Advancing the ETF industry

50+

200+

1,250+

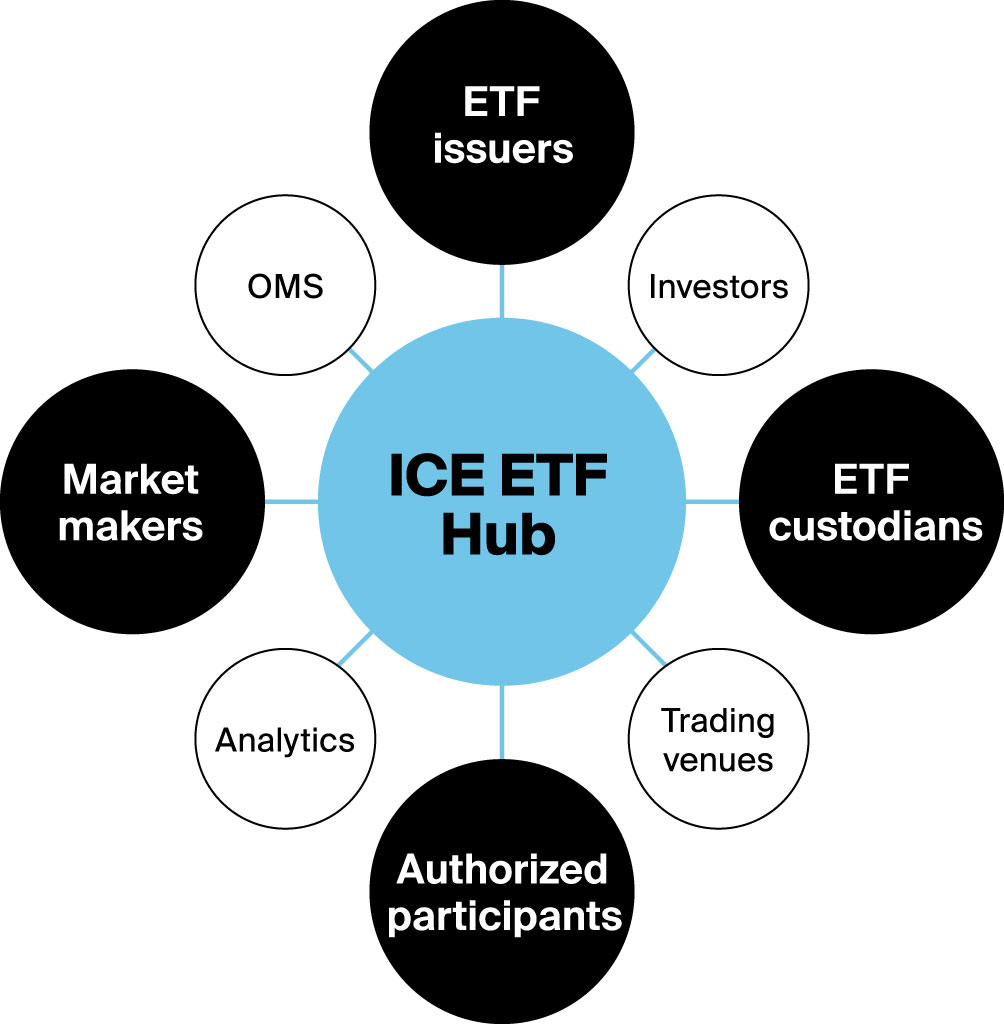

The U.S. ETP market has seen tremendous growth. According to the New York Stock Exchange, total net assets for US listed ETPs grew to over $15 trillion. As assets and trade volumes have accelerated, so has the need for solutions that drive further efficiencies in the primary markets. The ICE ETF Hub simplifies the creation and redemption process across ETPs of all asset classes.

