.44%.

The following week, the SDX rallied on May 12th to reach a high of 101.62 after the announcement of a temporary 90-day tariff relief agreement between the United States and China. It reached a daily resistance area at 101.60-103.11 before closing at 101.36. The bearish momentum gathered pace after the release of April’s softer inflation data on May 13th. While headline CPI remained stable, core inflation dipped slightly, which was slightly below expectations, causing the SDX to close lower. The index found support at the midpoint of the Bollinger Bands mid-week, bounced, and ended the week with a gain of 0.62% at 101.04. The sentiment shifted once again the following week as demand for the U.S. Dollar weakened, and the SDX dropped to break below the midpoint of the Bollinger Bands, closing the week with a loss of 1.41% at 99.21. The index rebounded on May 26th after almost reaching a daily support area at 98.61 - 97.70 as demand returned. In return, the SDX traded higher, reaching a daily resistance area at 99.94 - 100.34 on May 29th before reversing. The SDX closed the week with a gain of 0.85% at 99.53. The Mini U.S. Dollar Index ® futures closed the month with a modest increase of 0.07%.

Daily technical indicators of SDX prices indicated a strong sell overall based on the moving averages. The technical oscillators indicated generally neutral conditions, which could prompt investors to consider waiting for a pullback before seeking trading opportunities. Using historical volatility, the price from the prior month’s close could range between 103.01 to 95.51 within the next 32 days. Investors or traders may consider the weekly support (96.36 to 95.69) or resistance areas (101.62 to 97.70) when planning their entries or exits, depending on their trading strategies. In May, the SDX remained in a downtrend in the weekly timeframe and sideways on the daily timeframe.

| STATISTICAL VOLATILITY RANGES | STATISTICAL VOLATILITY RANGES | |||

|---|---|---|---|---|

| 21-day | 42-day | 63-day | Monthly (Min) | Monthly (Max) |

| 10.87% | 13.08% | 11.75% | ±3.115 | ±3.748 |

MINI BRENT CRUDE FUTURES

Mini Brent Crude futures (BM) retested the prior low set on April 9th, reaching $58.50 on May 5th before rebounding to an intra-month high of $66.81 on May 13th. The contract closed the month at $62.78, near the 50% Fibonacci retracement level between the intra-month high and low, recording an overall gain of 2.8% compared to the previous month’s close.

The International Energy Agency (IEA) forecasted a slowdown in global oil demand growth, easing from 990,000 barrels per day (bpd) in the first quarter to 650,000 bpd for the remainder of the year. This moderation was driven by persistent economic challenges and a surge in electric vehicle adoption. Market volatility was further heightened by trade tensions, including new U.S. tariffs.

On the supply front, oil output is scheduled to rise by 411,000 bpd in July, marking the third straight monthly increase, as part of the phased reversal of the 2.2 million bpd in voluntary cuts. The goal is to fully restore production by September 2026. Originally, the plan called for more gradual monthly hikes of approximately 138,000 bpd over 18 months. The higher adjustment levels reflect OPEC+ efforts to reclaim market share and enforce compliance among members exceeding their quotas, notably Iraq and Kazakhstan.

Daily technical indicators of oil futures (BM) prices indicated strong selling market conditions. Technical oscillators in the prior month pointed toward neutral to weak market conditions. Using historical volatility, the price from the prior month’s close could range between $54.64 and $70.92 ($16.28) in the next 32 days. Investors or traders could consider daily support ($53.89 to $55.04) or weekly resistance ($64.53 to $66.63) areas when planning their entries or exits based on their trading strategies.

