ICE Fixed Income monthly report

In this edition, global regulators are scrutinizing practices around fund liquidity management. Our President of Fixed Income & Data Services Amanda Hindlian shares her views on how to best serve investors, industry, and reduce systemic risk. Hear Coalition Greenwich’s Head of Market Structure and Technology Research Kevin McPartland discuss how data and technology are impacting bond market structure, and see what ICE models show about the recent floods in Vermont.

Join our mailing list to receive the newsletter and ICE Fixed Income team updates

Fund liquidity management: the case for a proven approach

Liquidity: when you need it most, it’s often in short supply. In fixed income, the vast range of liquidity profiles is a defining feature of the asset class. Timely and accurate data on asset prices for fixed income securities can thus be difficult to obtain, particularly during times of market upheaval. This dynamic is the crux of growing regulatory focus on fund liquidity management.

Earlier this month, Britain's financial regulator published a review that found most firms fell short in some aspects of their liquidity frameworks. This follows a report from the the European Securities and Markets Authority (ESMA) in May on valuation practices, which noted that the outcome of liquidity stress tests were not systematically applied by funds, and strongly encouraged firms to consider lessons from recent market events — such as the COVID-19 pandemic — when setting liquidation costs. For regulators, creating a backdrop that offers greater protection for retail investors is also central to their approach.

Globally, a few frameworks are emerging. The FCA in the UK has required that firms abide by ESMA’s stress testing guidelines, which were issued in 2020. Its recent review notes that many firms still fail to meet these guidelines, with a wide range of stress testing methodologies used, from highly sophisticated to more simple approaches.

The ESMA guidelines require funds to quantitatively assess the liquidity impact to their portfolios of both historical simulations and hypothetical scenarios. For example, firms may be required to apply analytics to stress test portfolios through simulations that replicate aspects of the 2008 credit crisis, as well as hypothetical stress levels. At ICE, we are advocates of this approach, given the broad range of factors that can impact the liquidity of financial instruments and the universal desire to ensure appropriate guardrails remain in place to protect market participants.

To date, the SEC proposals for fund liquidity management are the most prescriptive and far-reaching. Its November 2022 proposal includes requirements that attempt to conflate a normal baseline scenario with stressed inputs — for example, defining the daily classifications based on “current market conditions,” while also requiring the use of a stressed 10% liquidation volume. This approach could produce outputs that are neither baseline nor stressed. Instead, in our view, keeping these factors as separate outputs would offer greater visibility into a funds’ liquidity profile.

For global regulators, choosing the right frameworks for liquidity management is crucial. From our perspective, it means applying proven analytics to help reduce systemic risk, boost investor transparency and give funds a more accurate gauge of their position when markets get shaky, as they inevitably do from time to time.

Insights

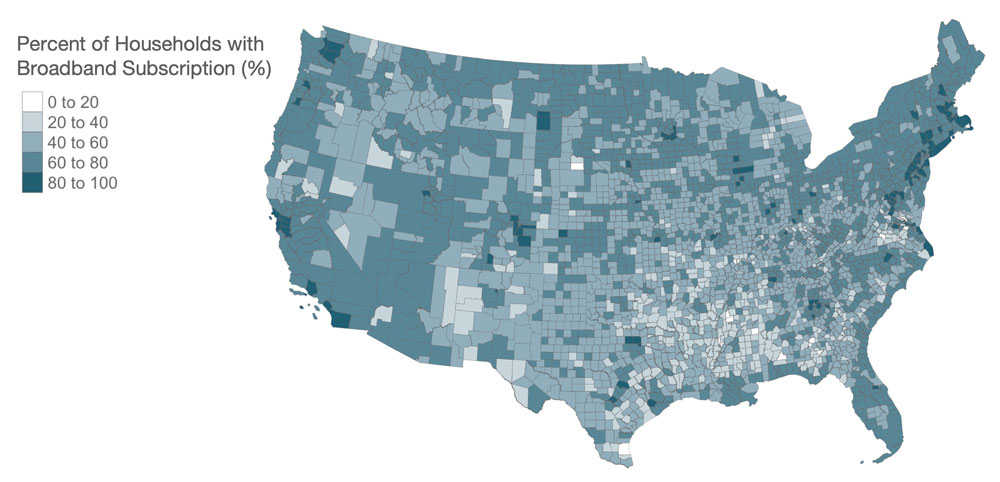

Municipal bonds and internet access:

Improving the United States' most inequitable infrastructure

Access to broadband internet is associated with a myriad of economic benefits including local growth, lower unemployment, increased household income levels, business activity, and general entrepreneurial activity. High-speed internet may also have social and health benefits, including easier access to social supports and telehealth resources. The transition of schools across the country to remote learning during the COVID-19 pandemic highlighted the critical importance of this digital resource to education.

Fixed Income in Focus

Data and technology and their impact on the bond markets

Across bond markets, the growing role of data and technology has had clear implications for market structure. What does this mean for how bonds trade, and the role of AI and machine learning? Head of Market Structure and Technology Research at Coalition Greenwich (a division of CRISIL) Kevin McPartland tackles the topic with to ICE’s VP of Fixed Income Corporate Development Michele Nicoletta.

