Recents

Expanding market hours: key considerations and the NYSE’s approachHow data can help municipal bond market participantsThe numbers are in for NYSE Options with our new platform in full operationA firsthand view of Japan's recent progressReflections on my visit to Brazil and ArgentinaWhy a government shutdown could not come at a worse timeCelebrating the intersection of climate and capital at ICE and NYSE during NYC Climate WeekAn impactful first year for the NYSE InstituteThe failed promise of unregulated cryptoHow higher taxes on share buybacks will hurt public companies and their shareholdersWednesday, Feb. 26, 2025

Expanding market hours: key considerations and the NYSE’s approach

With SEC approval, the NYSE is one step closer to longer trading hours

Earlier this month, the SEC approved the filing on an accelerated basis to extend trading hours on NYSE Arca, our fully electronic equities exchange, from 16 hours a day to 22 hours a day, five days a week. While this approval represents a positive step towards implementing our proposal, we must first align with the SIP committee, which consists of exchange groups, FINRA and industry advisors. This group manages the consolidated data feeds for the U.S. equity industry, and in our proposal, we committed to extending NYSE Arca’s trading hours only when the SIP data feeds are available for these same hours. Below we outline our reasoning for extending our hours to 22 hours in an effort to help the broader industry better understand the intricacies of extended-hours trading.

1. Everyone needs a break

Global markets, exchanges and trading platforms that offer “24-hour” trading tend to have a common thread: most take an hour or more break at least once per day. These breaks are used to ensure trades clear as expected, perform system maintenance, process various securities and contract operations (like coupon payments, corporate actions and expirations), and advance the trade date from one day to the next. There are substantial differences in both architecting and operating systems that operate 22 or 23 hours a day versus a full 24 hours; that continuous operation creates the need for a fundamentally different system architecture, such as separate systems, bringing additional operational complexity and cost. For these reasons, plus factors specific to equities trading, we proposed 22 hours and believe U.S. equities exchanges and ATS’s that plan to offer “24-hour” trading will more than likely take a similar pause. The duration and time of the break, in our view, should be aligned with one of the most critical elements in this discussion: clearing.

2. Centralized clearing matters

As a part of the Intercontinental Exchange, Inc. (NYSE: ICE), a leading operator of clearing houses around the world, the NYSE understands the systemic importance of centralized clearing and guaranteeing settlement.

We strongly believe exchanges should not match buyers and sellers when centralized clearing is not available because exchange clearing is fundamentally different than alternative trading systems (ATS) or other broker-to-broker clearing. When the clearing house (Depository Trust and Clearing Corporation or DTCC) is open, trades are submitted immediately, and counterparty risk is well defined. However, when DTCC is not open, the clearing firm absorbs counterparty risk. Clearing firms are specifically managed and regulated to serve this function; exchanges are not clearing firms and current market rules do not contemplate exchanges assuming counterparty risk by “holding” trades until the clearing house opens.

This is meaningful, even for small windows of time, as world events could create extreme volatility and volume. In such scenarios when the clearing house is closed, market participants trading on an exchange could have substantial exposure to an unknown counterparty, whereas on an ATS during such an event their exposure is to the ATS’s clearing firm.

3. What about corporate actions?

In 2024, the NYSE Group processed tens of thousands of corporate actions, including dividends, stock splits, distributions and other capital structure adjustments by corporations or funds. These adjustments happen while exchanges are closed between 8:00 PM and 4:00 AM, and nearly always affect the trading price of the security.

In a new world with longer trading hours, having a break in system operations is key to managing the risks associated with processing corporate actions. Today, some overnight venues mitigate this risk by not trading symbols with pending corporate actions. This approach can be improved through broader industry coordination with both DTCC and listing exchanges. We believe the industry is better served with a coordinated break in trading to ensure a safe and orderly transition to the next trading day, including the appropriate processing of corporate actions.

What’s next?

As the first established equity exchange to file and receive SEC approval to extend trading hours, the NYSE foresees global interest in U.S. equities markets continuing to increase, and responsibly expanding exchange trading hours will allow investors to safely access our markets. We understand both the opportunities and risks involved with extended-hours trading and strongly believe that any U.S. equity exchange should align its hours with those of DTCC, which can shift as DTCC continues to expand their hours of operation.

