VP, Sustainable Finance Data, ICE

Linking municipal bond securities to their geospatial footprints

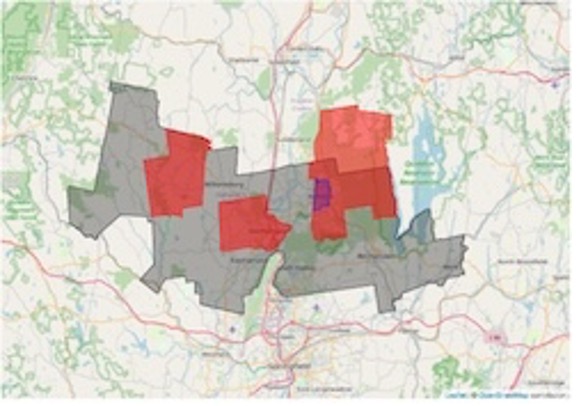

By some estimates, over 90% of local and state capital spending is funded by bonds in the United States*. However, linking a specific security with a specific geographical footprint is complicated by the fact that in many cases, the geospatial boundaries of obligors overlap. A security may also be obligated to more than one specific geospatial boundary.

Over the past five years, ICE has created and curated a comprehensive geospatial library of municipal obligor tax and rate-payer boundaries.

Find out more about the power and versatility of this geospatial library.

Market commentaries

Mortgage delinquencies and climate risk

There is often a rise in mortgage delinquencies after extreme weather events and natural disasters in the United States, as people struggle with loss of income and repair costs.

"Value at risk" is a common framework within the insurance industry that attempts to capture the degree of possible losses of an asset over a given time frame. ICE value at risk projections for CRT pools represent expected annual losses as a percentage of the replacement costs of homes securing loans in each pool.

What are socially labelled bonds funding?

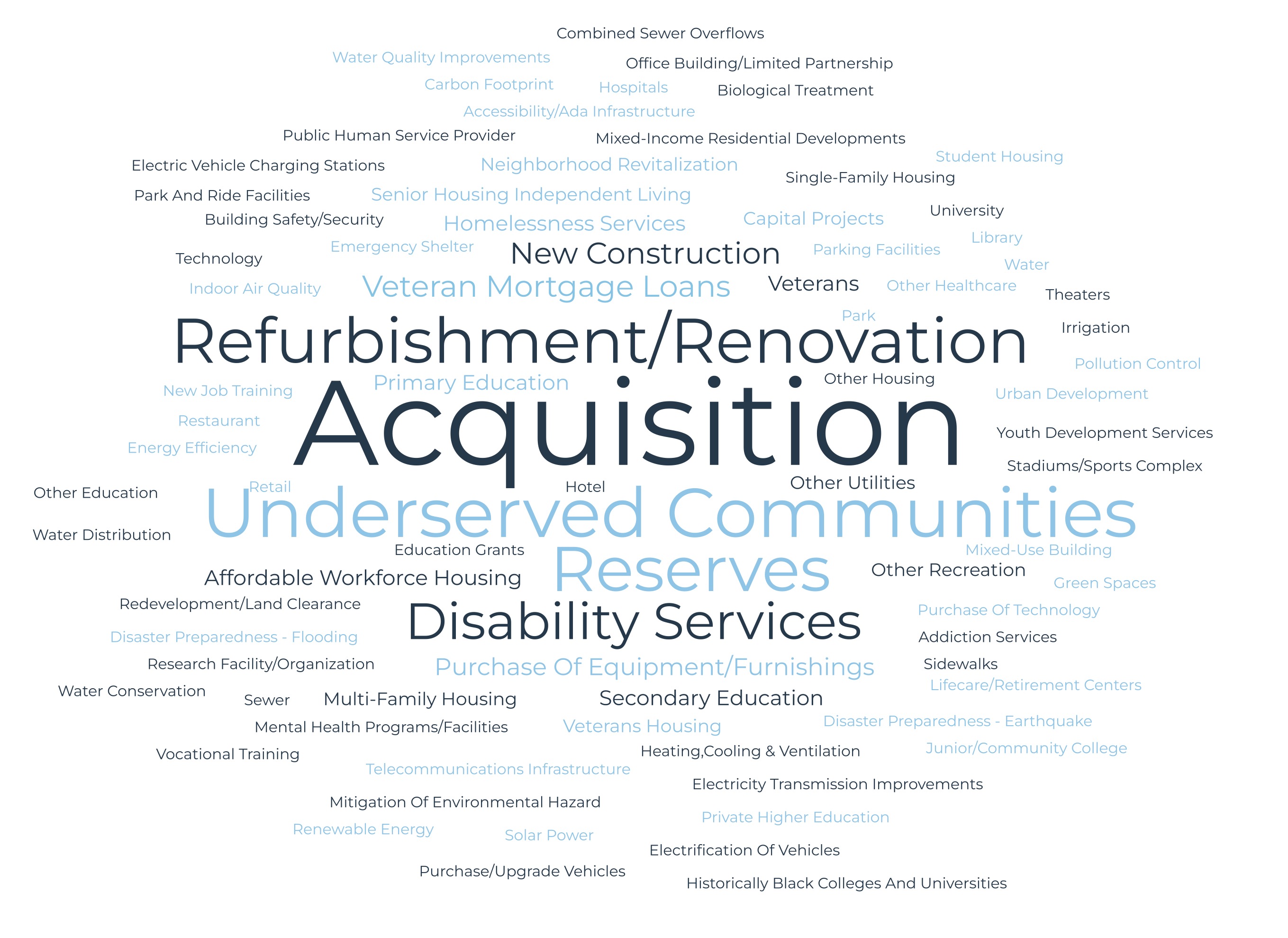

Socially labeled municipal bonds have been growing in popularity over the last five years...

ICE Expanded Use-of-Proceeds designations can illustrate the types of projects funded by these labeled bonds, as seen in this word cloud for the universe of outstanding socially labeled municipal bonds as of April 2024. The larger the designation in the cloud, the more often it appears as a designation.

Featured webinar

Home affordability: the cost of homeowners' basic needs in a changing climate

The panelists discuss ICE's estimates of the energy bills of hundreds of millions of households across the county, as well ICE data on mortgages, insurance premiums, water costs, and property tax bills and the broader implications of these costs for home affordability in a changing climate.

Sustainability spotlight

Credit risk metrics fall short in climate risk

Delve into the pivotal role of climate issues in shaping the municipal bond market. Evan Kodra (ICE) and Tom Doe (Municipal Market Analytics) discuss why current credit risk metrics fall short in addressing climate risk and discover what steps are needed for a transformative change.

Meet our experts

Andrew Teras

Senior Director, Americas Product Strategy, ICE Sustainable Finance

Andrew Teras is Senior Director, Americas Product Strategy for ICE Sustainable Finance. In this role, he oversees product strategy for U.S. municipal bonds, mortgage-backed securities, real estate, and sovereign debt.

Andrew was previously Director, Municipal Research at Breckinridge Capital Advisors and was responsible for integration of climate and sustainability considerations into the firm’s investment decision- making. Earlier in his career, Andrew was a bond rating analyst at Standard & Poor’s and a financial analyst with the New York City Comptroller’s Office.