What's new

April 2025 Enhancements

Highlights

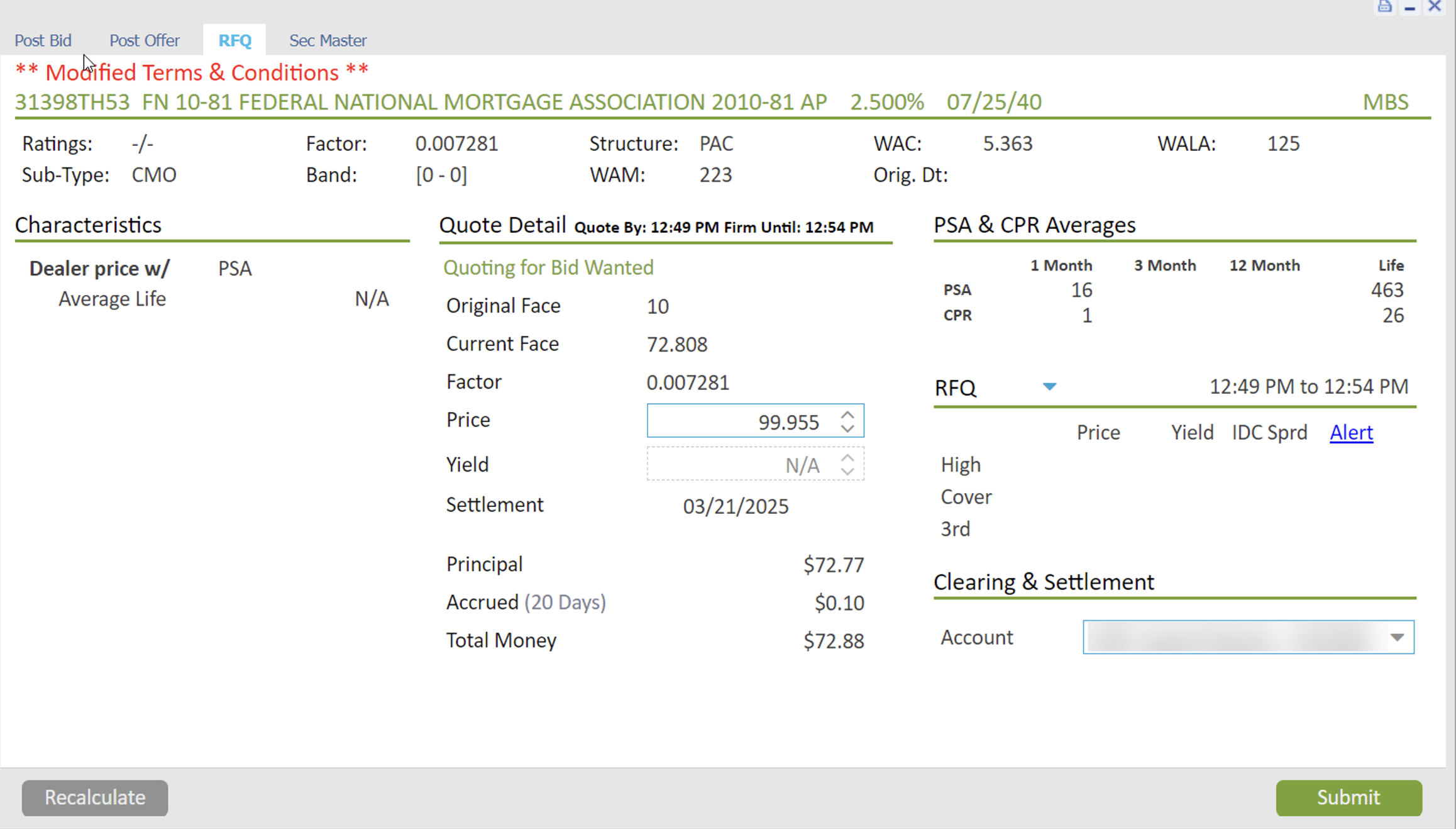

Add support for MBS RFQ on TMC – workflow mirrors the bid wanted workflow of any other products on TMC that have RFQ capabilities, just enhanced to include MBS.

