From raw data to decisions - in days, not months

RAP® is a cloud-based analytics environment built for speed, scale, and clarity. It gives your team direct access to ICE’s industry-leading mortgage, property, climate, and macroeconomic datasets - plus your own and third-party data - in one unified, ready-to-use platform. RAP® can help analysts, quants, and data scientists:

- Spot risk and opportunity in real time at the property, loan, or CUSIP level.

- Accelerate model development with clean, connected datasets and prebuilt solution notebooks.

- Collaborate effortlessly by sharing code snippets, dashboards, and results across teams.

- Integrate seamlessly with tools like Tableau and Power BI, using pre-built dashboards to get moving fast.

Explore on the platform

Source: ICE RAP®

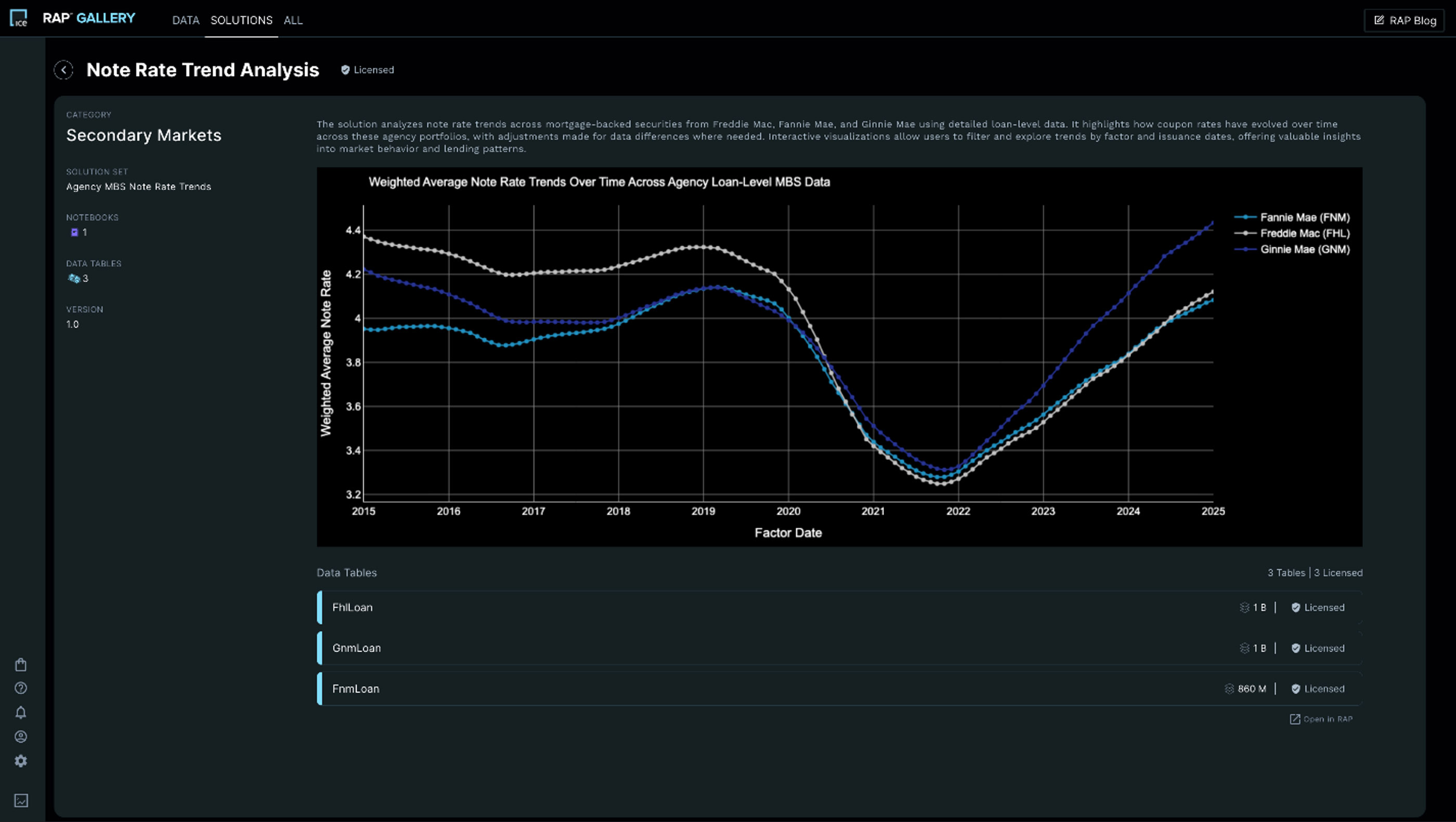

Note Rate Trend Analysis

Tracking agency Mortgage-Backed Securities note rate trends over time to uncover market shifts and inform portfolio strategies.

