Knowledge Bite

February 2026

Before you dive in, take your turn in our Monthly Knowledge Quiz to check how much you know about Cocoa Markets. Click this link or scan the QR code with your phone’s camera to access the quiz on your device.

Cocoa price drivers: a quick breakdown

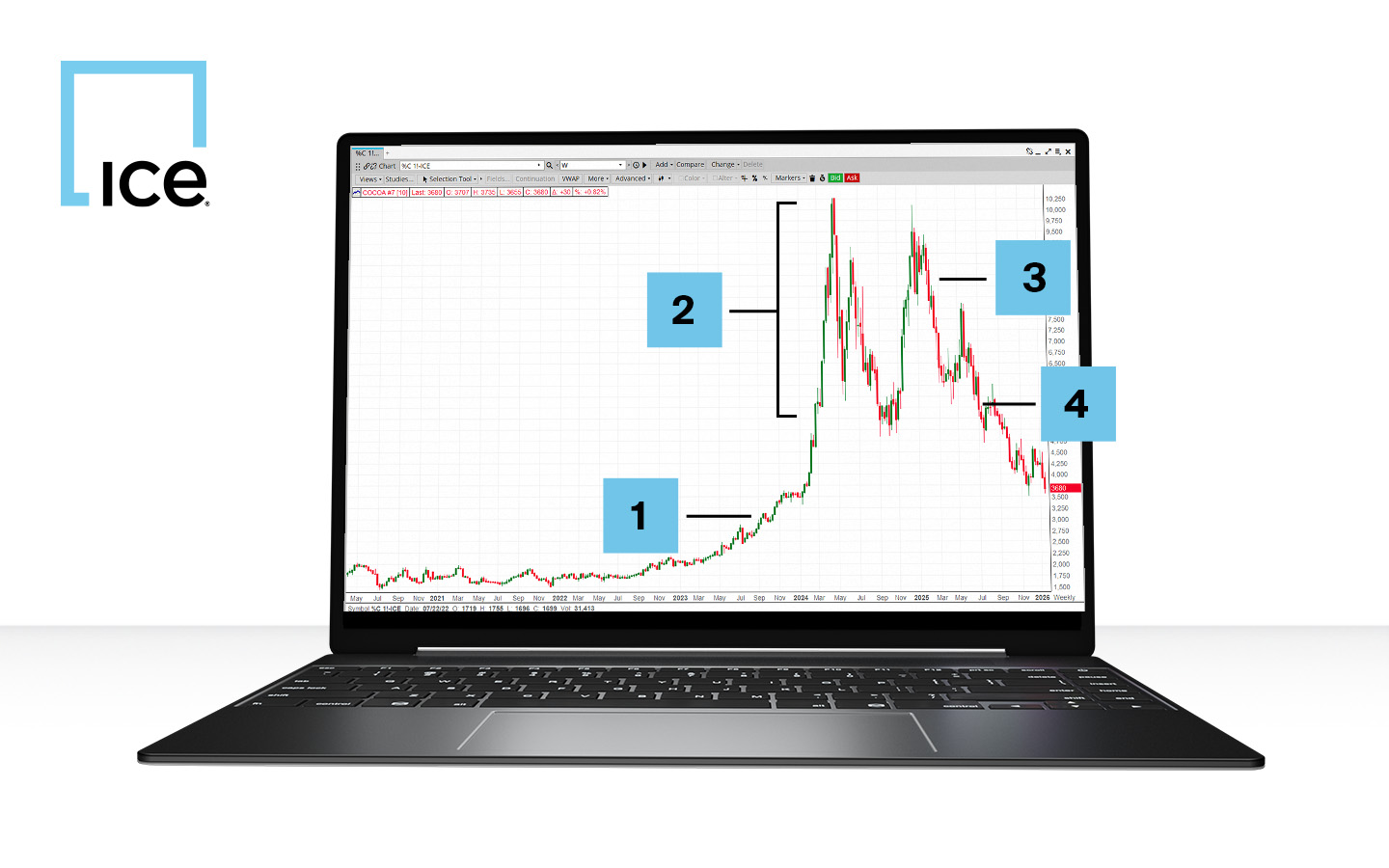

See the ICE Connect Price Chart and the summary of the price drivers below:

- Tight West African Supply - Due to worsening disease pressure, ageing trees and weather issues. Price starts to rise from ~£2,000/t.

