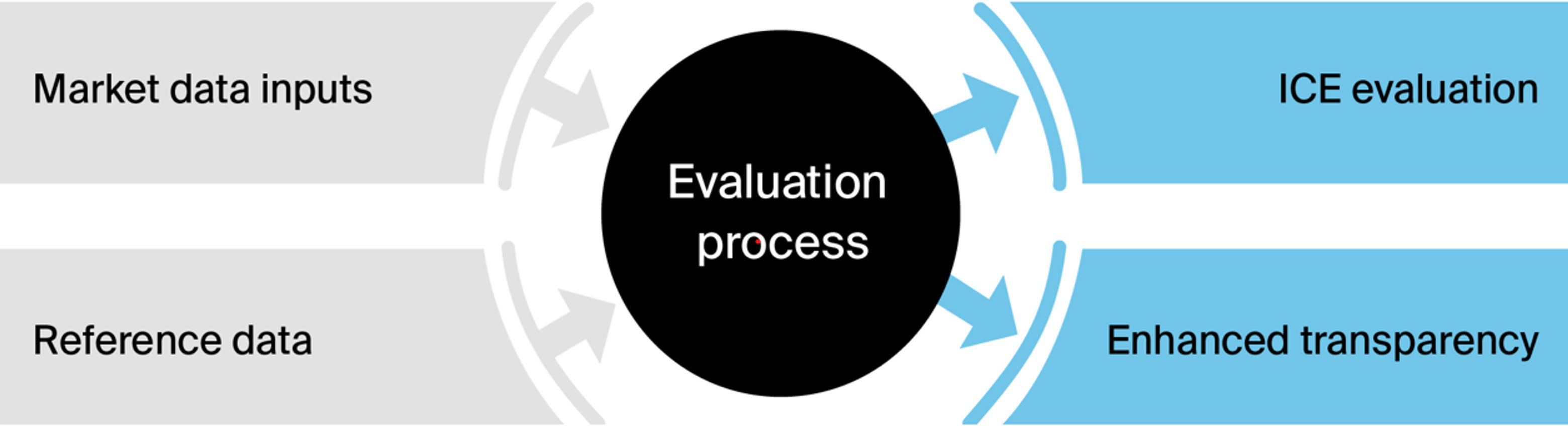

ICE has been evaluating fixed income instruments for over 50 years. Over that time, we have increased the amounts of data we consume and process to produce our high-quality evaluations. That “augmented intelligence” process creates dozens of data metrics utilized by our evaluators and algorithms. It is those metrics that are at the heart of the EET offering.

Benefits

Additional access to the data utilized by ICE’s evaluation team including methodology type and price movement reason codes.

Additional transparency to help clients fulfil their oversight obligations and help streamline/improve valuation oversight.

Help satisfy regulatory requirements.

Coverage

- Approximately 160 data points per identifier

- Coverage includes all of ICE’s fixed income evaluations, both Continuous Evaluated Pricing (CEP™) and EOD

- Data fields include basic reference data, price movement commentary, MBS assumptive data, and trade/quote info

- Also includes ICE Liquidity Indicators, quote/trade percentiles and standard deviations

- Bond pricing benchmarks and time stamps for select data sets

Use Cases

- EET data sets can assist with insight across the entire firm vertical

- EET combined with CEP can help expand the view of the market to help support decision-making processes

- Middle office supporting info for Independent Price Verification (IPV), fair value levelling and compliance oversight

- Back-office security level data provided in a way to help create efficiencies in the independent assessment of fixed income evaluations

- Support for ESMA Prudent Valuation and SEC Rule 2a-5 compliance

Delivery

- EET snapshots occur and are available every 15 minutes throughout the day

- CEP-related metrics update throughout the day as new information is received and processed; other metrics are updated daily

- Available via cloud and file delivery

Delivering opportunity through data access

Watch our latest video narrated by ICE's President of Fixed Income & Data Services, Chris Edmonds, to learn why access to data can provide an edge in fast-moving markets. Whether fixed income, derivatives, or mortgages, ICE delivers quality data and analytics across asset classes. ICE also offers specialization in pricing complex asset classes. It’s all about helping clients manage risk and spot opportunity.

We provide high quality information across commodities, equities, FX and fixed income markets. Streaming market data feeds across our different products power applications for thousands of financial institutions worldwide.

Resources

ICE Size-adjusted pricing

ICE’s Size-Adjusted Pricing (SAP) is intended to be used by clients to help value fixed income transactions and/or holdings.

A leap forward for ICE’s Evaluations

Our senior director of product management Tim Monahan discusses three takeaways on ICE’s Evaluations.

Fixed Income Trading Analytics

Insightful, high-quality fixed income evaluated pricing and trading analytics data can be critical components to help inform fixed income trade execution.