Highlights

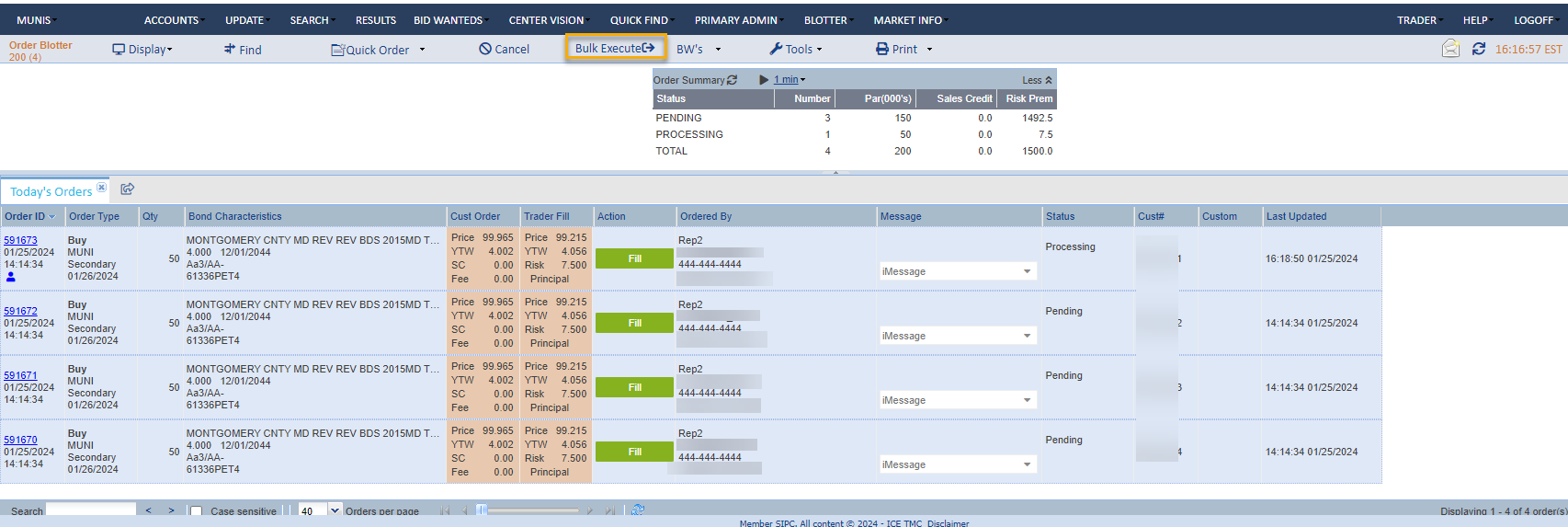

Send UW Order Fill Message for Primary CD Orders with TOMS

Enhanced the support for posting New Issue CD offerings via Bloomberg TOMs to include the order fill message which is necessary for dealers to manage the deal.

At time of order approval by the dealer, TMC sends an AE message to the dealer so that dealer can make their booking, after which UW will send quantity update message to TMC to update the deal available quantity.

At the time of deal execution (at “Expected Trade Datetime”), TMC tickets based on aggregate amount but doesn’t send duplicate AE messages to TOMS dealer.

Platform

Calculate Accrual for Fixed to Float Bonds

For accrued interest calculation, currently we handle fixed-to-float bonds when they are in the period when coupon rates are fixed. This project expands accrued interest calculation to the floating-rate leg. Calculation is available for the bonds with definitive coupon reset dates and regular payment frequencies.

