Tools tailored for your workflow

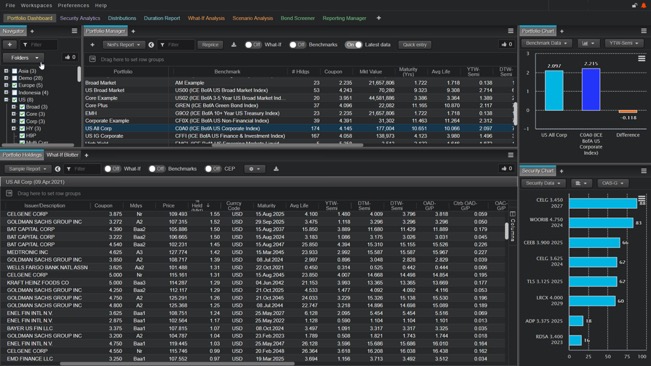

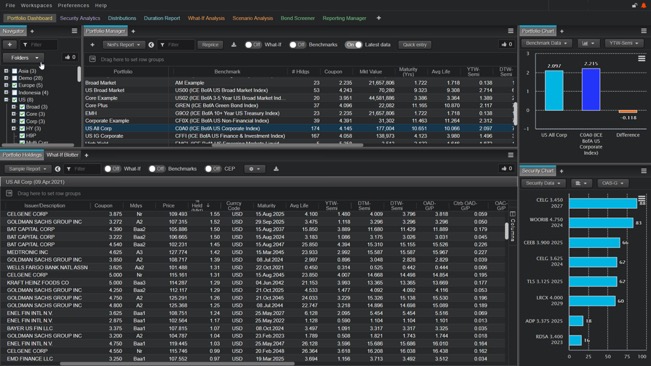

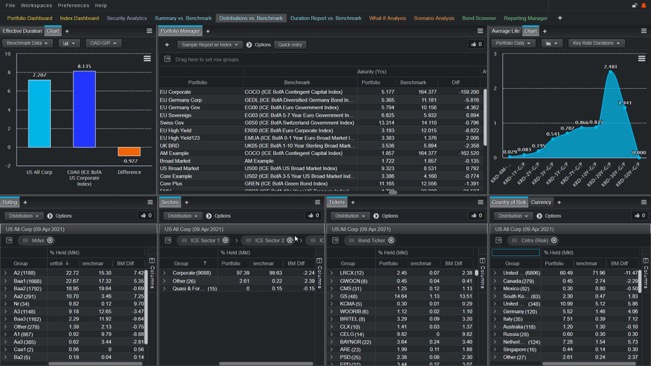

Dashboard

Choose from a library of workflow tools to customize your workstation with the analytical view points needed to make investment decisions.

Slice & Dice Your Portfolio

Organize your workflow tools to isolate segments of your portfolio by security types, qualities, sectors, countries, currencies, etc.

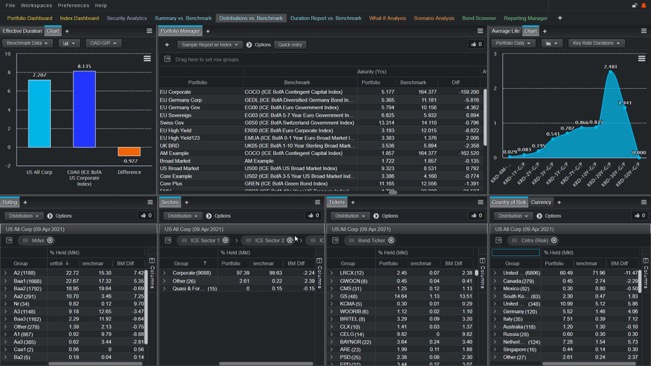

Benchmark Comparisons

Measure portfolio performance against indices from ICE Data Indices and other industry leading benchmarks.