Notably, we proposed 22 hours, rather than 24, not because we don’t think the industry can or will get there — rather we saw this as the most pragmatic and expedient next step for the industry to meet this growing demand without introducing unnecessary risk, complexity, cost or time to market.

A critical next step to extend trading hours as quickly and responsibly as possible is SIP committee approval of our proposal. We believe extended trading hours can be achieved in 2025 and are hopeful the industry will take this important step in meeting global demand for expanded access to liquidity in U.S. equities without further delay.

Friday, Oct. 11, 2024

How data can help municipal bond market participants

Hurricanes Helene and Milton recently struck the U.S. Southeast and Gulf Coast, highlighting the physical climate risk exposure of municipalities and their associated debt securities. These powerful storms posed immediate threats through destructive winds and flooding, emphasizing the urgent need to apply advanced data capabilities to navigate financial risks. By managing this exposure, stakeholders can better prepare for future disasters, ensuring the resilience of communities and financial assets.

Just two weeks ago, Hurricane Helene had a devastating impact on local communities in five states—Georgia, North Carolina, South Carolina, Tennessee, and Virginia. According to ICE Climate data, more than 300 entities with outstanding debt—including towns, cities, school districts, counties, and hospitals—were exposed to flooding, linked to over 15,000 municipal debt securities.

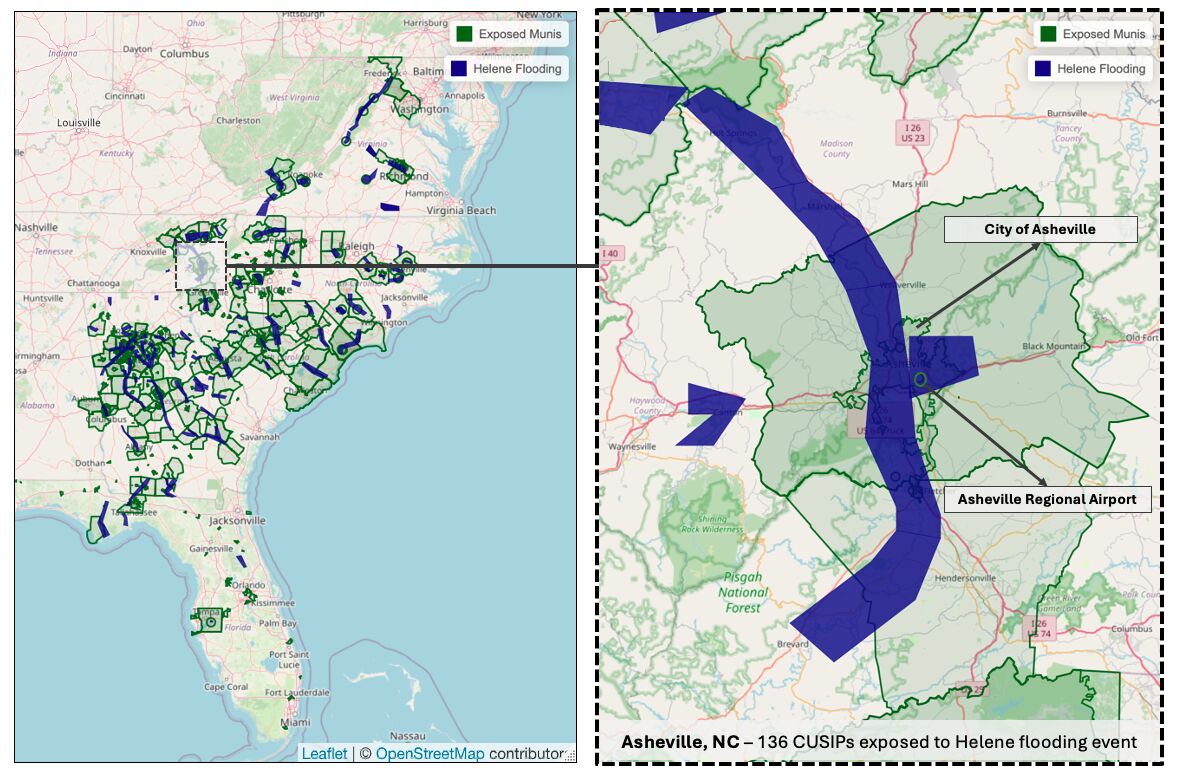

Two maps created by the ICE Climate team illustrate the extent of the exposure:

The map was created on Wednesday, October 9, based on the forecasted storm path at that time.

