ICE Muni Bonds Monthly Report

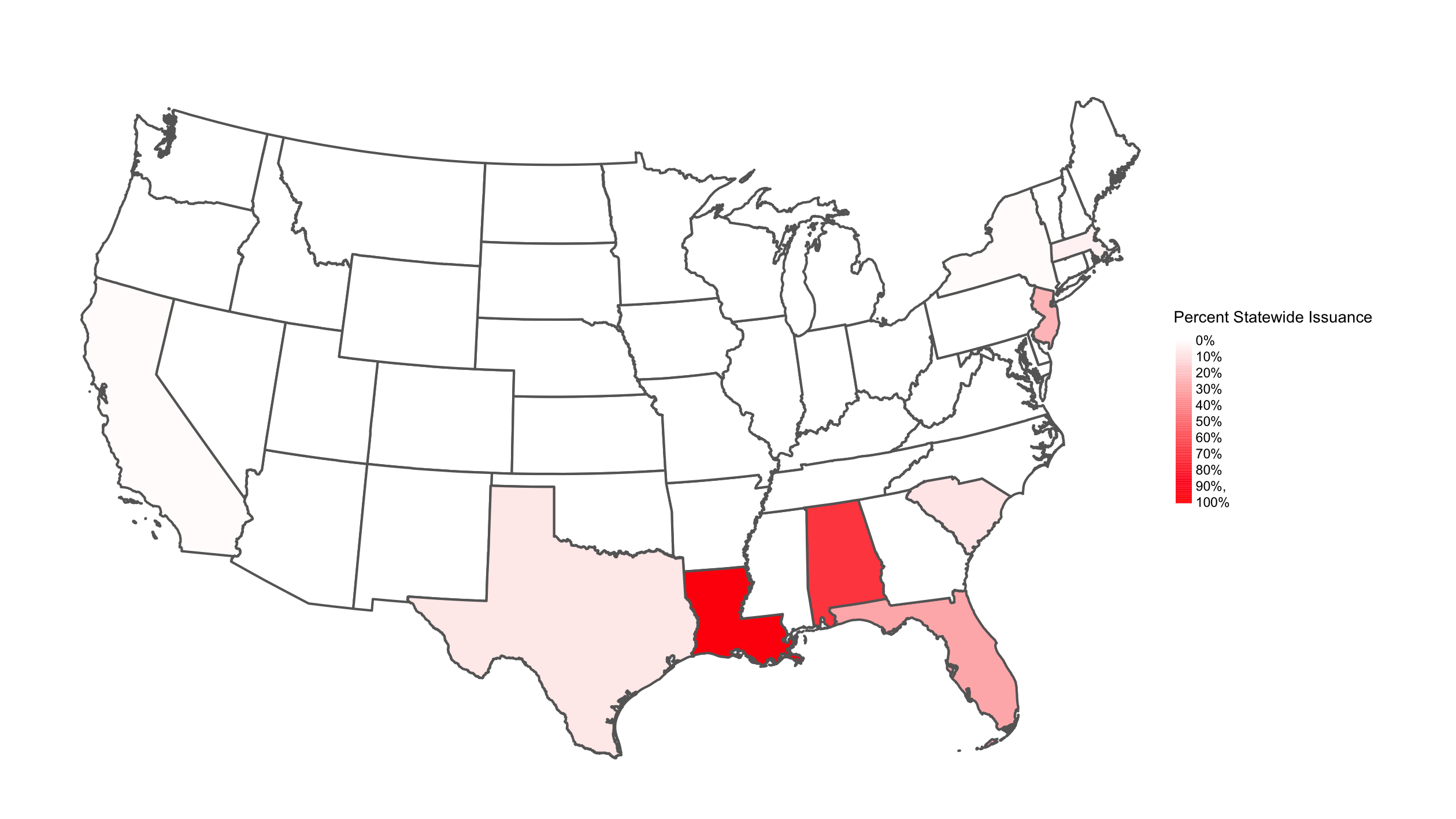

In September, there was over $1.9B in high physical climate risk1 (ICE Physical Climate Risk Score ≥ 3) municipal issuance across the 48 contiguous states, the majority concentrated across Alabama, Louisiana, and Florida.

Join our mailing list to receive the newsletter and ICE Muni Bonds team updates

September 2023

Total High Physical Risk Issuance by State

(ICE Physical Risk Score ≥ 3)

The story is also interesting when we looked at statewide percentages. In September, Louisiana, Alabama, Florida, and New Jersey issued the largest percentages of high physical climate risk debt.

The ICE Social Impact Score is designed to indicate the potential social benefit of investment within a given community or geographical area. Areas with a higher Social Impact Score may be more socioeconomically vulnerable; investment in these communities may have greater social benefits than investment in communities with a lower Social Impact Score.

In September 2023, there was over $2.9B in municipal issuance associated with high social impact obligors (ICE Social Impact Score ≥ 75). While Texas issued the largest amount of high social impact debt in absolute terms, states with the largest amounts in terms of statewide percentages were Louisiana and Kentucky.

September 2023

Percentages of High Social Impact Issuance by State

(ICE Social Impact Score ≥ 75)

Of the high social impact issuance in September, over $1.4B was also high physical climate risk (ICE Physical Climate Risk Score ≥ 3). This high social impact and high physical risk issuance is notable because socioeconomically disadvantaged municipalities are often the most vulnerable to the impacts of climate change—and they are also likely to be the communities most in need of investment to mitigate those same impacts.

September 2023

Percentages of Issuance by State that is both High Physical Risk and High Social Impact

(High Social Impact: ICE Social Impact Score ≥ 75)

Finally, soaring temperatures across the United States this summer have put a spotlight on the detrimental effects of heat exposure on health, productivity, and agriculture. In September, there was almost $10B in high heat stress issuance—that is, issuance associated with obligors that are projected to experience an average of 100 or more days with a heat index greater than 95 degrees by 2050 under the Intergovernmental Panel on Climate Change’s Representative Concentration Pathway 8.5.

1All numbers and charts are sourced from ICE Sustainable Finance data and models as of 10/5/2023 and are available via product offerings. Municipal issuances outside of the 48 contiguous states are not included along with other issuances that cannot be associated with a specific geographic location