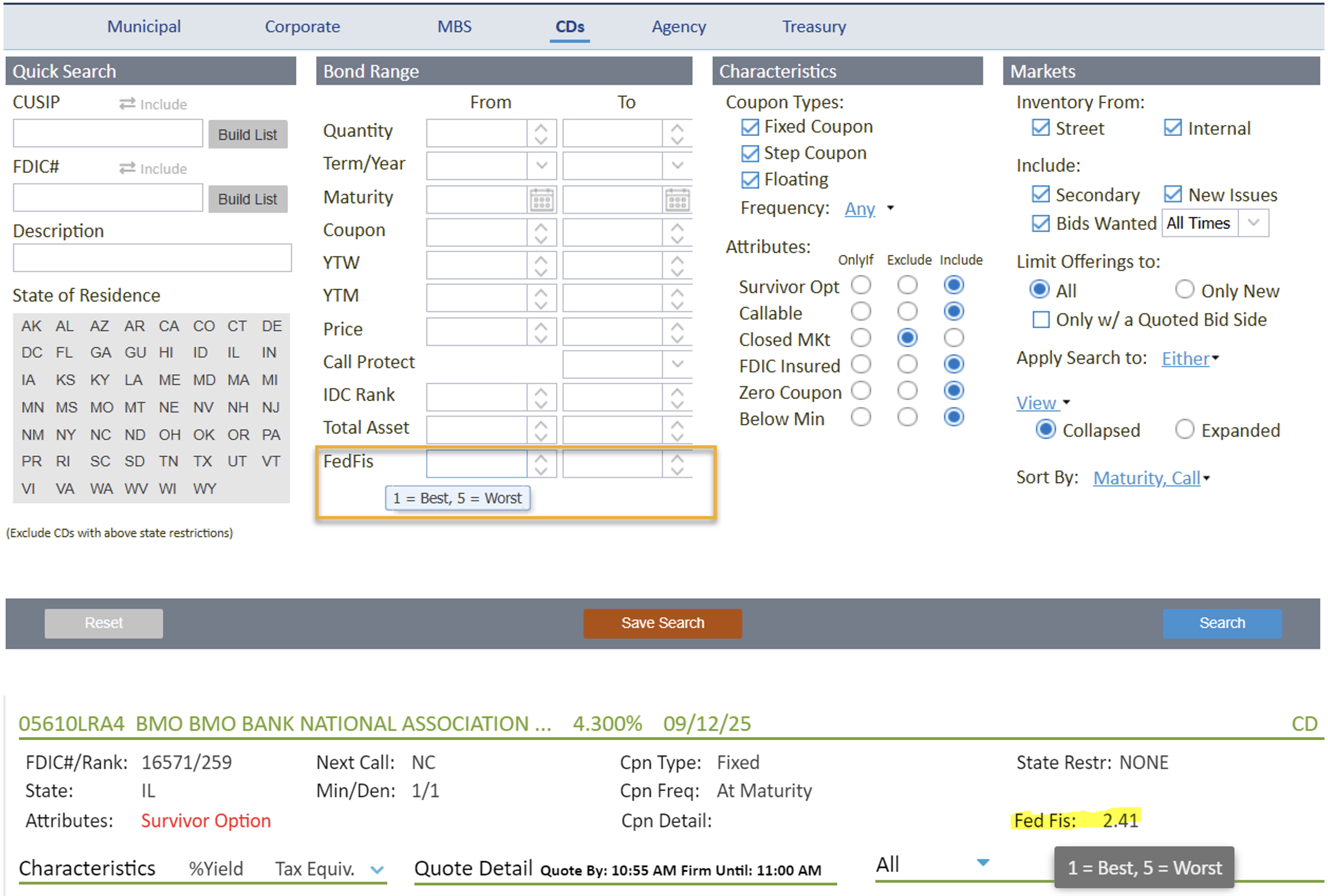

Support FedFis Rating for CD

We added FedFis rating data for CD, which is available on various screens, such as Advanced Search, Filters, Market Snapshot, Security Master, etc. A tool tip is available to indicate what scales mean in terms of quality of issues.

Additional enhancements and bug fixes

Update Corporate Office Address

Starting from December 2024, ICE Bonds is operating from a new corporate address. Updates were done to all platforms of ICE Bonds.

