Climate Driven Devaluation Cycle

Insurance premium costs increase

Affordability is diminished for current and future owners

Asset prices in affected areas are devalued

Loan losses impact securitized trust performance

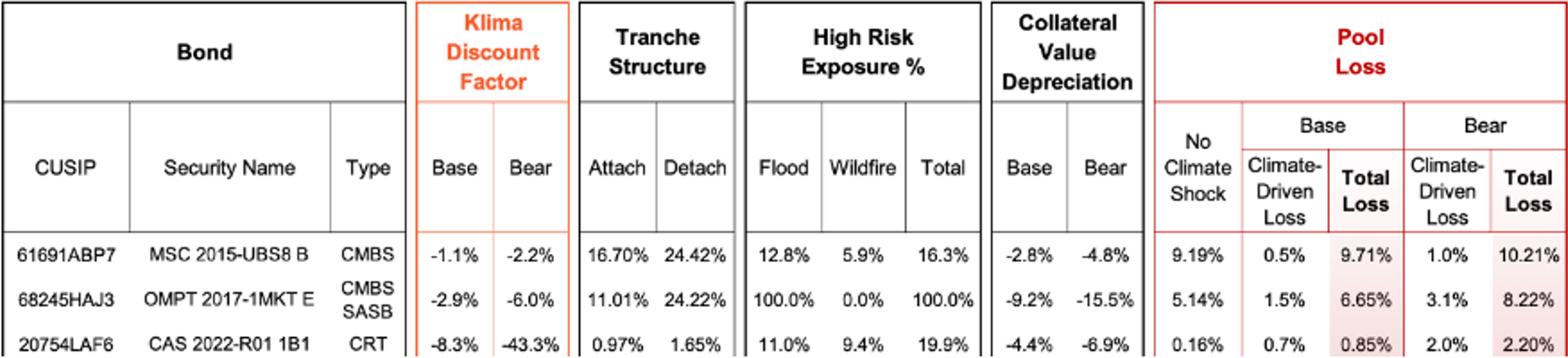

Turn-key metrics for securitized investors

- Bond intrinsic value impact in Base and Bear scenarios of insurance cost increases and property value declines

- Asset price depreciation risk from flood & fire exposure

- Climate-adjusted DTI/DSCR & LTV

- Loan expected default frequency & loss given default

- Pool expected loss distribution

Use Cases

- Investment Analysis

- Portfolio Risk Management

- TCFD-aligned Reporting

Coverage

- Agency Credit Risk Transfer

- Fannie Mae Connecticut Avenue Securities (CAS)

- Freddie Mac Structured Agency Credit Risk (STACR)

- Private Label CMBS

- Conduit/Fusion

- Single Asset Single Borrower (SASB)

- NEW - Non-Agency RMBS

- Prime Jumbo

- Non-QM

Turn-key metrics for securitized investors

- Bond intrinsic value impact in Base and Bear scenarios of insurance cost increases and property value declines

- Asset price depreciation risk from flood & fire exposure

- Climate-adjusted DTI/DSCR & LTV

- Loan expected default frequency & loss given default

- Pool expected loss distribution

Use Cases

- Investment Analysis

- Portfolio Risk Management

- TCFD-aligned Reporting

Coverage

- Agency Credit Risk Transfer

- Fannie Mae Connecticut Avenue Securities (CAS)

- Freddie Mac Structured Agency Credit Risk (STACR)

- Private Label CMBS

- Conduit/Fusion

- Single Asset Single Borrower (SASB)

- NEW - Non-Agency RMBS

- Prime Jumbo

- Non-QM

Climate Credit Analytics Data Sample

Related insights

Credit Risk Transfer bond ratings may fail to capture insurance-driven credit risk in agency mortgage pools

Over the past few years, many homeowners in the United States have seen their home insurance rates increase dramatically.

The FHFA’s Advisory Bulletin on Climate-Risk Management

Over the past few years, federal regulators have started to pay closer attention to climate-related risks in the real estate and mortgage markets.

Climate and insurance risk for lenders and securitized investors

In this recent webinar, we discussed how climate risks are contributing to dislocation in property insurance markets and the implications for mortgage credit.

Credit Risk Transfer bond ratings may fail to capture insurance-driven credit risk in agency mortgage pools

Over the past few years, many homeowners in the United States have seen their home insurance rates increase dramatically.

The FHFA’s Advisory Bulletin on Climate-Risk Management

Over the past few years, federal regulators have started to pay closer attention to climate-related risks in the real estate and mortgage markets.

Climate and insurance risk for lenders and securitized investors

In this recent webinar, we discussed how climate risks are contributing to dislocation in property insurance markets and the implications for mortgage credit.

Quantify your climate risk and opportunity

Important Disclosures

Trading and execution services are offered through ICE Bonds Securities Corporation or ICE Bonds, member FINRA, MSRB and SIPC. The information found herein, has been prepared solely for informational purposes and should not be considered investment advice, is neither an offer to sell nor a solicitation of an offer to buy any financial product(s), is intended for institutional customers only and is not intended for retail customer use. ICE Bonds offers extended hours trading on ICE BondPoint. Before engaging in extended hours trading, you should consider the points contained in ICE Bonds’ Extended Hours Trading Risk Disclosure, which can be found here.

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model-based curves, market sentiment scores, Size-Adjusted Pricing, and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC's website at adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC ’s Form ADV is available here or upon request.