Flooding and Municipal Bond Exposure (Left): This map shows the flood boundaries during Hurricane Helene (in blue) and intersecting municipal locations (in green), using data from the National Weather Service and NOAA, integrated via ICE’s geospatial platform.

Taking a Closer Look (Right): A closer look at Asheville, NC (above) shows 136 municipal securities (CUSIPs) tied to areas exposed to flooding.

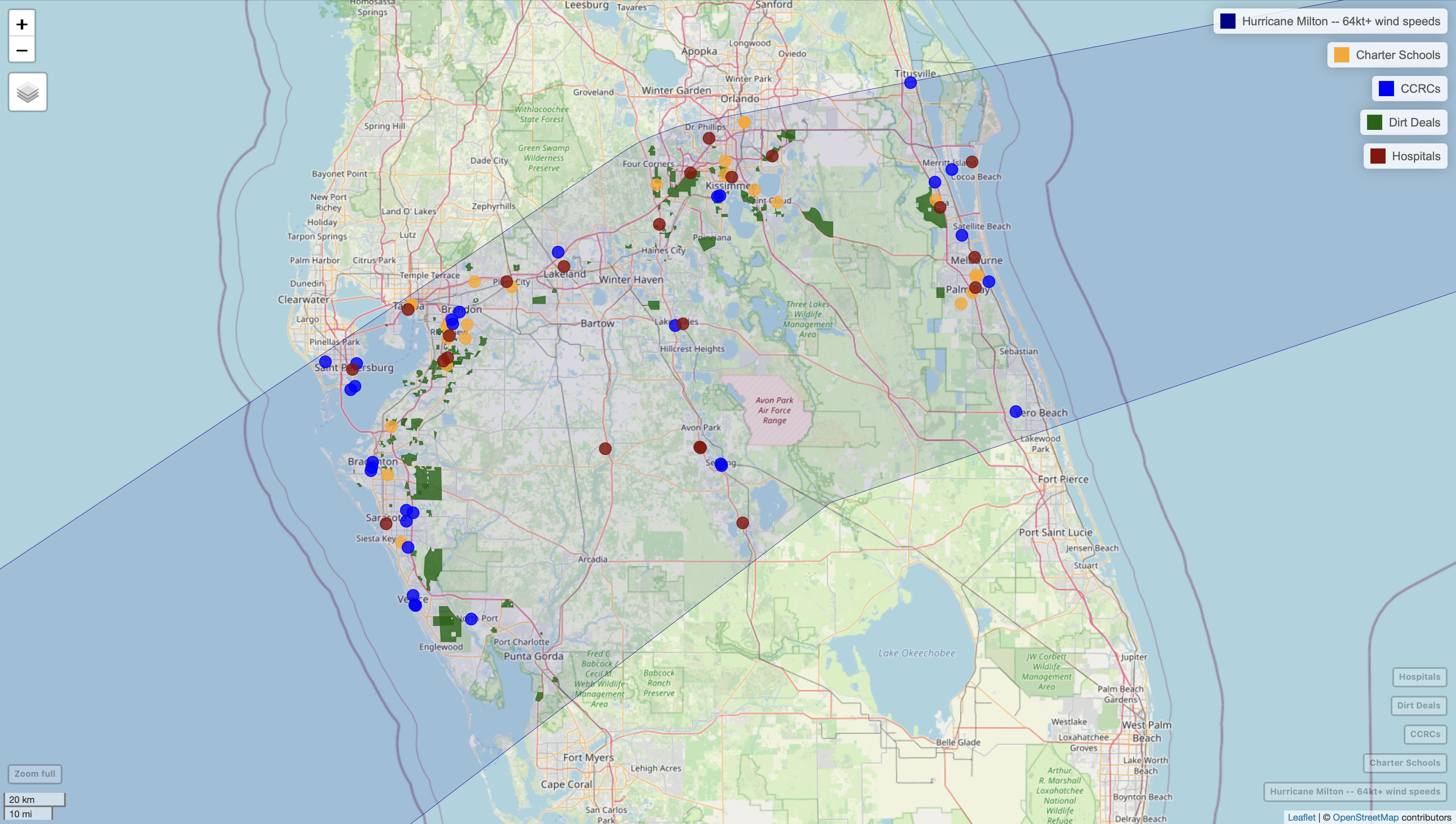

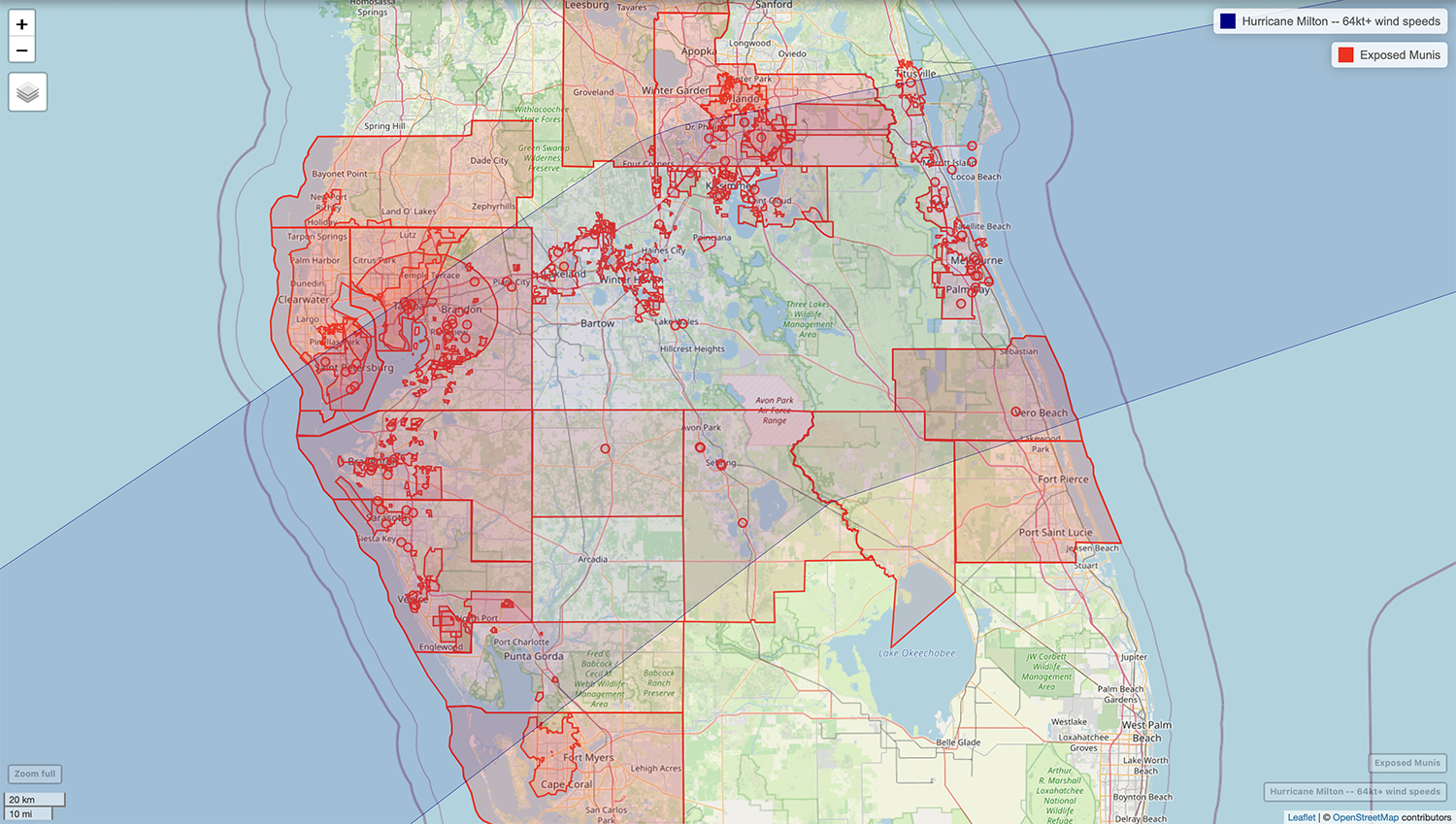

As recovery from Helene began, Hurricane Milton quickly emerged as a second threat to Florida. On the maps below, the municipalities and other entities (hospitals, charter schools, etc.) with outstanding debt that were potentially exposed to high winds shown on the maps below.

