ICE Fixed Income monthly report

In this edition, Amanda Hindlian our President of Fixed Income & Data Services shares her optimism over the growth of fixed income assets in Asia. You can also read our latest insight on the proposed liquidity requirements by global asset management regulators and a new whitepaper from BlackRock on bond ETFs.

Join our mailing list to receive the newsletter and ICE Fixed Income team updates

In Asia, fixed income has its time in the sun

I’ve just returned from Hong Kong and Singapore, where one theme stood out: fixed income as an asset class is flourishing. To be fair, it’s the extension of a global story as rate hikes and inflation woes cast a shadow on equities. In Asia, the theme has regional nuances. For example, much support comes from the growth of wealth - both for the upper middle class and high net worth investors - since rates were last this high. That’s at least a decade ago for several Asian markets, when fixed income ETFs were largely unknown to retail investors.

Now, they’re booming: one regional issuer noted in our conversation that they were seeing daily inflows of ~US$50 million in retail money into bond ETFs over recent months. Assets under management benchmarked to our bond indices - the bulk in Taiwan - are at ~US$15 billion, up from just over $US4.5 billion five years ago. Local issuers are cognizant of the fact that they’re now competing with international brokers for inflows. Unlike North American markets, it’s less a case of ‘bonds are back’ and more ‘bonds break through’ for a region where stocks, commodities and alternative investments have traditionally been more popular.

For retail investors, the attraction is clear: yield. Asia investment grade debt has returned ~9.1% since last November while US investment grade paper has returned ~7.6%. For those with the stomach for greater risk, Asian high yield paper has notched an eye-popping 25.1% in the same period. Yet overall, the flight to quality in other markets is also clear in Asia, with liquidity drying up in the Chinese high yield space amid a backdrop of macroeconomic uncertainty.

Greater comfort with the asset class is also evident among high net worth investors, many of whom are showing a preference for the higher risk-reward of owning direct bonds versus funds, especially in markets like Taiwan. More broadly, while Hong Kong remains the regional epicenter for trading, a massive shift in capital continues, with markets like Singapore benefitting. Could this see the status of Singapore rise as the financial hub for fixed income and wealth management? What are the wider implications of fixed income growth for the region? Like many of you, I’ll be watching this space.

1All figures discussed in this article are based on data from ICE Data Services as of 5/19/23

ICE BofA Investment Grade Corporate Bond Index Total Return

ICE BofA High Yield Corporate Bond Index Total Return

Data in Action

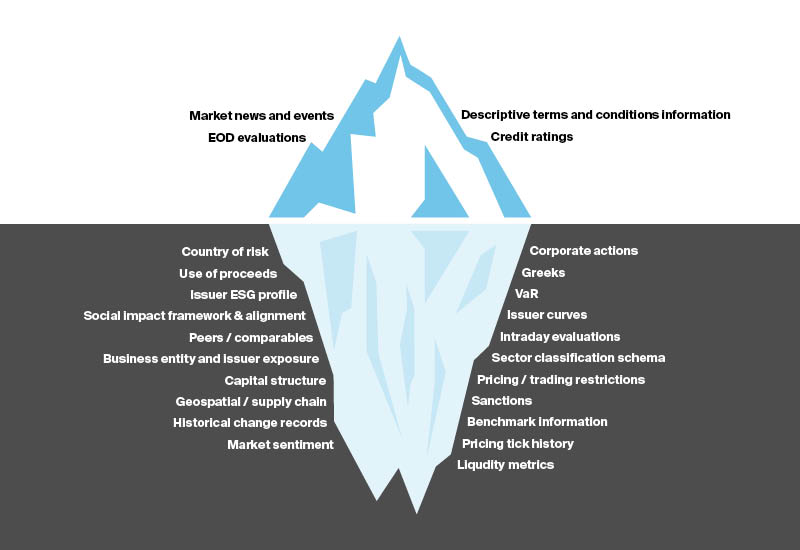

Beneath the surface: Visibility is only as good as your data

Financial market upheaval is typically accompanied by higher volatility and reduced liquidity as participants trim risk and tighten counterparty oversight. These hallmarks were evident during the Global Financial Crisis of 2008-09 when investment firms shunned the so-called “alphabet soup” of securitized products, selling or avoiding CLOs, CDOs, and MBS. Other examples include the EU sovereign debt crisis, when government bonds issued by “PIGS” nations (Portugal, Italy, Greece, and Spain) were blacklisted, and in the municipal space during major bankruptcy events. Astute risk management during these shakeouts relies on nimble, efficient analysis of information.

