Central clearing for the IBA Gold and Silver Auctions

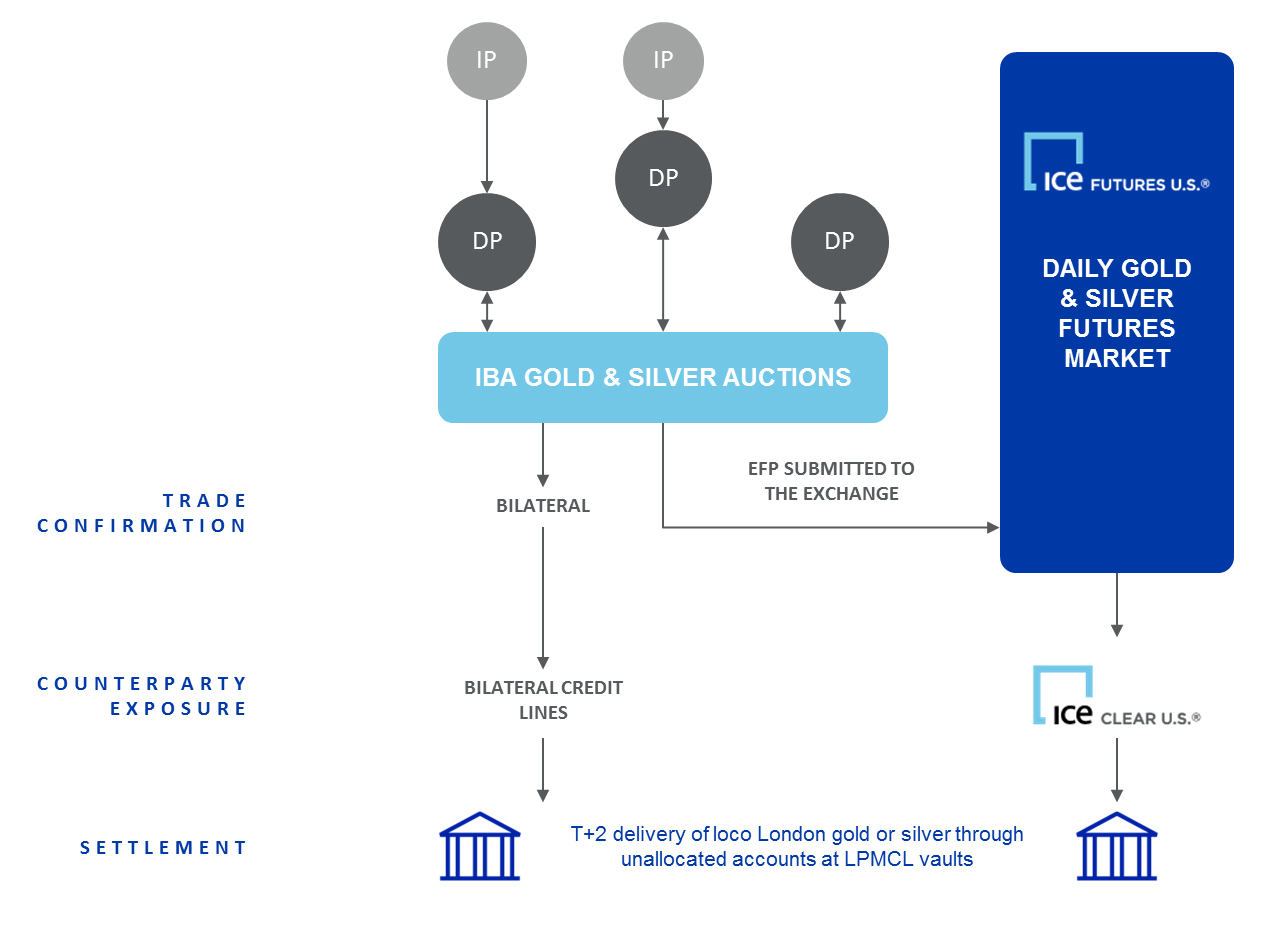

Central clearing for the IBA Gold and Silver Auctions removes the need for firms to have large bilateral credit lines in place with each other in order to become a Direct Participant (DP). This opens up the auction to a broader cross section of the market and also facilitates greater volume in the auction.