The map was created on Wednesday, October 9, based on the forecasted storm path at that time.

Municipal Boundaries and Asset Locations: This map displays municipal boundaries and asset locations overlapping with Milton’s projected hurricane-force wind speeds (at least 64 knots / 74 mph), marked in blue.

The map was created on Wednesday, October 9, based on the forecasted storm path at that time.

Sector Exposure: This map categorizes locations by sector, identifying those most at risk, including Community Development Districts (CDDs), Charter Schools, Continuing Care Retirement Communities (CCRCs) and Hospitals.

Overall, ICE's analysis indicated that nearly 400 municipal issuers and ~9,000 municipal securities were potentially exposed to hurricane-force winds in Hurricane Milton.

The challenges posed by Hurricanes Helene and Milton underscore the need for municipalities and market participants to understand and manage their vulnerabilities. By using advanced data capabilities, stakeholders can better prepare for and respond to these disasters, ensuring community resilience and financial stability.

Our research team is available for discussions to provide additional support. Please read ICE Climate Analytics for Municipal Debt for more information.

Tuesday, Jul. 23, 2024

The numbers are in for NYSE Options with our new platform in full operation

At the conclusion of trading on Dec. 21, 2023, members of the team responsible for rolling out our industry-leading technology platform across both our options exchanges made their way to the NYSE’s iconic podium to ring the closing bell. They were celebrating a job well done, the successful migration of our second and final options exchange, NYSE American Options, to the Pillar platform.

An accomplishment to be sure, but the team’s work was far from over. In some ways, it was just getting started.

Today, with a full half-year behind us operating both of the NYSE’s options markets on Pillar, we are beginning to see the fruits of this effort, which began years earlier with the migration of the NYSE’s five equity exchanges to Pillar. However, in our options markets, which have experienced a massive surge in trading the past few years, the results are as clear as they are remarkable.

From the moment Pillar went live on NYSE American Options in late 2023, we saw, as anticipated, median latency drop by a stunning two-thirds to less than 30 microseconds, in line with our NYSE Arca Options exchange, which moved to Pillar in 2022. Latency is how quickly electronic messages — orders, cancels and bulk quotes— can be processed. In modern markets, this is a critical metric.

As latency came down, we saw an immediate increase in daily message traffic across both markets simultaneously, more than doubling pre-Pillar levels. This also outpaced traffic growth across the industry. Because options trading tends to come in discrete bursts of activity, rather than evenly across the day, the reduced latency removed a significant capacity constraint, allowing a greater number of messages to flow through our exchanges at these peak times.

In an industry where meaningful market-share gains are measured in double-digit basis points, NYSE Group has grown market share over 250 basis points, when comparing the first two quarters in 2024 to the last two quarters of 2023. Over 200 basis points of this increase has come from electronically matched trades, arguably the most competitive part of the options business, where industry leading technology is a differentiator.

Now that the multi-year Pillar rollout is complete, we have refocused our work. Our team’s emphasis is now squarely on further optimizing the performance of Pillar across our markets, exploring new features and product innovations, while continuing to grow and strengthen our relationships with market participants.

While we are thrilled with what we’ve seen in the first two quarters of Pillar operating across both options exchanges, we are equally excited about continuing to innovate and deliver for market participants in the years to come.

Tuesday, Apr. 30, 2024

A firsthand view of Japan's recent progress

Have a conversation about global economics today and it’s likely the Japanese stock market’s impressive resurgence will be a central theme. Japan is making financial headlines once again, and it comes just a year and a half after Prime Minister Fumio Kishida laid out his economic plan in a major speech delivered from the Board Room of the New York Stock Exchange.

The NYSE’s relationship with Japan has been a close one for many years, with some of the nation’s largest public companies listed on our exchange. So, I was understandably thrilled to travel to Tokyo and witness Japan’s most recent progress firsthand.