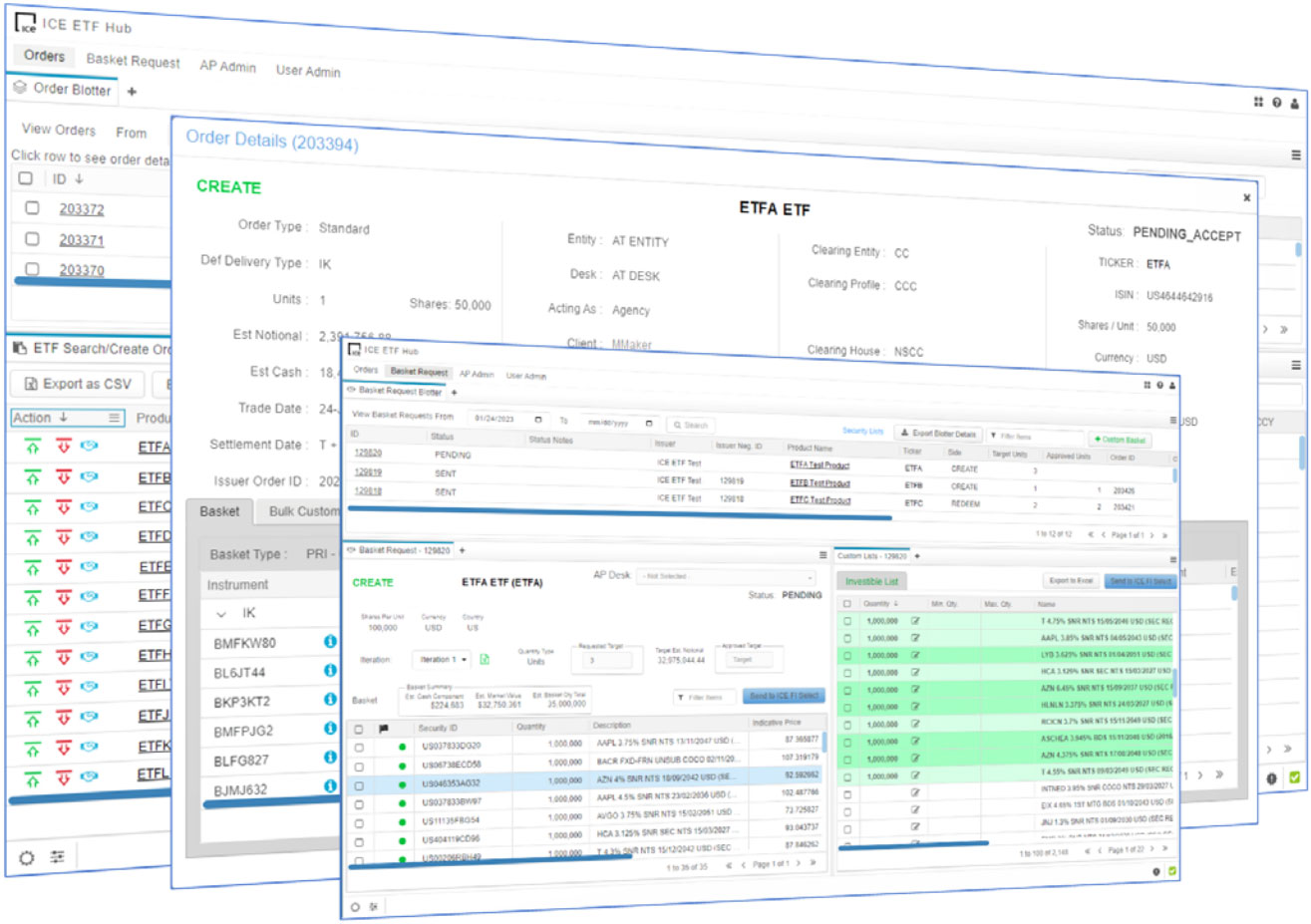

- Simplified workflow reduces number of connections and platforms

- Robust API protocols offer standardization and simplicity

- Comprehensive set of services offer solutions across the primary market workflow

- Open architecture

- Real time status updates via ICE Chat

- Ability to STP orders in real time

- Integrate into ICE’s fixed income data and execution platforms

Bringing efficiencies to the primary trading workflow

Streamlined ETF order entry across all types of ETFs through FIX API messaging and user interface

User interface and standardized API messaging to improve the speed and accuracy of custom basket facilitations for fixed income and equity ETFs

Seamless integration with ICE instant messaging enabling real-time communication throughout the order workflow

Source bonds directly via connectivity to ICE Bonds liquidity pools

Functional Overview

Steady growth and development

2019

- ETF Hub launched with support for equity and fixed income ETF order placement

- Introduced bulk-order entry

2020

- FIX API developed and integrated for standard order entry and basket negotiation

- Support screening basket proposals against a list of securities provided by the portfolio manager

- Launched Issuer Direct functionality allowing issuers and their agents to manage the C/R workflow through ETF Hub

2021

- Multi-factored feedback added for basket negotiations

- Display product and basket reference data in the GUI

- Enhanced Issuer Direct order notifications and confirmations, and PCF consumption and end of day reporting

2022

- US Bank replaced the DASH order entry system with ETF Hub

- JPM Custody integration for basket negotiation

- Enhanced custom basket feature to support pre-approved baskets and directed baskets

2023

- Support for ETN creations/redemptions

- Support for ActiveShares® ETF creations/redemptions

- Expand order entry functionality for Ireland-domiciled ETPs

- API integration with LiquidityBook

2024

- Share class switching functionality

- Directed trade support for cash orders

2025

- Incorporate market and portfolio analytics to aid in basket negotiation

- Support for ETPs domiciled in the European Union

- Display corporate action information