| STATISTICAL VOLATILITY RANGES | STATISTICAL VOLATILITY RANGES | |||

|---|---|---|---|---|

| 21-day | 42-day | 63-day | Monthly (Min) | Monthly (Max) |

| 30.80% | 44.91% | 39.43% | ±5.58 | ±8.14 |

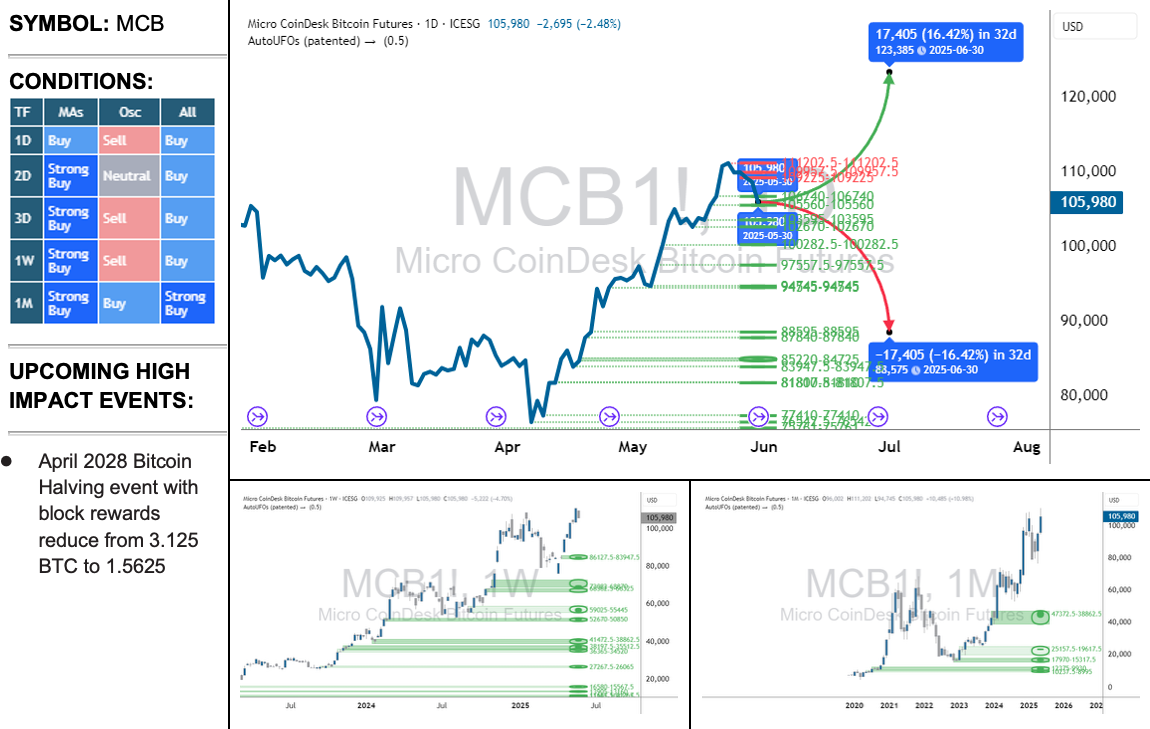

MICRO COINDESK BITCOIN FUTURES

Micro Coindesk Bitcoin futures (MCB) ascent to $111,202 marked a new all-time high in the contract, driven by institutional investments and favorable regulatory developments toward bitcoin. The price traded past the $100,000 level and prior all-time-high of $108,772, closing the month at $105,980, marking a 11.0% gain.

Institutional demand for bitcoin surged as the U.S. government activated its Strategic Bitcoin Reserve, following President Trump's March Executive Order, officially recognizing bitcoin as a reserve asset. Strategy (formerly MicroStrategy) acquired over 4,000 additional bitcoin, raising its total to 580,250 and reaffirming its position as a corporate pioneer in bitcoin adoption. Trump Media also announced plans to raise $2.5 billion to build a bitcoin treasury, underscoring a growing trend of corporations integrating bitcoin into their financial infrastructure. These moves signaled a deepening institutional commitment supported by favorable regulatory momentum.