Key points

- Available to both API and GUI users for submitting requests and bidding

- Price only

- ASAP model similar to corporates (vs wire time / curtain time model)

GUI support

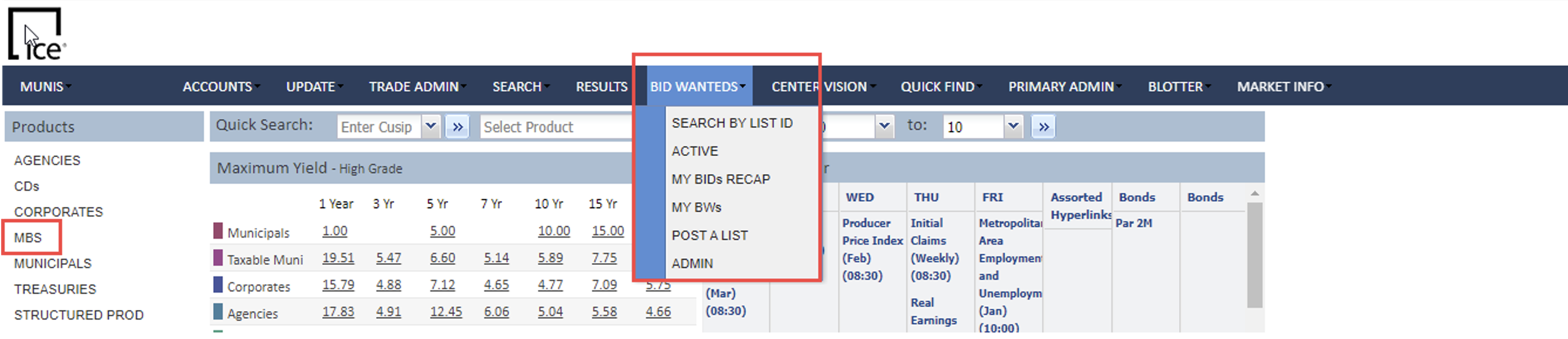

- Add Menu/Submenu option

- Add MBS RFQ ticket

Platform

Support Principal Factor

This project finalizes the incorporation of principal factors from DTC into TMC. Key updates include enhancing the processing of DTC files, updating multiple screens on the front-end and updating order and trade workflows.

Filter Depth of Market Items by Search Criteria

This project extends the “Depth-filtering feature” for treasures to additional debt types. This allows a user looking to trade a specific quantity to only return offerings that match that size. Key updates include modifications to the Bond Range panel, such as renaming labels for clarity, explicitly listing Quantity and Trade Size options, and applying these changes across all asset types. A new "Apply to Depth of Market" option replaces "Exact Match", filtering offerings in the depth that do not match search criteria.

Markup grid enhancement to workout date

For markup grid selection (ie Matrix Admin screen) use termination date when determining maturity bucket vs just using the maturity date.

Definitive dates include: prerefunded date, mandatory put date, called date and maturity date.

Logic to follow:

- use earliest date between these values to determine maturity bucket

- use called date only when fully called (does not look at partially called date or use the dates from the call schedule)

Accrued Interest calculation for Fixed To Floats

Incorporation of “interest payment business day adjustment” data point to adjust the previous coupon date in the accrued interest calculation if it fell on a weekend or holiday for specific instruments.

Servicing Company Filter Enhancement: Expand FDIC # limit from 1000 to 5000

Expand the FDIC filter limit to allow more flexibility for firms to manage a larger list of eligible FDIC values.

Platform/Trade Desk

Auto Create PCD Offer upon TOMS Quotation Post

This project aims to automate the creation of primary CD offers by integrating TOMS quotation data with TMC systems. The new workflow eliminates manual processing by enabling automatic offer setup based on CUSIP, pricing, and market parameters, etc. Key enhancements include updating market permissions, refining data structures, expanding Deal ID character limits, and improving offer price handling. Additionally, system improvements will ensure expired deals are properly closed to prevent execution conflicts.

Primary CDs Trade Messages via TOMs

Updated messaging logic to TOMs not to send trade message to underwriter at deal execution time if message was sent during order allocation.

Add Some New Insurance Codes

Made additional Muni New Insurance codes which is reflected in search results and security details.