Central clearing for the auction is enabled by effecting Exchange for Physical (“EFP”) transactions into the new physically settled, loco London gold daily futures contract and silver daily futures contract which are traded on ICE Futures U.S. The EFPs establish positions in the futures contract which are cleared and can be physically delivered at ICE Clear U.S.

CENTRAL CLEARING FOR THE GOLD AND SILVER AUCTIONS

- DPs must establish a clearing account with an ICE Clear U.S. Clearing member

- DPs may still maintain credit lines to settle bilaterally against other DPs

- DPs can elect, for each counterparty, their preference for a bilateral or cleared match

ABOUT THE IBA GOLD AND SILVER AUCTIONS

ICE Benchmark Administration (IBA) is the administrator for the LBMA Gold Price and the LBMA Silver Price and operates the Gold and Silver Auctions which underlie these benchmarks.

The physically settled, electronic auctions are run at 10:30am and 3:00pm London time for gold and at 12:00pm London time for silver, providing a market-based platform for buyers and sellers to trade precious metals.

The final auction prices are published to the market as the LBMA Gold Price AM, the LBMA Gold Price PM and the LBMA Silver Price benchmarks. These are widely used across the globe by participants such as producers, consumers, investors and central banks.

The price formation for the gold auction is in US Dollars and the auction settles against US Dollars only.

PRECIOUS METALS FUTURES - SUMMARY CONTRACT SPECS

| GOLD DAILY FUTURES | SILVER DAILY FUTURES | |

|---|---|---|

Description | A physically settled daily futures contract for gold delivered loco London in unallocated vault accounts. | A physically settled daily futures contract for silver delivered loco London in unallocated vault accounts. |

| Contract Symbol | AUD | HIO |

Contract Size | 100 fine troy ounces | 5,000 fine troy ounces |

Price Quotation | US Dollars and cents per fine troy ounce | US Dollars and cents per fine troy ounce |

| Eligible Contract Dates | London Business Days on which commercial banks are generally open for business in New York. | London Business Days on which commercial banks are generally open for business in New York. |

| Minimum Price Movement | One cent ($0.0100) per fine troy ounce ($1.00 per contract), except that Block and EFRP trades may be executed at $0.0001 per fine troy ounce ($0.01 per contract). | One half cent ($0.00500) per fine troy ounce ($25.00 per contract) except that Block and EFRP trades may be executed at $0.00001 per fine troy ounce ($0.05 per contract). |

| Settlement | Physical Delivery | Physical Delivery |

| Delivery Points | Vaults in London operated by an LPMCL member which provides vaulting services for gold. | Vaults in London operated by an LPMCL member which provides vaulting services for silver. |

| Grade/Standards/Quality | Gold meeting the specification standards published by the LBMA for gold bars that are acceptable in settlement of unallocated loco London gold transactions, as revised from time to time. | Silver meeting the specification standards published by the LBMA for silver bars that are acceptable in settlement of unallocated loco London silver transactions, as revised from time to time. |

| Last Trading Day | The London Business Day prior to the Contract Date; trading in the expiring Contract Date ends at noon London time on LTD. | The London Business Day prior to the Contract Date; trading in the expiring Contract Date ends at noon London time on LTD. |

| Clearing Venue | ICE Clear US | ICE Clear US |

| Trading Hours | 8:00 pm to 6:00 pm EST | 8:00 pm to 6:00 pm EST |

| Non-Screen Trade Types | EFP, EFS and Block Trades permitted | EFP, EFS and Block Trades permitted |

| Block Trade Minimum Quantity | 5 lots | 5 lots |

Exchange and Clearing Fees | Screen, EFRP and Crossing Order Trades: $1.00 per side, Block Trades: $1.10 per side | Screen, EFRP and Crossing Order Trades: $1.00 per side, Block Trades: $1.10 per side |