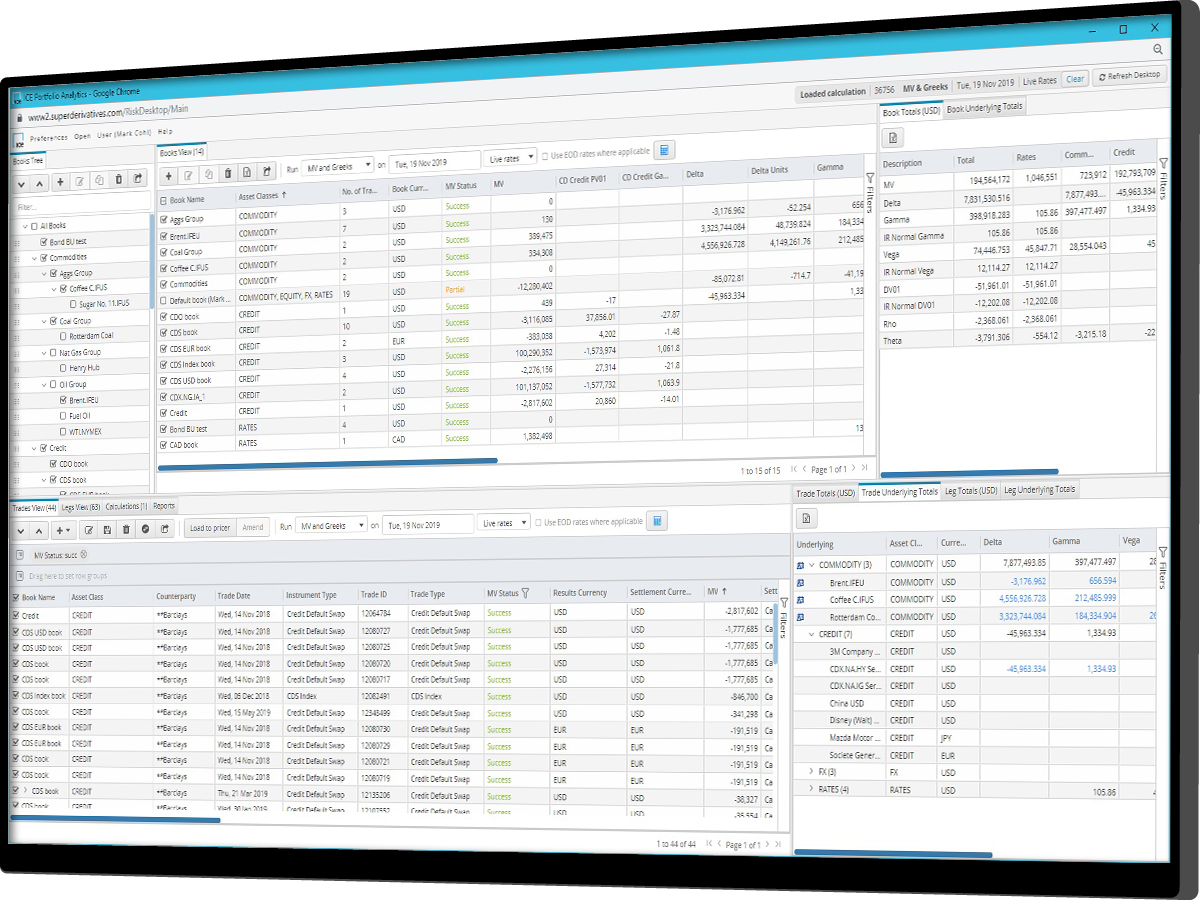

Discover how market participants view and manage market and credit risks of their diversified portfolios all on one platform.

ICE Portfolio Analytics (IPA) supports pre-trade price discovery and decision support tools, RFQ, STP deal capture, trade repository, scenario analysis, risk management reports. Helping you gain an edge in derivatives markets.