It was an inspiring trip. While in Japan, I was able to meet with members of the National Diet and officials from the Bank of Japan and the Financial Services Agency. I also had discussions with leaders at the Tokyo Stock Exchange and executives of NYSE-listed companies headquartered in Japan.

Many of these individuals shared that they are seeing near-term developments and macroeconomic and geopolitical trends they believe are leading to a fundamental shift in how the world — particularly investors — sees the country after the economic stagnation that followed the postwar boom years that ran through the 1980s.

For example, Kishida’s economic reforms have included an emphasis on Nippon Individual Savings Accounts (NISA), which have encouraged increased investments in U.S. and global stock funds, as well as pushing for large trading houses to unlock value by spinning off assets. Indeed, Japanese retail investors purchased stocks through NISA at a record pace in January, according to the Nikkei Asia.

During the prime minister’s visit in late 2022, the NYSE signed a memorandum of understanding with the Tokyo Stock Exchange to support cross-border investment and collaborate on product development. This initiative led to the NYSE helping TSE to launch active ETFs, and since then we have assisted the exchange in launching 11 active ETFs.

Those I met with in Japan credited increased foreign participation in its stock market and a number of other factors in helping to create a more robust and resilient economy. Japan is also well positioned to capitalize on investments in chips, semiconductors and other high-end electronics, building on its resources and expertise in these areas.

Reflecting on my trip from the NYSE’s iconic headquarters in lower Manhattan, I am impressed and enthusiastic about Japan’s direction and achievements. We look forward to future visits by members of the Japanese government to 11 Wall Street and will continue to watch Japan’s growth with great interest.

Sunday, Apr. 14, 2024

Reflections on my visit to Brazil and Argentina

This year, the United States is celebrating an important milestone in international affairs — the bicentennial of diplomatic relations with Brazil. A resource-rich nation with a population of more than 200 million, Brazil is an important country economically and, naturally, its companies have a significant presence on the New York Stock Exchange.

I recently had the opportunity to visit Brazil ahead of this anniversary, as well as travel to Argentina, which celebrated its 200th year of diplomatic relations with the U.S. in 2023. With a renewed commitment to free markets, Argentina is another important nation in the region, one whose companies are also valued members of our NYSE community.

In fact, Brazil and Argentina each rank within the top five nations, outside of the U.S., with the greatest number of NYSE-listed companies. During my trip, I had the opportunity to meet with more than 25 NYSE listed-company CEOs, representing over half a trillion dollars in combined market value, to understand firsthand how these two nations are approaching the challenges and opportunities inherent in our modern, global economy.

Based on my conversations with government officials and listed-company executives, I continue to be excited about Brazil’s direction and am following with great interest developments out of Buenos Aires, as the new government works to stabilize and grow its economy.

On regional economics, it has been interesting to watch the Brazilian economy in recent years become increasingly led by agriculture, which today accounts for about 25% of its GDP. This, incidentally, is a sector ICE supports energetically through our commodities futures markets, where we facilitate the trading of regionally important items like coffee and sugar.

My interest in Brazil, Argentina and other Latin American economies is far more than academic. The NYSE is a champion of global commerce, so visits like this one allow us to better understand where opportunities lie for global investors and companies. Interest in the region is very real. For example, nearly half of the NYSE’s most actively traded companies hail from Brazil.

This spring, we plan to continue hosting representatives from important global economies at the NYSE’s home at 11 Wall Street, and look forward to further strengthening our relationships with Argentina and Brazil, building on our more than two centuries of diplomatic relations.

Thursday, Sep. 28, 2023

Why a government shutdown could not come at a worse time

Now is not the time to threaten companies’ ability to raise capital.

Our U.S. capital markets are the envy of the world, allowing companies across a broad range of industries to raise the capital they need to drive growth and innovation. Following a lengthy slowdown, the IPO market recently began to regain momentum, starting with transactions that took place at the New York Stock Exchange in the second quarter of this year.

A government closure would impede federal regulators from processing filings for IPOs and other transactions, and potentially impact investor confidence and market performance. I’d urge our elected leaders to seek common ground in support of our capital markets at this critical time for the global economy.