Insights

Fund liquidity scrutinized by global regulators

Global regulators in Europe, Asia and the United States are scrutinizing fund liquidity requirements in the wake of the pandemic and recent market volatility. The aim: to bolster sector resilience, maintain market integrity, and strengthen funds ability to meet redemption requests. Here, the protection of retail investors and reduction of systemic risk is in sharp focus, after the pandemic ‘dash for cash’ in March 2020 and the U.K. pensions crisis last year.

Insights

Drought as a credit risk in the municipal bond market

Over the next forty years, ICE’s analysis projects the duration and severity of droughts across the United States will likely increase due to climate change. The effects could be far-reaching and profound: in 2015, drought conditions in California caused over $1.5 billion in agricultural losses and over $2.5 billion in total losses. Drought conditions may also directly impact human health—dust and wildfires can worsen air quality and put people with lung diseases and asthma at higher risk of irritation and infection, and newly stagnant water creates mosquito breeding grounds that have been linked to outbreaks of West Nile Virus. Widespread food shortages and rising prices that result from drought can affect populations well outside areas directly affected.

Insights from BlackRock

The Great Yield Reset: Bond ETFs and the generational opportunity in fixed income

A watershed moment in bond investing is occurring and the opportunity is profound. After last year — the most challenging bond market in decades — yields are back across most fixed income sectors. As a result, there are strong flows into fixed income assets, much of which are migrating into bond ETFs as investors adjust risk and recalibrate portfolios to higher yield levels. This new fixed income paradigm is accelerating bond ETF adoption — a trend that paradoxically gathered speed in 2022 despite the challenging bond market and was most recently evident in March 2023 when volatility was triggered by concerns about the banking sector. Once again, investors turned to bond ETFs to adjust their portfolios and navigate market uncertainty, reinforcing the more traditional “flight to safety” role of bonds.

Best practices: post-pandemic review of funds’ liquidity risk management programs

Global regulators are looking to improve fund liquidity requirements as part of the post pandemic review and recent market volatility. They are seeking to strengthen buy-side liquidity management programs to help boost transparency and bolster sector resilience. The areas of focus are common across several jurisdictions such as liquidity stress testing, liquidity classification, and liquidity management tools.

Join experts from ICE and FactSet to learn about the proposed changes and their impact globally.

Fixed Income

Manage risk, uncover opportunities, and make informed decisions in real-time with ICE’s end-to-end fixed income solutions. Reimagine your fixed income workflow from price transparency & discovery and efficient execution through to performance analysis.

This material contains information that is confidential and the proprietary property and/or a trade secret of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”), is not to be published, reproduced, copied, modified, disclosed or used in any way without the express written consent of the ICE Group. This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between the ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, or other professional advice.

The information contained herein is provided “as is” and the ICE Group makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. The ICE Group makes no representation or warranty that any data or information (including but not limited to evaluated pricing) supplied to or by it are complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall the ICE Group have any liability for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits) in connection with any use of and/or reliance on the content of this document even if advised of the possibility of such damages.

This document is not an offer of advisory services and is not meant to be a solicitation, or recommendation to buy, sell or hold securities. This document represents ICE Group’s observations of general market movements. Trades and/or quotes for individual securities may or may not move in the same direction or to the same degree as indicated in this document. Please note that the information may have become outdated since its publication.

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model-based curves, market sentiment scores, and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

Trademarks of the ICE Group include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data, and New York Stock Exchange,. Information regarding additional trademarks and intellectual property rights of the ICE Group is located at www.ice.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.