Also built into the system is ICE’s derivatives market data and calculation models to support a wide asset class coverage, underlyings and instruments. A range of APIs provide online access to pricing and portfolio analytics, powering internal systems, web-portals and more. The new cross-asset ICE Portfolio Analytics platform is at the core of our Pricing and Analytics offering:

Boost workflow efficiency with a cross-asset offering:

Price Discovery

- Helps inform trading decisions

- Strategy testing and optimization

- Analyse historical data

- Perform exposure calculations

- Fixings and payments

- Sales productivity & support tools

Deal Capture & Life Cycle

- Book, manage and hedge derivative positions

- Manage lifecycle events including expirations, fixings and payments

Risk Management & Analytics

- A range of result fields and Greeks

- Risk ladders and matrices

- Bucketed views

- “What If” scenarios and time horizon

- Live reference pricing and best execution reference pricing and analytics

Parsing Engine

- Leverage credit data scanned, validated and cleaned in real-time by our artificial intelligence-based parsing system

- Monitored by a dedicated team of data analysts

Price Discovery

- Helps inform trading decisions

- Strategy testing and optimization

- Analyse historical data

- Perform exposure calculations

- Fixings and payments

- Sales productivity & support tools

Deal Capture & Life Cycle

- Book, manage and hedge derivative positions

- Manage lifecycle events including expirations, fixings and payments

Risk Management & Analytics

- A range of result fields and Greeks

- Risk ladders and matrices

- Bucketed views

- “What If” scenarios and time horizon

- Live reference pricing and best execution reference pricing and analytics

Parsing Engine

- Leverage credit data scanned, validated and cleaned in real-time by our artificial intelligence-based parsing system

- Monitored by a dedicated team of data analysts

Integration and Analytics APIs:

A front office distribution solution that can be integrated to your trading and portfolio systems:

Pricing & Distribution Module

- Web-based online solution

- Electronic RFQ and order system between internal Sales – Trader

- ICE Data Derivatives market data & valuation models included

- Electronic pricing tables for Equity Linked and Dual Currency structures, ability to change spot and margin

Trade Blotter & Transaction Archive

- View entire portfolio (per counterparty, per asset, per instrument)

- MTM and Greeks calculation

- Management information tools - analyse performance and service quality, execution metrics, RFQ hit ratios

- Complete usage and instrument trading data archive

Real-time Calculations & Analytics

- Price discovery and investigation tools

- Historical analysis and analytics

Connectivity

- STP integration into back-office systems

- Upstream & downstream integration with trading and portfolio systems

Pricing & Distribution Module

- Web-based online solution

- Electronic RFQ and order system between internal Sales – Trader

- ICE Data Derivatives market data & valuation models included

- Electronic pricing tables for Equity Linked and Dual Currency structures, ability to change spot and margin

Trade Blotter & Transaction Archive

- View entire portfolio (per counterparty, per asset, per instrument)

- MTM and Greeks calculation

- Management information tools - analyse performance and service quality, execution metrics, RFQ hit ratios

- Complete usage and instrument trading data archive

Real-time Calculations & Analytics

- Price discovery and investigation tools

- Historical analysis and analytics

Connectivity

- STP integration into back-office systems

- Upstream & downstream integration with trading and portfolio systems

Related insights

Trading and intraday risk management amid market dislocation

With increased volatility and inflations risks, trading activity brings a high degree of risk and sensitivity to any new market development which cause price swings on top of the inherent volatility within the assets.

Hear from ICE alongside industry experts from Asia Risk, CSOP Asset Management, ING and International Economics Consulting, to examine the practical risk management approaches and innovation to support intraday pricing, and the challenges faced amid changing market conditions.

Trading and intraday risk management amid market dislocation

With increased volatility and inflations risks, trading activity brings a high degree of risk and sensitivity to any new market development which cause price swings on top of the inherent volatility within the assets.

Hear from ICE alongside industry experts from Asia Risk, CSOP Asset Management, ING and International Economics Consulting, to examine the practical risk management approaches and innovation to support intraday pricing, and the challenges faced amid changing market conditions.