Source: ICE RAP®

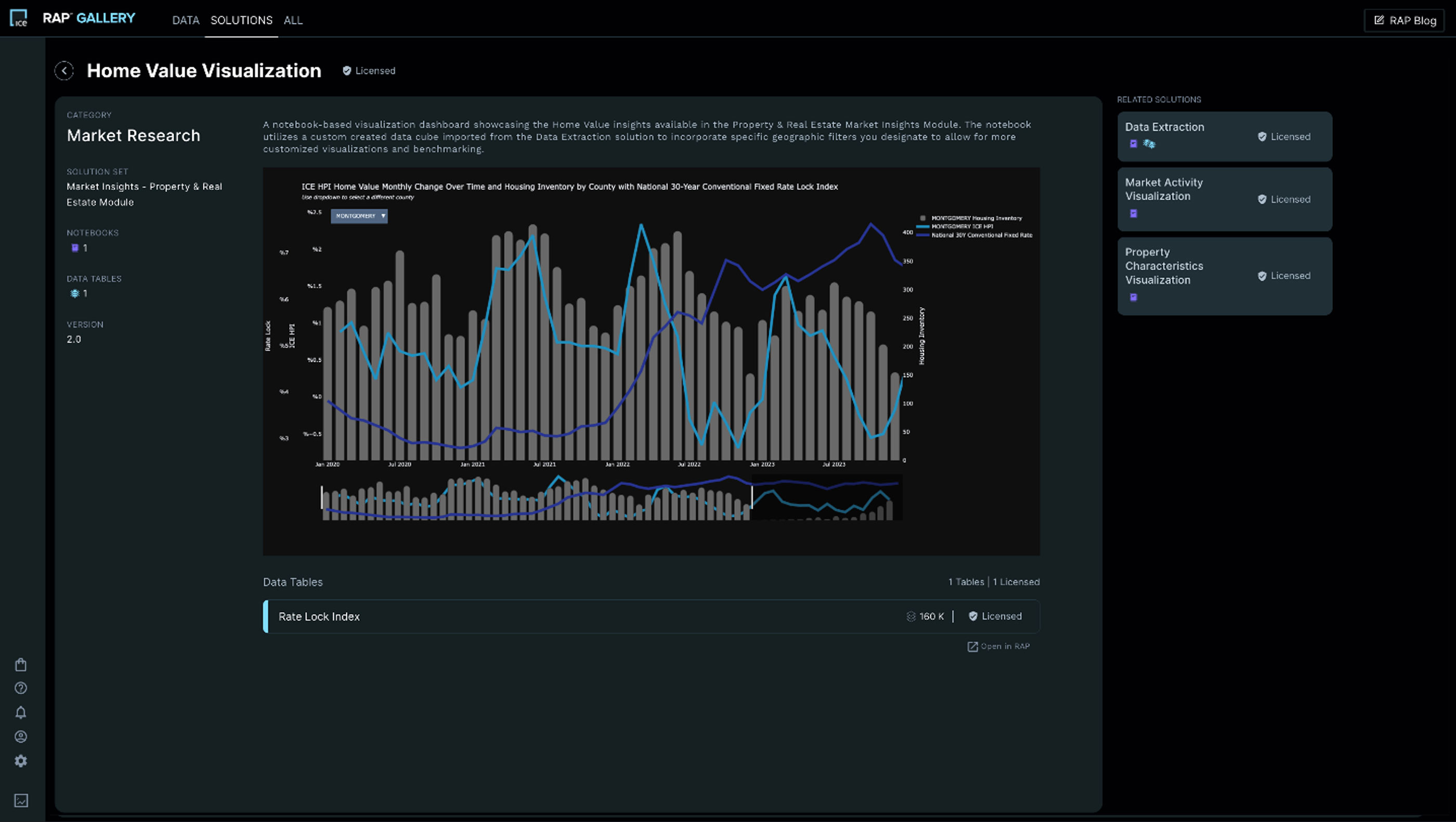

Home Value Visualization

Leveraging property and real estate data with customizable dashboards to help model market trends, build geographic insights, and power advanced analytics.

Why choose RAP®

Immediate insight

Start delivering portfolio KPIs and market intelligence from day one. Unlike traditional platforms that require weeks of setup and customization, RAP® enables immediate access to actionable insights.

Reduced cost and complexity

Predictable pricing, no hidden query charges, and fewer integration projects. Compared to legacy systems and custom-built solutions, RAP® helps lower total cost of ownership and simplifies deployment.

Multi-language flexibility

Work in SQL, Python, R, or Scala in a familiar Integrated Development Environment (IDE).

Always-current data

Datasets refresh daily and are cloud-hosted for quick access.

Scalable performance

Handle the largest loan-level and property datasets with Spark-powered distributed processing.

Automated workflows

Schedule analytics to run and deliver insights to your chosen endpoints without manual intervention.

Your data — in one place

Whether you’re valuing portfolios, modeling prepayment and default risk, running Community Reinvestment Act (CRA) and Basel reports, or exploring new investment strategies, RAP® can help you work smarter, faster, and with greater confidence. With RAP®, you can access and combine:

- Active portfolio and paid in full portfolio data

- Public records and Multiple Listing Service data

- Mortgage-performance and loan-level insights

- MBS and rate lock data

- Automated valuation models and home price indices

- Climate risk analytics

- Market-condition and rental-market intelligence

- Economic indicators and macro trends

Expertise on demand

Alongside the platform, RAP® gives you access to our dedicated data science and advisory teams - specialists who understand your market and can help you:

- Ideate new use cases

- Optimize workflows

- Build custom analytics from the ground up

- Get new analysts productive in days through targeted training sessions

Related insights

Creating clarity in the MBS market through better data

The highly fragmented nature of mortgage asset components has historically translated into a lack of granular data for investors.

Home prices are cooling this spring led by a softer condo market

Amid heightened uncertainty, ICE's same-month Home Price Index offers insights that are weeks ahead of rival benchmarks with no lag.

The full cost of home ownership

ICE Climate integrates information about insurance premiums, property taxes, and utility bills to provide a more complete picture of home affordability.

Have a question?

Request a guided demo and see how RAP® delivers decision-ready insights from day one.