Transparency. Usability. Stability.

AFX enables efficient and economical experiences in the overnight market.

The benefits run across virtually every facet of the lending and borrowing process.

Ease of use

We offer rapid onboarding, an intuitive user experience and the ability to transact directly with specific market participants that align with almost any credit, size or geography preference.

Transparent rates

The transparent price discovery revealed by our marketplace enables lenders and borrowers to source liquidity at market rates.

How it works

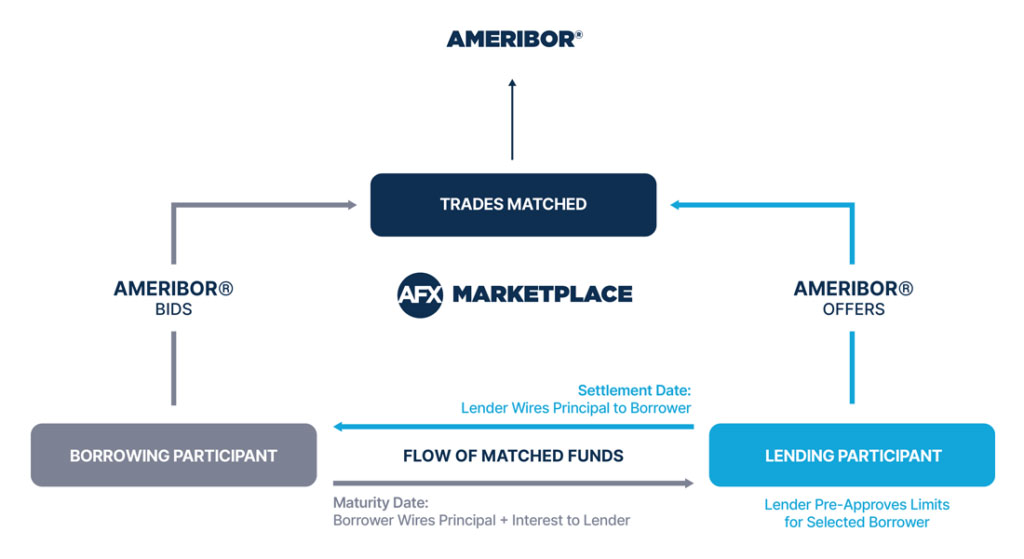

The AFX Marketplace facilitates electronic trade matching and two-way liquidity combined with robust security.

Over $2 Trillion

Over 1,800

Where business gets done

AFX is home to more than 200 banks and financial institutions operating in all 50 U.S. states.

Many of these participants are the community and regional banks that power the American economy through their diversified lending portfolios. Providing these institutions with a robust marketplace for lending and borrowing creates a more accurate cost of funds in AMERIBOR – intelligence these institutions utilize for managing their risk and profitability.

Get started today

Whether it’s a safe, efficient marketplace or actual reflection of the overnight market, we deliver modern solutions for interbank lending and borrowing. Take the next step.