Mailing address: ICE Bonds Securities Corporation, 1345 Avenue of the Americas, 7th Floor, New York, NY 10105

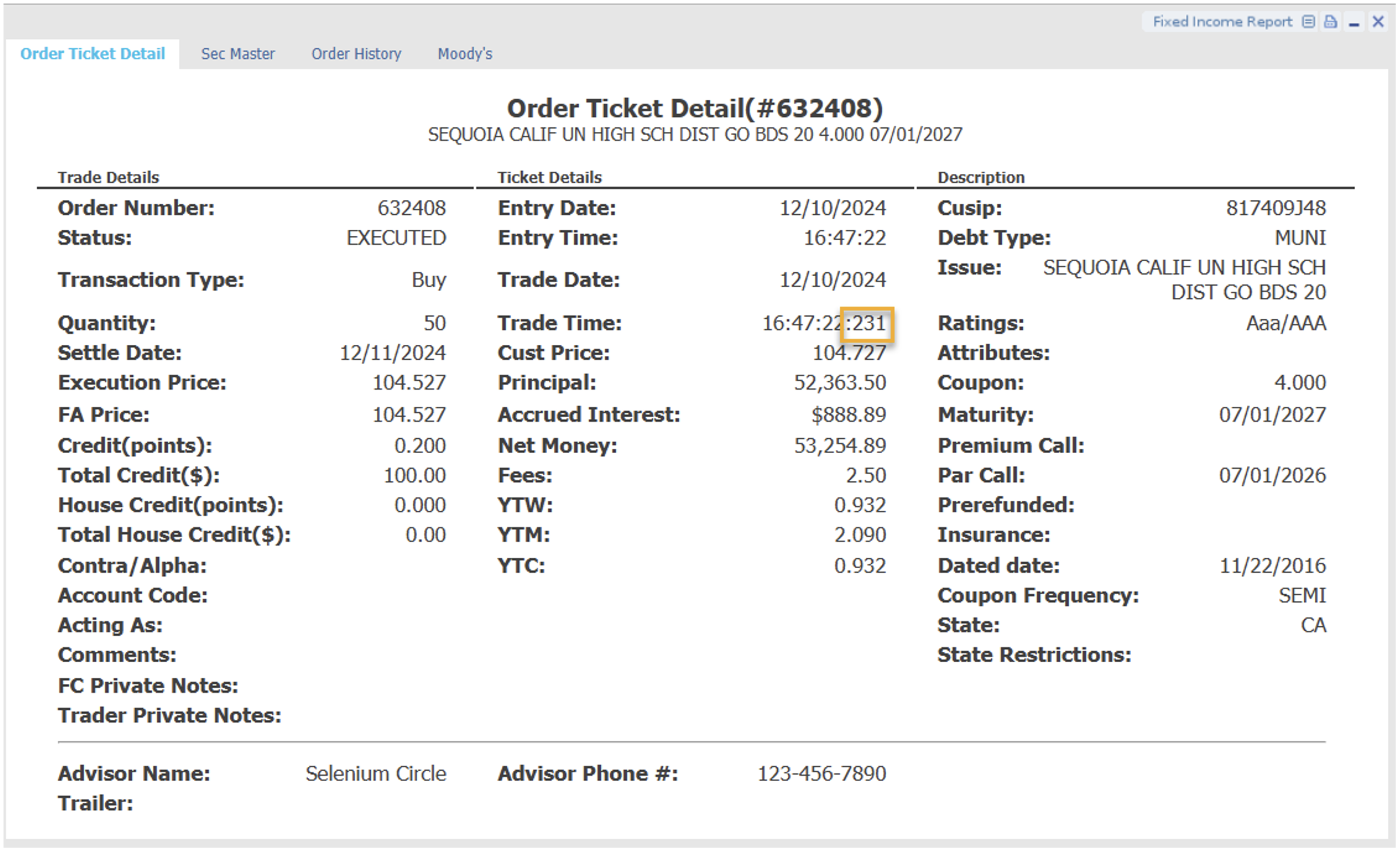

Add Millisecond to Trade Time on Order Ticket Detail

An enhancement is made to provide the millisecond portion of the Trade Time for an order after it’s executed on Order Ticket Detail.