Monday, Sep. 25, 2023

Celebrating the intersection of climate and capital at ICE and NYSE during NYC Climate Week

For those who live and work in New York City, the start of fall is not only characterized by the changing of leaves or aroma of pumpkin spice, but also the road closures and traffic delays that accompany the UN General Assembly and coinciding Climate Week.

Against the backdrop of the IPO of Klaviyo on the New York Stock Exchange, signaling the increasing energy returning to the IPO market, we hosted a number of events last week at the NYSE, where the intersection of climate and capital is embodied and celebrated. To kick-off NYC Climate Week, the NYSE hosted the launch of the Taskforce on Nature-Related Financial Disclosures (TNFD) Natural Capital Standards on Monday.

TNFD Co-Chairs David Craig and Elizabeth Maruma Mrema addressed the audience, sharing their excitement of the launch and bringing some bees and plants on the trading floor “to bring nature into the financial markets.”

The NYSE proudly hosted this milestone event as an organization that understands the importance of transparency to financial markets and the global economy, as well as the key role of standardization in delivering the transparency on which our markets rely.

Our community of NYSE listed companies and ICE’s data and exchange clients have a growing appreciation of the importance of natural capital and the need to understand and measure the risks to which assets are exposed. The launch of the TNFD framework is a valuable partner to companies as they measure and disclose the risks associated with nature’s critical enabling role in their businesses.

On Wednesday, ICE hosted its annual Climate and Capital Conference to bring together industry leaders across the investment, business and climate communities to discuss emerging climate-related challenges and opportunities. With the positive response of last year’s event and the many connections and conversations it generated, we decided to make this an annual meeting and welcomed Accenture this year as a co-host and sponsor.

To open the conference, David Craig’s keynote remarks shared with the audience that “[t]he financial industry is starting to realize the magnitude of nature and climate risks. Nature risk is quite larger than what many companies thought.”

The event was structured around three interconnected themes: adaptation, innovation, and regulation.

Adaptation is an important element to our success living in a world where we’ve greatly impacted the natural environment. Innovation is a key component of how we're going to solve the climate problem. And regulation continues to be an important issue to shareholders, stakeholders, and customers of companies that are driving disclosure and commitments to reducing emissions and net zero goals.

During the conference, I had the privilege of talking to Kamran Khan, Managing Director and Head of ESG in Asia Pacific at Deutsche Bank, in a fireside chat to discuss how to measure impact with the right data. “Investors can only make smart decisions with effective, useful, and timely data. In the ESG world, it’s important to think about private versus publicly available data, which is being created as we speak and different metrics being presented by TCFD, TNFD, ISSB, among others,” Khan shared.

“When thinking about making smart business decisions that are also impactful, players like ICE who can combine financial data with well-monitored non-financial data into the same package are very well placed,” he added.

We were also pleased to welcome Jeffrey Ubben, Founder and Managing Partner of Inclusive Capital Partners, to open the Innovation portion of the day, and also appeared on a recent episode of Inside the ICE House.

According to Ubben, “The urgency of this situation around atmospheric CO2 is how do we decarbonize now and how do we do it at scale.” He added, “The best way to do it now is to work with carbon emitters themselves, who are often left out of the conversation or run away from by the ESG community.”

To round out the week, the NYSE hosted the UN Sustainable Development Goals Investment Forum on Thursday, where the conversation centered around investment in critical areas of sustainable development. As demand for impact investing continues to grow, the UN SDGs remain as one key framework of measuring impact for investors.

We at ICE look forward to continuing the conversation around climate and capital at COP28 in UAE later this year.

Tuesday, Aug. 22, 2023

An impactful first year for the NYSE Institute

When we first announced the NYSE Institute’s launch a little more than a year ago, the response was overwhelmingly positive. Members from all parts of our community immediately understood the power of codifying the New York Stock Exchange’s efforts in global affairs and policy in support of our listed companies and markets.

Since that time, the NYSE has been at the center of many of the biggest policy issues of the day, from the war in Ukraine to the federal debt-limit debate, the future of our markets to collaboration with exchanges across the globe. By the numbers, it’s been quite a first year for the Institute.

The NYSE has hosted delegations from more than 30 countries and met with seven current heads of state. Our in-person programs have brought more than 1,500 attendees to the NYSE, including nearly 500 representing our listed companies. We have welcomed to 11 Wall Street four U.S. cabinet secretaries, met in person with one-quarter of the U.S. Senate, commented on six SEC or PCAOB rulemakings, and signed memorandums of understanding with five global exchanges.