Daily technical indicators of MCB prices indicated strong buying price action for daily and weekly moving averages. The technical oscillators indicated neutral to weak market conditions. Using historical volatility, the price from the prior month’s close could range between $88,575 and $123,385 ($34,810) in the next 32 days. Investors or traders could consider the weekly support ($83,948 to $86,128) or daily resistance ($109,225 to $111,202) areas when planning their entries or exits based on their trading strategies.

| STATISTICAL VOLATILITY RANGES | STATISTICAL VOLATILITY RANGES | |||

|---|---|---|---|---|

| 21-day | 42-day | 63-day | Monthly (Min) | Monthly (Max) |

| 33.56% | 51.85% | 56.89% | ±10267 | ±17405 |

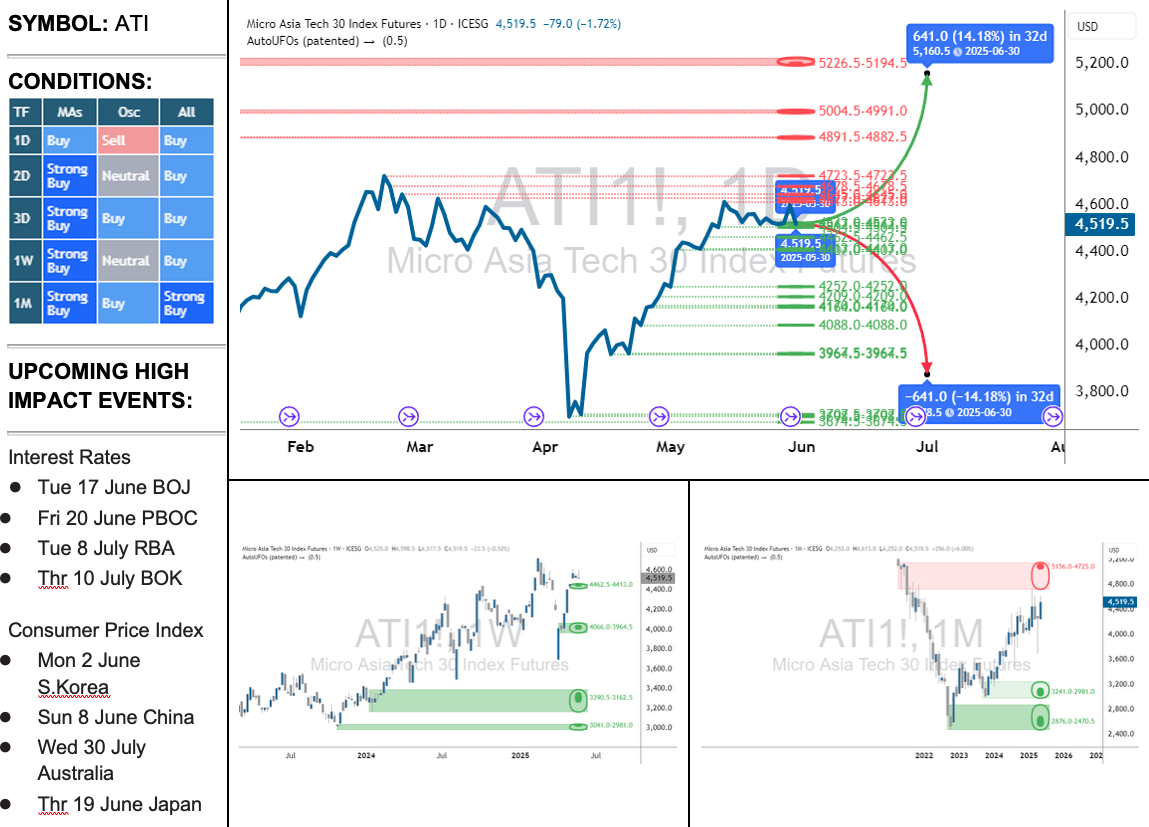

MICRO ASIA TECH 30 INDEX FUTURES

Asia Tech 30 Index (ATI) futures closed higher in May, finishing the month at $4,520, up 6.0% from April. The technology sector attracted strong inflows, bolstered by better-than-expected earnings from key semiconductor firms such as TSMC and Samsung. Additionally, increased capital expenditure by major technology companies on artificial intelligence (AI) infrastructure was viewed as a positive catalyst for future growth in the sector.

