ICE Three-Month SOFR Index Future82724011

ICE Futures U.S.

ICE Three-Month SOFR Index Future

Description

Cash settled future based on the compounded average of Secured Over Night Financing Rate (“SOFR”) for the referenced quarter

Market Specifications

- Trading Screen Product Name

- ICE Three Month SOFR Index Future

- Trading Screen Hub Name

- ICUS

- Contract Size

- $2,500 x the Rate Index

- Contract Series

- March, June, September and December; the number of listed contract months shall be as determined by the Exchange.

- Price Quotation

- 100 minus the numerical value of the Rate Index.

One Interest Rate basis point = 0.01000 Index Points or $25.00 per contract - Rate Index

- Business-day compounded average of the Secured Overnight Financing Rate “SOFR” per annum for the quarterly accrual period.

- Tick Size

- 0.00250 Index Points, equal to $6.25 per contract.

(Block and EFRP Trades can be priced at .00001 Index point increments) - Trading Hours

- 7:45 pm to 5:00 pm NY time

Preopen starts 15 minutes prior to the start of trading. - Last Trading Day

- One Business Day prior to the third Wednesday of the next quarterly Delivery Month

- Contract Symbol

- SR3

- Daily Settlement Window

- 14:58 to 15:00 NY time

- Final Settlement

- Cash Settlement at expiration, on the Business Day following the Last Trading Day

- Final Settlement Price Quotation

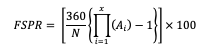

- The Final Settlement Price shall be determined as 100 minus the Final Settlement Price Rate (“FSPR”). The FSPR shall be the compounded average of the daily SOFR rate for the delivery quarter, calculated as:

Where:

x = the number of SOFR rates determined in the Accrual Period.

N = the number of calendar days in the Accrual Period.

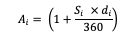

Ai = the overnight return factor in respect of the ith SOFR rate of the Accrual Period, determined as:

And rounded to eight decimal places, where:

Si = the ith SOFR rate of the Accrual Period, expressed in such a way that for a rate of 1% per annum, Si = 0.01.

di = the number of days that Si is applied, such that di represents the number of calendar days between the day in respect of which the rate Si is determined and the next day on which a SOFR rate is published.

For calendar days on which SOFR is not calculated (e.g, Saturdays, Sundays and bank holidays) the rate shall be determined on the most recent business day for which a rate was determined. - First Accrual Date

- Third Wednesday of the Delivery Month

- Last Accrual Date

- Business Day prior to the third Wednesday of the next quarterly Delivery Month

- Interest Rate Basis

- Act/360 Fixed

- Position Accountability and Limit Levels

- Position Accountability Level, single month and All Months Combined: 10,000 lots

- Daily Price Limit

- None

- Off Exchange Trade Types

- Block: 5 lot Block Minimum Quantity

EFP

EFS - Other Information

- Statement Regarding Final Settlement Price

The contracts have a standardized basis point value so that, for hedging purposes, a calculation will need to be made in relation to the hedge ratio to take into account any mismatch between the standardized basis point value and the actual basis point value of the position being hedged, determined by the actual number of days in the accrual period. - MIC Code

- IFUS

- Clearing Venues

- ICUS

Related Products

Trading Hours

| City | Trading | Pre-Open |

|---|---|---|

| NEW YORK | 7:45 PM - 5:00 PM* 19:45 - 17:00 | 7:30 PM 19:30 |

| LONDON | 12:45 AM - 10:00 PM 00:45 - 22:00 | 12:30 AM 00:30 |

| SINGAPORE | 8:45 AM - 6:00 AM* 08:45 - 06:00 | 8:30 AM 08:30 |

*Next Day

Codes

- Clearing Admin Name

- ICE US SOFR SR3

- Physical

- SR3

- Logical

- SR3

- GMI (FC)

- ION A.C.N.

- Symbol Code

- SR3