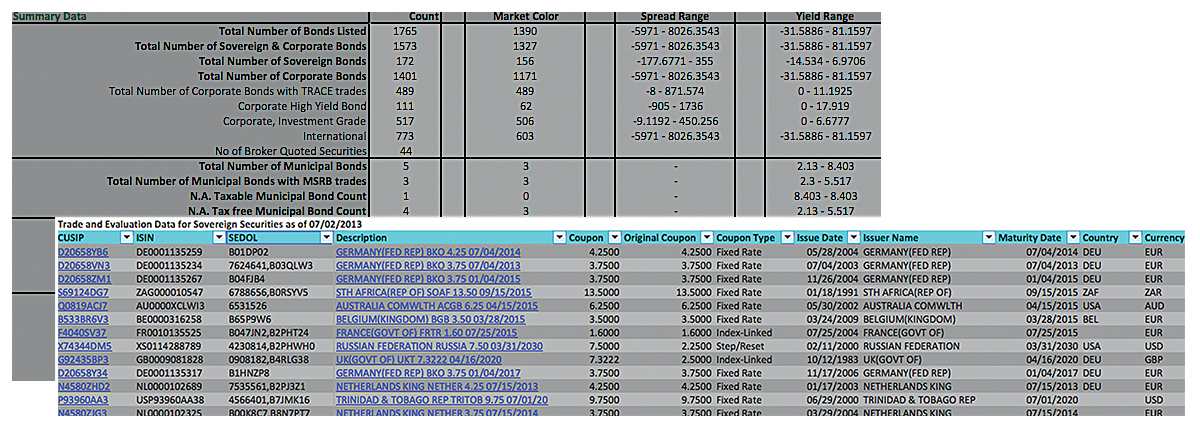

Vantage provides a way for you to better understand evaluated prices within the context of a broad range of relevant market information, including public and proprietary market data inputs used in the evaluated pricing process. These inputs appear side-by-side with our evaluated prices in a single display, and feature our assumptive data and proprietary market color. This includes anonymous trades, quotes, dealer runs and market posts, along with publicly available FINRA TRACE® and MSRB data.

Key features

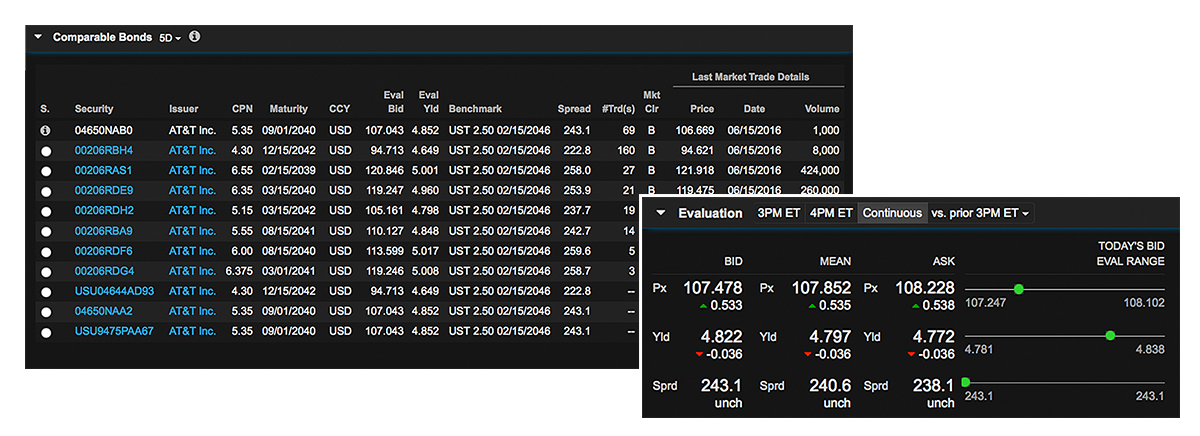

- Graphic displays of daily and historical market data and trades alongside the ICE Data Services evaluated price

- An innovative "Market Depth Indicator" that quantifies the number of market data sources and the number of quotes provided per source

- A comparable bond feature that helps to identify and analyze securities with similar characteristics

- Highlighted market events, activity, tolerance reports and other information

- Reference data including terms and conditions

- A Trade/Cover Summary that provides MSRB and FINRA TRACE trade and cover activity statistics