Taiwanese stocks delivered strong results. Quanta Computer outperformed with a gain of 13.80%. Delta Electronics advanced 12.10%, while Hon Hai Precision rose 10.20%. TSMC climbed 6.50%, ASE Technology edged up 1.80%, but MediaTek declined 6.70%.

Japanese stocks broadly gained. Advantest led the rally with a surge of 25.70%, followed by DISCO up 19.00% and FUJIFILM Holdings rising 11.90%. Lasertec added 9.90%, while Tokyo Electron rose 8.40% and Renesas Electronics gained 6.60%. Fujitsu increased 5.30%, Keyence rose 1.50%, and Sony inched up 1.00%. Canon gained 0.60%, Nintendo was flat, and Murata Manufacturing declined 3.70%.

Chinese stocks showed mixed performance. NetEase climbed 14.20%, Meituan gained 5.90%, and Tencent advanced 4.40%. Kuaishou added 3.30%, Xiaomi rose 2.00%, and JD.com edged up 0.80%. Meanwhile, Alibaba fell 3.10% and Baidu declined 5.60%.

South Korean stocks were divided. SK hynix surged 15.20%, Samsung Electronics rose 1.30%, but LG Energy Solution tumbled 11.90%.

Australian shares saw strong gains, with Wisetech Global jumping 21.00% on solid software demand.

Daily and weekly moving average technical indicators of ATI prices indicated strong buying market conditions during the month. Technical oscillators indicated mixed market conditions last month. Using historical volatility, the price from the prior month’s close could range between $3,876 and $5,161 ($1,282) in the next 32 days. Investors or traders could consider weekly support ($4,413 to $4,463) or daily resistance ($4,991 to $5,005) areas when planning their entries or exits based on their trading strategies.

Index Composition: 31.9% Taiwan, 26.9% Japan, 26.5% China, 14.2% South Korea, 0.5% Australia

| STATISTICAL VOLATILITY RANGES | STATISTICAL VOLATILITY RANGES | |||

|---|---|---|---|---|

| 21-day | 42-day | 63-day | Monthly (Min) | Monthly (Max) |

| 22.57% | 49.13% | 43.10% | ±294.5 | ±641.0 |

Product highlights

MINI HONG KONG DOLLAR/U.S. DOLLAR FUTURES

Mini Hong Kong Dollar/U.S. Dollar Futures contract with a contract size of 100,000 HKD is cash-settled. Open contracts are marked-to-market daily. Clients could leverage this and other foreign exchange contracts such as the Mini U.S. Dollar/Singapore Dollar, Mini Taiwan Dollar/U.S. Dollar, or Mini Korean Won/U.S. Dollar in their trading strategies or hedging. The reduced product size allows clients to optimize their capital exposure allocation and flexibility to utilize financial leverage across multiple products, giving portfolio diversification opportunities to the client.

DAILY INTERVAL

WEEKLY INTERVAL

CONTRACT SPECIFICATIONS

| 21-day | Expirations | Min. Fluctuation | Multiplier Value |

|---|---|---|---|

| SHD | 13 Calendar Months | USD $0.00001 | USD $1.00 |

| Trading Hours | Closed Per Day | Initial Margin* | Daily ATR* |

| 8:00AM-6:00AM SG Time | 2.0 hours/day | ≈ $29 | 0.00011 |

BROKERS

KGI Futures | Orient Futures Singapore | Phillip Nova

*Notional size and Initial Margin and Daily ATR values are updated as of the date of this publication