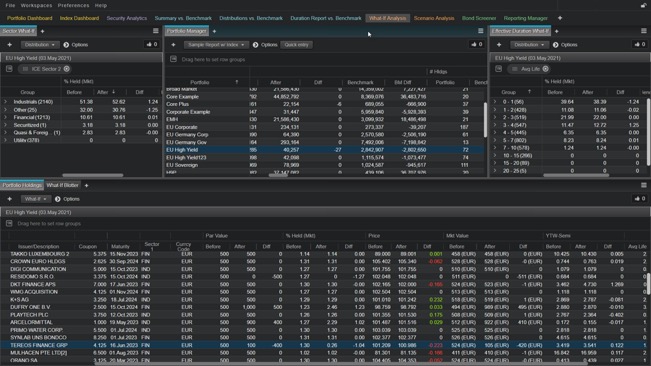

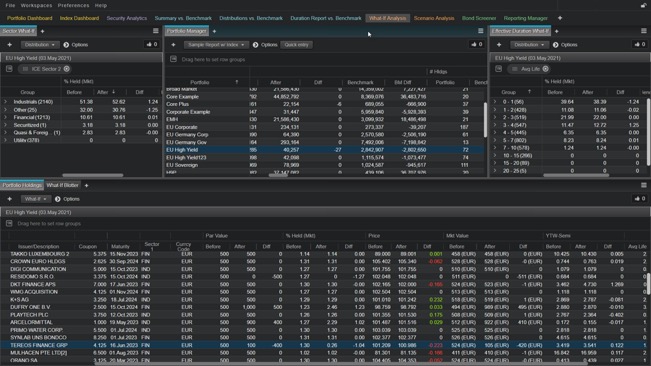

Pre-trade / What-if Analysis

Perform what-if and scenario analyses to help assess opportunities in dynamic markets.

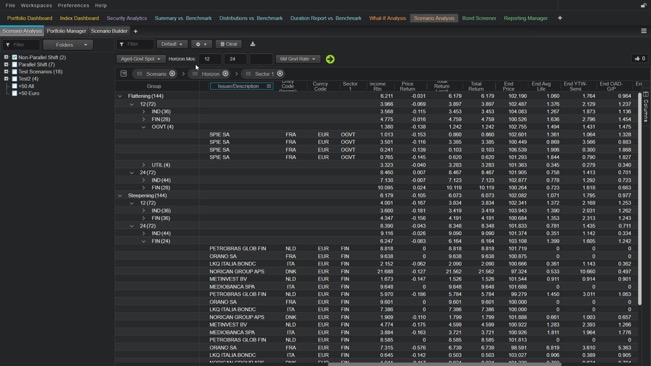

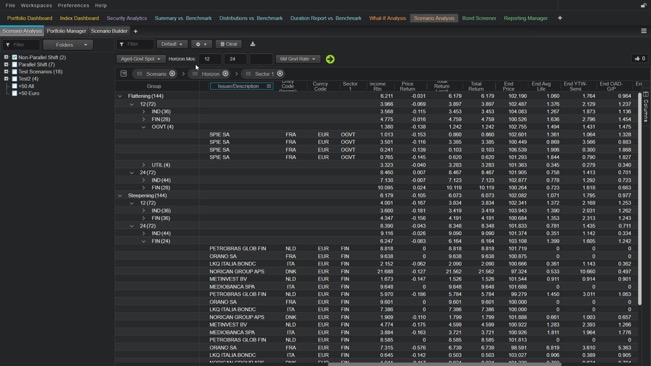

Simulations / Stress Testing

Simulate portfolio performance based on specific interest rate or credit spread forecasts.

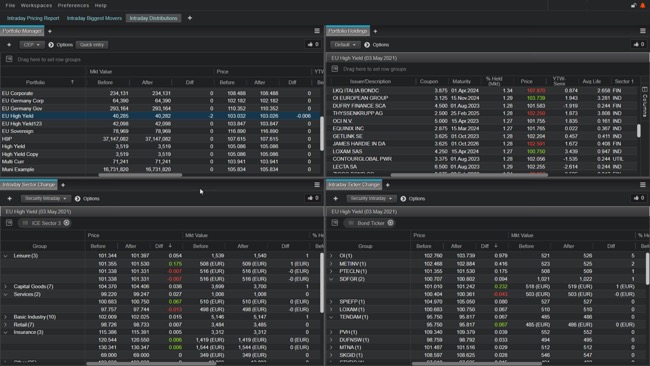

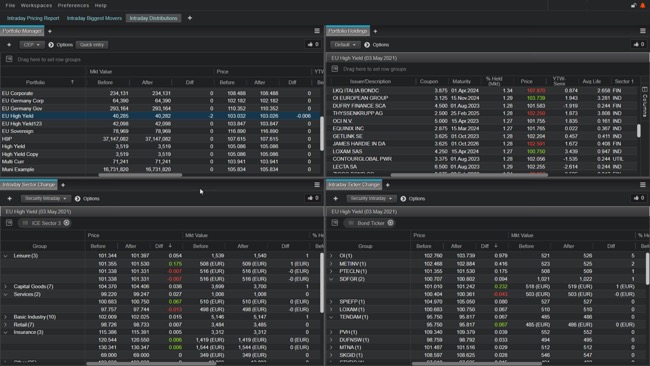

Intraday Analysis

Monitor portfolio risk intraday using CEP® and streaming yield curves.