- Evaluated price and spread history

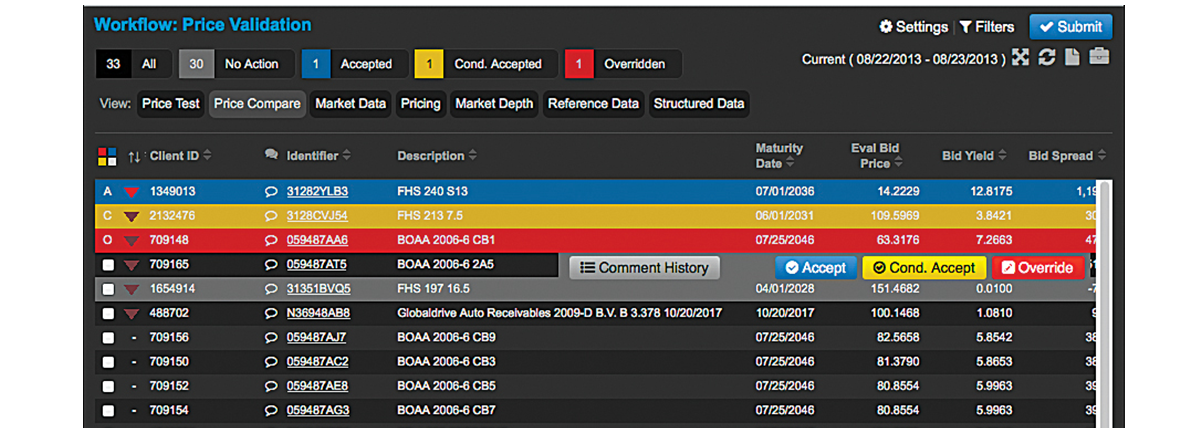

Use the Vantage Price Validation Workflow to efficiently manage the price exception validation or trade review process with a set of auditable, controlled and spreadsheet-free reporting and workflow tools.

Key features

- Reduce the operational cost of meeting current regulatory requirements

- Review your data alongside our ICE Data Services content within a user-friendly interface

- Support fair value hierarchy determinations under U.S. GAAP and IFRS

- Enhance communication between front office, back office, compliance, risk, legal and audit personnel

- Quickly link to the Vantage Evaluation Toolkit download

- Use dashboard and workflow filters for more efficient tracking of exception processing

- Streamline your process with bulk accept of price exceptions

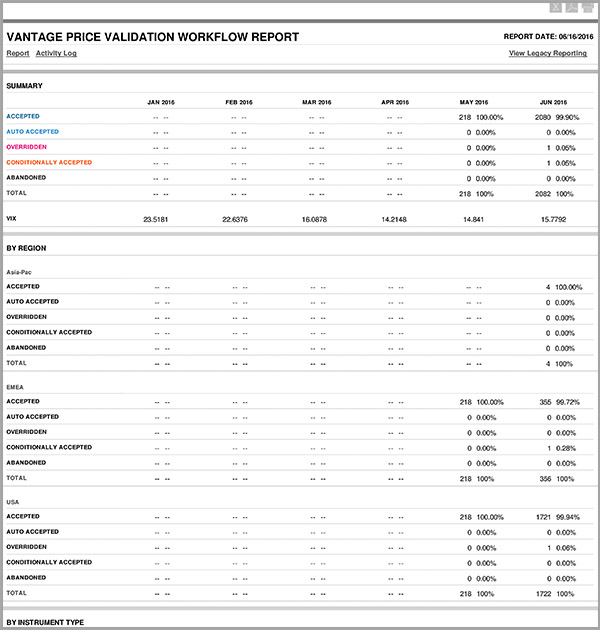

Price Validation Workflow Reports are available, providing summary statistics and drill down on validation activities.

Key features

- Generate pre-formatted and custom reports on a daily or monthly basis to support your valuation oversight process

- View consolidated reports on tolerance and challenge activity, which can be produced by region, by instrument type and by action taken (such as evaluated price accepted or overridden)

- Eliminate manual consolidation and improve risk management processes with automated aggregation of data into a standardized set of reports

- Create reports for board directors and auditors

FASB ASC Topic 820 and IASB IFRS 13, plus heightened scrutiny from SEC and PCAOB staff on valuation practices, have magnified demands on firms to assess the assumptions and inputs that vendors use in producing evaluated prices. MiFID, FINRA Rule 5310 and MSRB Rule G-43 establish minimum standards for broker dealers when executing client orders. The Vantage Evaluation Toolkit Report and the Vantage Trade and Evaluation Compliance Report were designed to help support these accounting standards and regulatory rules.

The Vantage Evaluation Toolkit Report provides evaluation, market data, bond characteristics and assumptive data to support deep-dive activities. You can review inputs that support evaluated prices for security holdings in support of Topic 820 and IFRS 13 research.

The Vantage Trade and Evaluation Compliance Report can be used to support best execution compliance and analysis. This data rich report provides basic reference data, our ICE Data Services’s evaluated prices and available trade data, including FINRA-TRACE® and MSRB reported trade prices, trade times and trade size information. The data is provided in an FTP file.