Insights

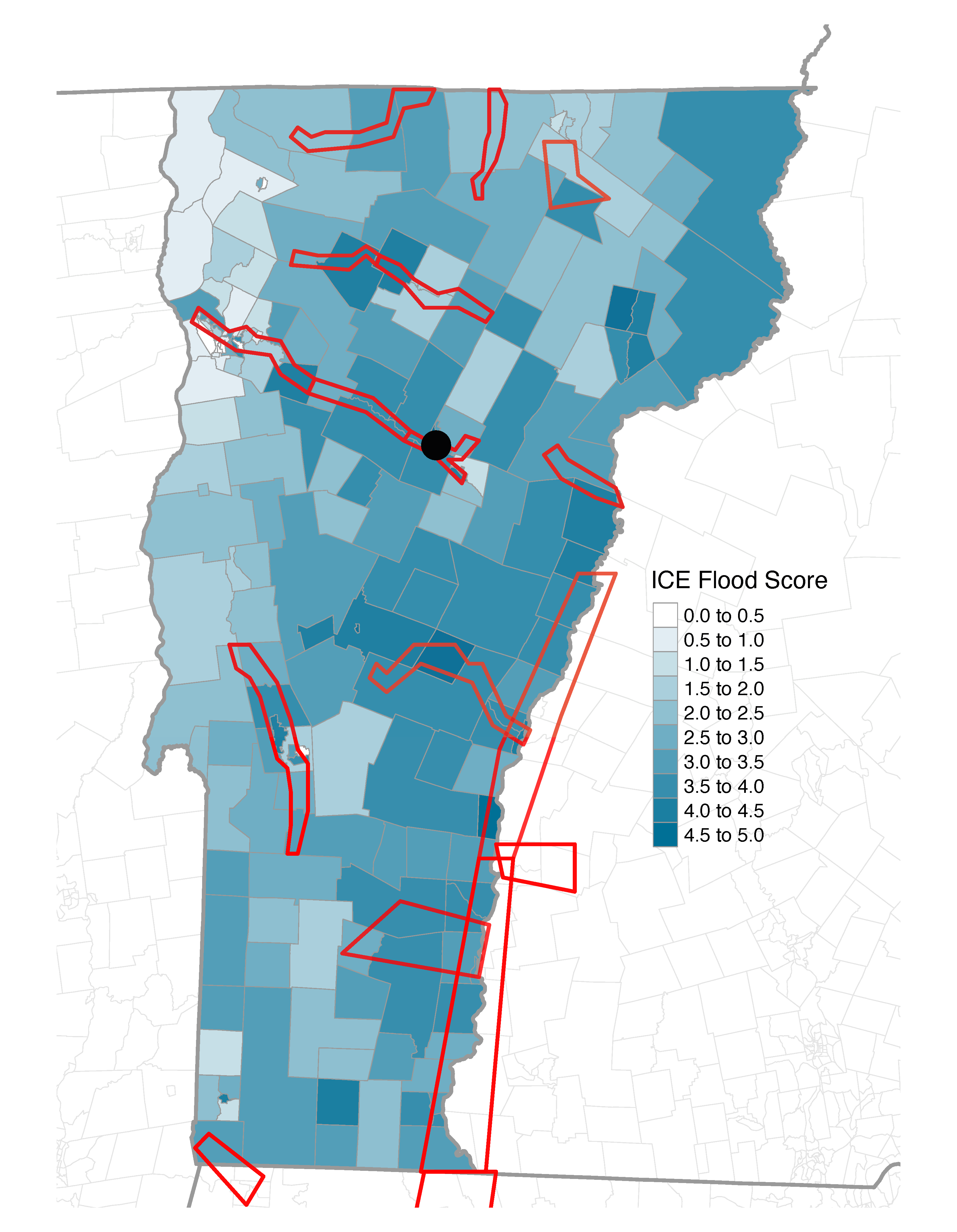

Vermont flooding: What ICE models show

Because it does not have an ocean coastline, Vermont is not typically thought of as a state with high physical climate risk exposure. The recent flooding there is a reminder that inland flooding can be incredibly dangerous and destructive to human life and property.

The floods in Vermont are being compared to flooding from Hurricane Irene in 2011, which killed seven people and caused $700 million in damage across the state. ICE Climate models suggest that under the Intergovernmental Panel on Climate Change’s “business as usual” emissions scenario, the risks associated with inland flooding across the state will increase in the upcoming decades

Webinar Replay

ICE’s Fixed Income Portfolio Analytics: Managing Interest Rate Risk

The ability to efficiently project portfolio and security cash flows and returns under multiple interest rate environments is essential for effective risk management.

The cash flow and scenario analysis capabilities in ICE Portfolio Analytics - Bonds can quickly project cash flows, total returns, unrealized gain/losses, prices, durations and other key analytics which invoke ICE’s proprietary term structure and prepayment models for over 2.8 million securities.

Fixed Income

Manage risk, uncover opportunities, and make informed decisions in real-time with ICE’s end-to-end fixed income solutions. Reimagine your fixed income workflow from price transparency & discovery and efficient execution through to performance analysis.

This material contains information that is confidential and the proprietary property and/or a trade secret of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”), is not to be published, reproduced, copied, modified, disclosed or used in any way without the express written consent of the ICE Group. This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between the ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, or other professional advice.

The information contained herein is provided “as is” and the ICE Group makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. The ICE Group makes no representation or warranty that any data or information (including but not limited to evaluated pricing) supplied to or by it are complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall the ICE Group have any liability for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits) in connection with any use of and/or reliance on the content of this document even if advised of the possibility of such damages.

This document is not an offer of advisory services and is not meant to be a solicitation, or recommendation to buy, sell or hold securities. This document represents ICE Group’s observations of general market movements. Trades and/or quotes for individual securities may or may not move in the same direction or to the same degree as indicated in this document. Please note that the information may have become outdated since its publication.

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model-based curves, market sentiment scores, and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

Trademarks of the ICE Group include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data, and New York Stock Exchange,. Information regarding additional trademarks and intellectual property rights of the ICE Group is located at www.ice.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.