Funds must either be classified as Limited Derivatives Users or adopt a formal derivatives risk management program that includes:

| Designating a derivatives risk manager that reports to the board at least annually on program implementation and effectiveness and other matters |

| Calculating portfolio VaR and ensuring it is either below 200% of its designated reference portfolio (relative VaR test) or, if unavailable, below 20% of NAV (absolute VaR test) |

| Running at least weekly stress-testing that considers all market risk factors and their interdependencies, and |

| At least weekly backtesting the VaR model against actual realized PNL |

Benefits of our service

Perform Limited Derivatives User test cost effectively

- Calculate notionals for all derivatives

- FX adjust non-USD positions

- Scale down options and swaptions by their deltas

- Factor all IR futures, swaps and swaptions to their 10-year equivalent

- Allow for IR and FX hedged positions to be excluded

Calculate portfolio VaR daily

- Use historical simulation methodology to calculate portfolio VaR daily

- Run relative VaR tests against both the securities-only portfolio and a benchmark or weighted-basket of benchmarks

- Calculate absolute VaR test

- Provide evidentiary support for all calculations

Run weekly stress tests and back tests

- Prepacked scenarios with a mix of historical-based and pre-defined risk-factors scenarios

- Comparison of mark-to-market PNL to 1-day VaR and count the number of breaches for the weekly backtests

Perform Limited Derivatives User test cost effectively

- Calculate notionals for all derivatives

- FX adjust non-USD positions

- Scale down options and swaptions by their deltas

- Factor all IR futures, swaps and swaptions to their 10-year equivalent

- Allow for IR and FX hedged positions to be excluded

Calculate portfolio VaR daily

- Use historical simulation methodology to calculate portfolio VaR daily

- Run relative VaR tests against both the securities-only portfolio and a benchmark or weighted-basket of benchmarks

- Calculate absolute VaR test

- Provide evidentiary support for all calculations

Run weekly stress tests and back tests

- Prepacked scenarios with a mix of historical-based and pre-defined risk-factors scenarios

- Comparison of mark-to-market PNL to 1-day VaR and count the number of breaches for the weekly backtests

Why ICE?

- Workflow portable from existing connectivity with fund families and their service providers (e.g. ICE Liquidity Indicators and N-PORT)

- Historical VaR calculations that leverage ICE’s expertise in both Fixed Income and Derivatives

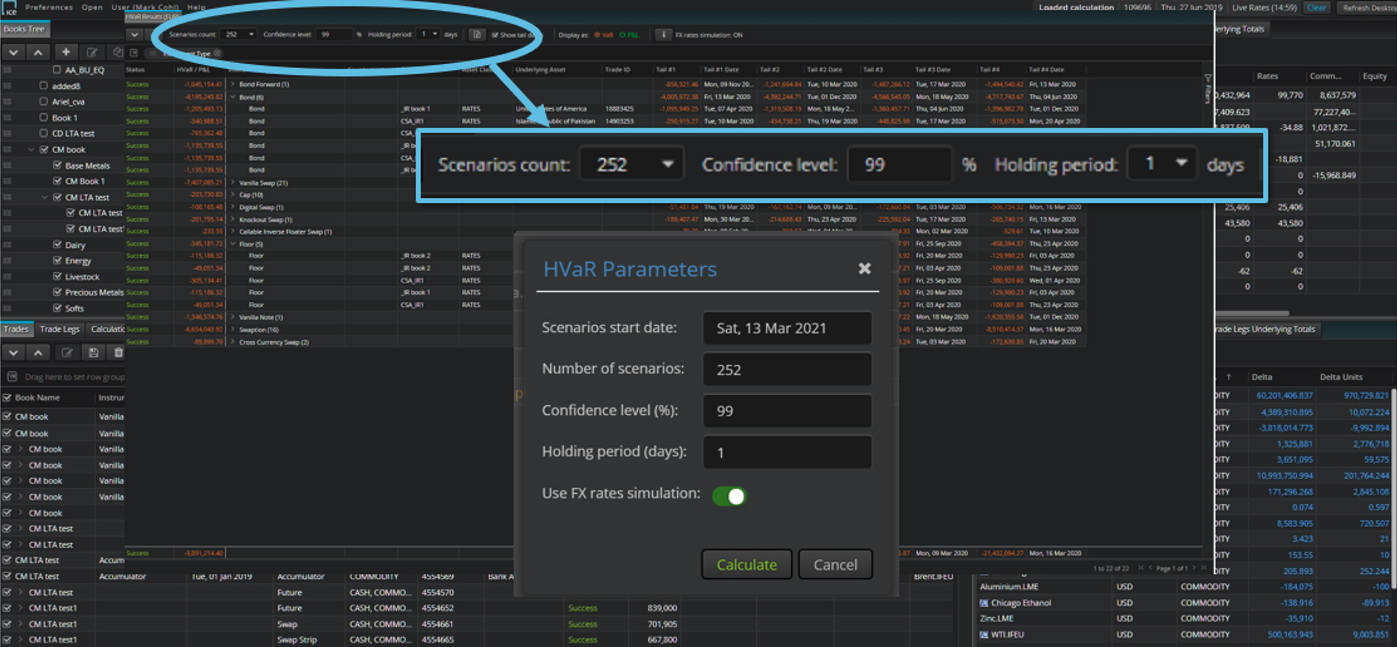

- Quality derivatives analytics and market data including an already existing HVAR model within ICE Portfolio Analytics (IPA)

- Robust and flexible methodology for structured assets utilizing indices administered by ICE Data Indices. A client can choose from over 6,000 indices for the security-mapping and beta calculations

Screenshot of HVAR in ICE Portfolio Analytics (IPA) - Derivatives

Insights

ARTICLE

Unpacking European ESG Regulation

ESG regulation is shaping the investment landscape in Europe. To help our clients navigate these challenges, we share key takeaways on the new requirements and how ESG data can help you gain compliance.

ARTICLE

Sustainable Finance and New Regulation

A patchwork of ESG standards across the investment landscape can often make meaningful comparisons difficult. Learn how consistent and reliable data can help you navigate these challenges.

ARTICLE

Why Having Granular ESG Data Matters

When it comes to ESG, not all data are created equal. Companies use their judgment in determining what information to disclose, in what format and which metrics to use. Having access to granular data is essential to making those judgments.

ARTICLE

Unpacking European ESG Regulation

ESG regulation is shaping the investment landscape in Europe. To help our clients navigate these challenges, we share key takeaways on the new requirements and how ESG data can help you gain compliance.

ARTICLE

Sustainable Finance and New Regulation

A patchwork of ESG standards across the investment landscape can often make meaningful comparisons difficult. Learn how consistent and reliable data can help you navigate these challenges.

ARTICLE

Why Having Granular ESG Data Matters

When it comes to ESG, not all data are created equal. Companies use their judgment in determining what information to disclose, in what format and which metrics to use. Having access to granular data is essential to making those judgments.