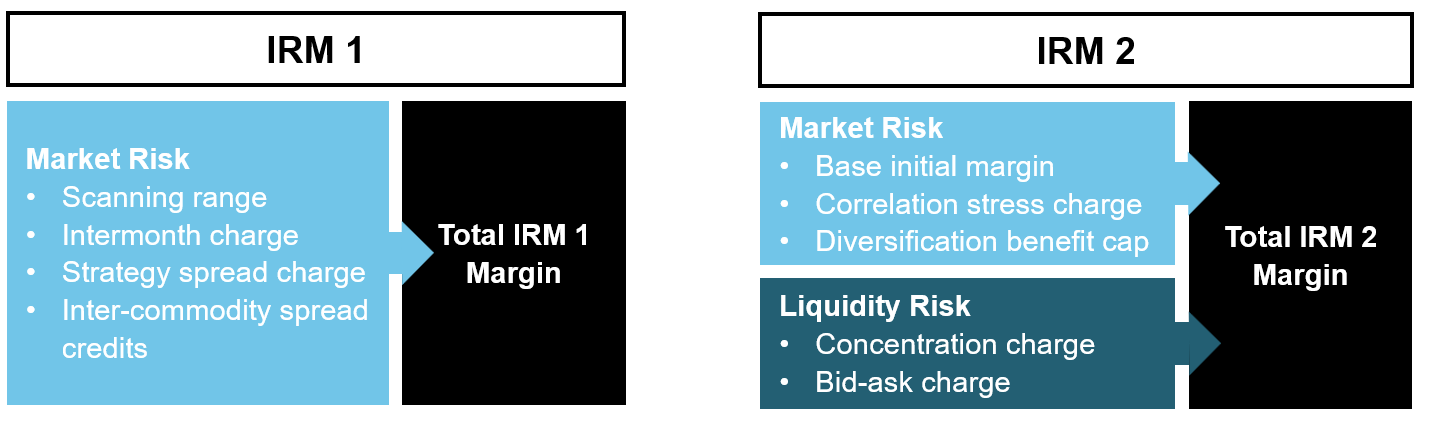

ICE Clear Europe aims to reduce the model procyclicality, without compromising the model performance. For ICE Risk Model 1 (IRM 1), this is achieved by adding stress observations to the volatility calculation of each risk factor. In particular, a weighted average of 25% stress volatility and 75% current volatility is used in the parameterization of the models, where the stress volatility is defined as the maximum 250-day volatility calculated on a rolling basis over the entire available history of the risk factor return series. For ICE Risk Model 2 (IRM 2), this is achieved by applying a margin buffer of at least 25% of the calculated margins at the risk factor level, which is depleted linearly in periods of increasing stress.***

All risk models used by ICE Clear Europe are reviewed and subject to a formal model governance process. Model performance is monitored daily, with the suitability of all models independently reviewed on an annual basis. Any material change to an existing model and all new models are subject to independent model validation.

Parameters used within the models are reviewed and set by the ICE Clear Europe in accordance with policies and procedures approved by the appropriate committees.

* For IRM 1, a 500-day lookback applies. For IRM 2, a 750-day lookback applies.

**1-day MPOR applies to Oil, US Gas and Power, Coal, US Emissions, NGL, Petrochemicals; 2-day MPOR applies to EU Gas and Power, EU Emissions, and Freight contracts.

*** This corresponds to options (b) and (a) of Delegated Regulation (EU) No 153/2013, Article 28, as incorporated into UK law with modifications at the end of the Brexit transition period by virtue of the European Union (Withdrawal) Act 2018, for IRM 1 and IRM 2 respectively.

Additional Margin Requirements

Clearing Members may be required to provide additional margin for risks not covered by the Initial Margin, as detailed below:

- Concentration Risk - An amount calibrated to cover risk on portfolios/positions which are significant relative to market liquidity and may incur additional cost to liquidate.

- Wrong-Way Risk - An amount calibrated to cover risk where the portfolio of instruments may be directly related to the deterioration of the credit quality of the Clearing Member holding the portfolio.

- Credit Risk - An amount to cover risk where an assessment of the counterparty creditworthiness of the Clearing Member supports collateralisation beyond the Initial Margin calibration.

- Delivery Risk - Payment or settlement risks that may arise during the delivery process of physically settled products.

Margin may also be collected for additional risks not captured in the above categories in accordance with the Clearing Rules and applicable regulations.

Intraday Margin

ICEU calculates both Initial Margin and Variation Margin on a near real-time basis intraday. ICEU sets intraday exposure limits for the Intraday Initial Margin + Intraday Variation Margin, i.e. the Intraday Margin. Exposure limits are based on the maximum difference between the Intraday Margin and total haircut value of collateral for an account, i.e. the Intraday Shortfall.

In particular, intraday exposure limits are set at the:

- Individual margin account level, as a percentage of the total haircut value of collateral, where the percentage depends on whether the account is margined on a gross or net basis.

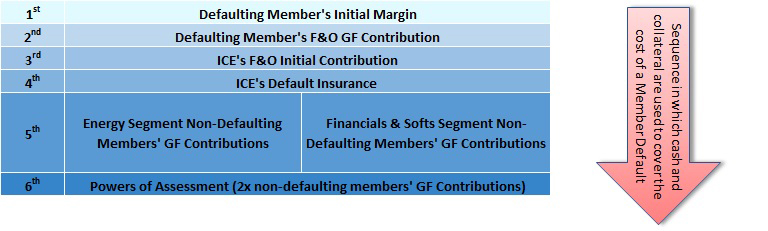

- Clearing Member level, based on the aggregate Intraday Shortfall of all of its accounts, and assessed against ICE Clear Europe’s contribution to the default waterfall, the total haircut value of loss-making accounts, the Clearing Member’s capital, and its pre-funded requirements.

Margin Calls

An Intraday Margin call will be made if either the individual account limit and one Clearing Member Limit are in breach; or if a set of Clearing Member Limits are in breach.

The Intraday Margin call window is from 07:30-20:00 London Time on business days. All Intraday Margin calls are subject to a minimum materiality threshold of USD 1 million (per account).

Please see the Finance Procedures for further details on the scheduling of margin calls.