- Record Price Surge - Due to multi year supply deficits, low certified stocks and hot/dry conditions. Price rises rapidly to ~£10,250/t.

- Demand Destruction - Due to persistently elevated prices cocoa grindings fall indicating weaker industrial demand. Prices correct down to ~£5,000/t.

- Supply Outlook Improves - Due to better rainfall and pod counts in West Africa. Funds start to liquidate long positions. Price continues to move back towards long term average but still at ~£3,700/t.

Let’s consider how a market participant could have benefited from hedging with ICE London Cocoa futures during this period in the scenario below:

A European cocoa processor needs to secure physical cocoa beans for Q1 2024 production. In mid 2023, they see signs of tightening supply in West Africa (disease, ageing trees, adverse weather), which later drove prices sharply higher into 2024.They want to protect against rising raw material costs, so they go long ICE London Cocoa March 2024 futures (buy futures) as a hedge.

Hedge Established (May 2023)

March 24 futures price: £2,600/t

Futures: ICE London Cocoa (10t)

Action: Processor buys 20 contracts to hedge 200 tonnes for Q1 2024.

Why: Tightening supply and rising price risk.

Hedge Impact

Without a hedge:

Physical cost jumps from

~£2,600/t → ~£5,000/t

Increase:

≈ £2,400/t → £0.48m extra for 200t

With a long futures hedge:

Futures bought at ~£2,600/t, settled near ~£5,000/t

Profit: ≈ £2,400/t, also ~£0.48m total

Futures gains offset physical cost surge, keeping effective input cost at £2,600/t

Price Shock (2024)

By december 2024, cocoa prices hit historic highs near £10,250/t, pushing physical prices to record levels and dramatically raising costs for anyone unhedged.

Why ICE London Cocoa Futures are effective

- Contract aligns with West African cocoa, the core price driver

- Strong liquidity even during volatility

- Reliable convergence with physical prices

- High correlation enables near 1:1 offset

To explore how the physical and ICE cocoa futures markets connect, check out our course run in partnership with the Federation of Cocoa Commerce (FCC).

Ready for a challenge? Try our new interactive quiz to test your knowledge about Cocoa markets and see how much you’ve learned from this month’s edition. It’s quick, engaging, and a great way to stay sharp. Click here to take the quiz.

Complete the form to get access to the full newsletter

© 2026 Intercontinental Exchange, Inc. The following are trademarks of Intercontinental Exchange, Inc. and/or its affiliated companies: Intercontinental Exchange, ICE, New York Stock Exchange and NYSE. For more information about trademarks owned by Intercontinental Exchange, Inc. and/or its affiliated companies, see intercontinentalexchange.com/terms-of-use.

This publication contains information that is confidential and proprietary property and/or trade secret of Intercontinental Exchange, Inc. and/or its affiliates, is not to be published, reproduced, copied, disclosed or used without the express written consent of Intercontinental Exchange, Inc. and/or its affiliates.

This publication is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between Intercontinental Exchange, Inc. and/or any of its affiliates and their respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, investment or other professional advice. The information found herein is neither an offer to sell nor a solicitation of an offer to buy any financial product(s). Those considering buying or selling any financial product(s) should independently consider the risk in doing so, and also any legal and regulatory requirements applicable to them in the relevant jurisdiction.

Intercontinental Exchange, Inc. and its affiliates, makes no representations or warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or of title, non-infringement, quality or any other matter. Without limiting the foregoing, Intercontinental Exchange, Inc. and its affiliates makes no representation or warranty that any data or information (including but not limited to evaluations and calculations) supplied to or by it are complete or free from errors, omissions, or defects nor does it guarantee the timeliness, accuracy or completeness of any of its data or the accuracy or completeness of the IFEU Intellectual Property. No oral or written information or advice given by IFEU shall create a warranty and the information or advice may not be relied upon.