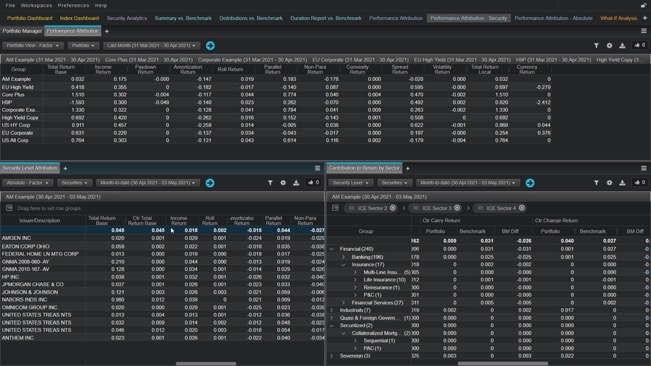

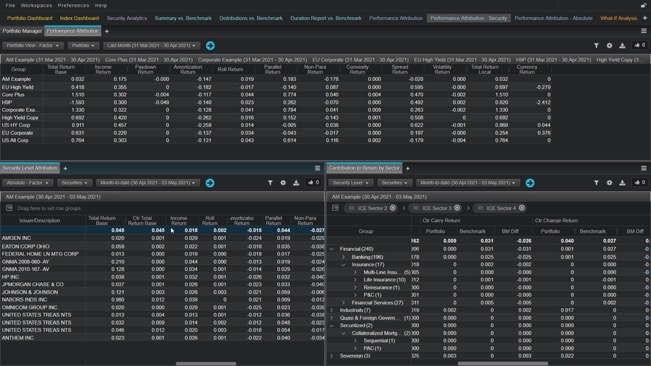

Performance Attribution

Identify, quantify and explain sources of performance for portfolios and benchmarks historically given changes in market conditions.

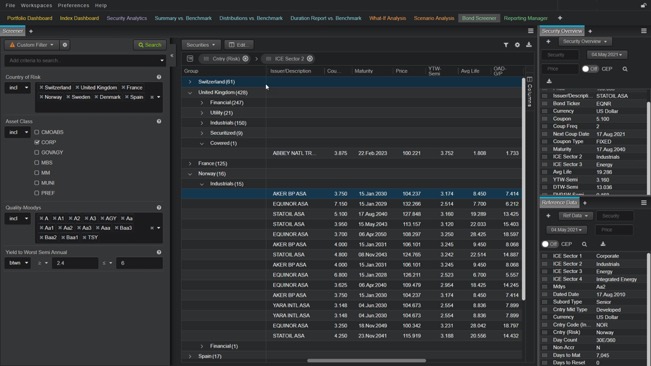

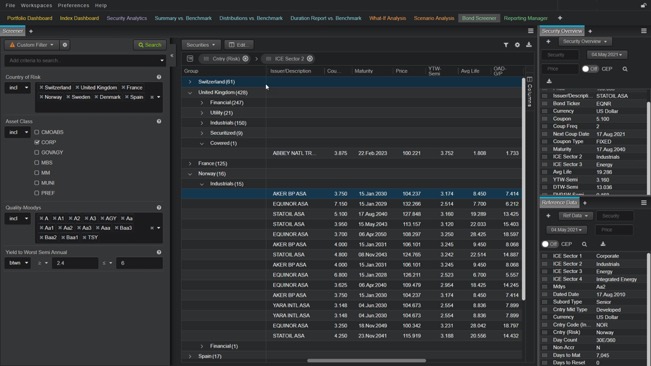

Bond Screener

Quickly scan our security database or portfolios to find securities based on user set criteria.

Dashboard

Choose from a library of workflow tools to customize your workstation with the analytical view points needed to make investment decisions.

Slice & Dice Your Portfolio

Organize your workflow tools to isolate segments of your portfolio by security types, qualities, sectors, countries, currencies, etc.

Benchmark Comparisons

Measure portfolio performance against indices from ICE Data Indices and other industry leading benchmarks.

Pre-trade / What-if Analysis

Perform what-if and scenario analyses to help assess opportunities in dynamic markets.

Simulations / Stress Testing

Simulate portfolio performance based on specific interest rate or credit spread forecasts.

Intraday Analysis

Monitor portfolio risk intraday using CEP® and streaming yield curves.

Performance Attribution

Identify, quantify and explain sources of performance for portfolios and benchmarks historically given changes in market conditions.

Bond Screener

Quickly scan our security database or portfolios to find securities based on user set criteria.

- « First

- ‹ Previous

- 1

- Next ›

- Last »