ICE Fund Names Rule Service

Alignment of portfolio holdings with terminology in the fund’s names

Policy-makers are adopting rules on the use of sustainability terms in fund names and marketing to reduce greenwashing in multiple regions.

EU ESMA Fund Naming Guidelines

- Covers UCITS and AIFs using sustainability terms*

- Must have ≥80% investments supporting the selected term(s)

- Must exclude investments described in regulation of EU Climate Transition and EU Paris-Aligned Benchmarks

- Must only reference benchmarks whose constituents support the selected item(s)

- Must demonstrate measurable transition path (where using ‘transition’ terms)

*Sustainability terms include, but are not limited to transition, improve, progress, net-zero, environmental, green, climate, ESG, SRI, social, equality, governance, controversies, impact, sustainable.

UK Sustainable Disclosure Regulation

- Covers UCITS using sustainability terms or applying the 4 investment Labels

- Must have ≥70% of assets supporting the selected label /term

- Must only reference indices that align with label criteria

- Must specify measurable KPIs to track progress towards objectives

- Must produce separate consumer facing product documentation

US SEC Fund Names Rule

- Covers US SEC registered funds with ANY label implying an investment strategy

- Must have ≥80% of assets supporting the selected label / term

- New prospectus disclosures defining the terms and fund’s selection criteria

- Holding-by-holding level disclosures on Form N-PORT

EU ESMA Fund Naming Guidelines

- Covers UCITS and AIFs using sustainability terms*

- Must have ≥80% investments supporting the selected term(s)

- Must exclude investments described in regulation of EU Climate Transition and EU Paris-Aligned Benchmarks

- Must only reference benchmarks whose constituents support the selected item(s)

- Must demonstrate measurable transition path (where using ‘transition’ terms)

*Sustainability terms include, but are not limited to transition, improve, progress, net-zero, environmental, green, climate, ESG, SRI, social, equality, governance, controversies, impact, sustainable.

UK Sustainable Disclosure Regulation

- Covers UCITS using sustainability terms or applying the 4 investment Labels

- Must have ≥70% of assets supporting the selected label /term

- Must only reference indices that align with label criteria

- Must specify measurable KPIs to track progress towards objectives

- Must produce separate consumer facing product documentation

US SEC Fund Names Rule

- Covers US SEC registered funds with ANY label implying an investment strategy

- Must have ≥80% of assets supporting the selected label / term

- New prospectus disclosures defining the terms and fund’s selection criteria

- Holding-by-holding level disclosures on Form N-PORT

The deadlines to which fund managers must adhere, are fast approaching! Compliance requires sustainability data for assessment, reporting capabilities, and ongoing monitoring of thresholds.

UK SDR – Fund Naming & Marketing Rules

- July 31, 2024 - 1st change to use labels

- December 2, 2024 - Naming and Marketing Rules Apply

- April 2, 2025 - Temporary Flexibility deadline for Naming and Marketing Rule compliance, applicable in certain circumstances.

EU ESMA Fund Naming Guidelines

- November 21, 2024 - Effective date for compliance for new funds

- May 21, 2025 - Effective date for compliance for existing funds

SEC Fund Names Rule (35d-1)

- June 11, 2026 – Compliance date for Names Rule – fund groups with $1Bn AUM or more

- December 11, 2026 - Compliance date for Names Rule - fund groups with less than $1Bn AUM

- November 17, 2027 - Compliance date for reporting in N-Port - fund groups with $10Bn net assets or more

- May 18, 2028 - Compliance date for reporting in N-Port - fund groups with less than $10Bn in net assets

ICE Solutions to help with compliance

ICE combines a range of reported data from corporates on ESG themes with controversies and sustainable regulatory data as well as instrument reference data and fundamentals to help customers build screens aligned with investment strategies to ‘test’ fund holdings.

Features

- Start with ICE’s rule library

- Create own rules to define terms aligned with investment strategy

- Adjust rule parameters to reflect changing investment circumstances

- Accommodate updated market cap definitions

Benefits

- Consistent application across portfolio

- Automated workflow

- Evidentiary support provided for review

- Auditable Rules Engine maintained by ICE

- Client driven test initiation

User configuration workflow

- Leverages existing rules engine and workflow architecture used across ICE regulatory solutions.

- A client-configured rules engine* that translates the client's requirements into a defined, hierarchical, set of processing rules

- Tools to help meet regulatory requirements and public disclosures with a consistent, repeatable and auditable process

- Ability to run rules

- “as of last month end”

- “as of today”

- User defined specific terminology based on the ICE information, including hundreds of attributes across:

- Reference Data

- Fundamentals Data (e.g., Market Capitalization)

- ICE Sustainable Finance Data (ESG)

- Obtain a fund level summary in XML with holding level granularity of the test determination.

*ICE will work with user to create and perfect their rules

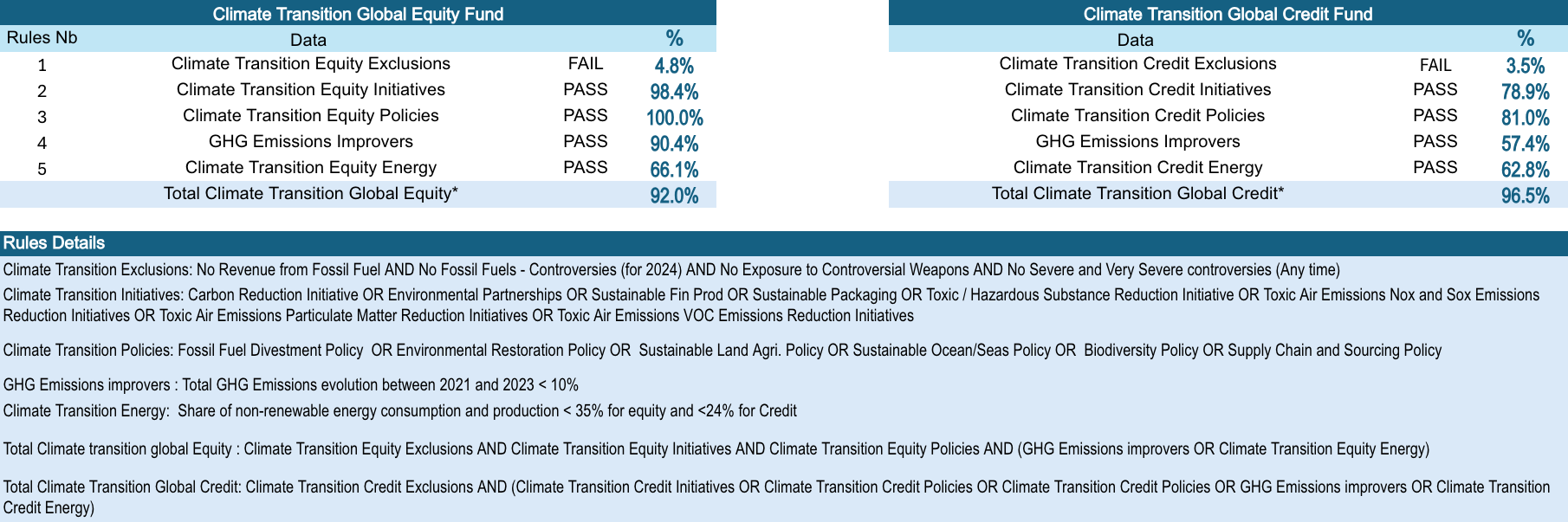

Below is an example of rule details that can be run for funds and the summary of the pass or fail rate across rule sets.

*The ICE service currently provides results in XML format for clients to use in the production of their fund reports.