Numbers alone, though, don’t fully capture the NYSE’s impact over the past year. The NYSE is the destination for world leaders and government officials who wish to reach the global business community and the Institute’s work has underscored this unique position.

When Ukraine President Volodymyr Zelenskyy needed to appeal for the world’s economic support, he gave a speech from the NYSE. When U.S. House Speaker Kevin McCarthy sought to kick off debate on the federal debt ceiling, he addressed the nation from 11 Wall Street. When Treasury Secretary Janet Yellen wanted the global business community’s feedback on the administration’s China policy, she visited the exchange. When Japanese Prime Minister Fumio Kishida wanted to outline his economic plan for Japan, he spoke from our Board Room.

“For inspiration, we need look no farther than to the dynamism of NYSE, which remains ever-vibrant, ever-renewing and ever-changing,” Kishida said during his remarks. World leaders. Local officials. Republicans. Democrats. The NYSE provides a platform for those seeking to share ideas on issues that matter.

Since our July 2022 launch, the NYSE has continued working to shape the world around us. Our collaborations with global exchanges, for example, have resulted in the introduction of active ETF listings in Japan. At home, we have worked with regulators to craft key rules that govern our markets. We have traveled on the road to host half a dozen roundtables for issuers on public company issues such as clawbacks, SEC climate disclosures and proxy advisors, with more to come. Our policy newsletter for listed companies now reaches an active readership of nearly 10,000.

Next month, the United Nations General Assembly convenes in New York City, and we have been hard at work creating activities around this annual diplomatic gathering. Stay tuned for much more from the NYSE Institute. We are just getting started!

Wednesday, Aug. 02, 2023

The failed promise of unregulated crypto

Markets have short memories. Four years ago, ICE created a fully-regulated, physically-delivered crypto futures market, with institutional-grade custody provided by ICE’s then-subsidiary, Bakkt. The custodian was regulated by the New York State Department of Financial Services - a license which is, rightly, not easy to obtain - and all crypto transactions were protected by our highly regulated clearing house.

Why did we start here? The answer is simple. The history of markets shows that physically delivered commodities provide price signals and allowing such pricing to occur in a transparent manner with clear rules INCREASES consumer confidence.

Working with Bakkt, ICE spent two years building from the ground up the safest version of a custody solution for digital assets. We built a custodian to store physical bitcoin with round-the-clock, state of the art security. We offered the most regulated environment for institutions to trade an unregulated asset class.

It was months and months of work, not without setbacks, and requiring copious amounts of perseverance and patience. But we were propelled by a vision to bring a regulated, connected infrastructure to digital assets to build confidence in crypto. And in doing so, we were applying a vision that has been consistent with our focus these past two decades – to bring transparency and trust to unregulated markets.

That was in 2019. The market did not then - and we believe evidence continues to show still does not - value the fully regulated, physically delivered crypto market. Rather, the market continues to congregate around the unregulated or cash-settled crypto markets, even despite news of some crypto firms defrauding customers of their money. So, we are perplexed by the supposed disappointment in the market on the recent news that another venture to bring a regulated custodian crypto service was recently abandoned.

The success of the regulated, cleared model has proven itself over again - through the volatility of the pandemic, the Ukraine war, and the UK’s mini budget. When the market was sucked into the hype around FTX, we consistently said that the crypto market remained immature and volatile, and that it was at risk of market manipulation, fraud, illicit finance and lack of governance, with economic, technical, ethical and public policy issues that needed to be addressed. The well-publicized failures in crypto over the last year show that the “traditional” finance model - with aspects like segregated customer funds - exist to keep customers’ money safe and secure.

The exchange and clearing industry provide critical financial infrastructure so that markets can discover the price of an asset and manage risk. And over the past 18 months, the industry has done that consistently through some of the most volatile trading days ever witnessed. Belts and braces of trading finance have an underappreciated mature role. We should not forget these strengths and we must not allow rules around crypto to create regulatory arbitrage which would be detrimental to the stability of the market. Crypto can only develop as a true asset class if it follows existing regulation under which markets in the real world operate.