ICE Fixed Income monthly report

What’s the future of fixed income investing? And what role does the AI revolution play in bond markets? To discuss the sector’s biggest questions, the annual ICE Fixed Income Forum gathered industry luminaries - read more about the key themes and watch the replays. Also in this month’s edition, learn about the impact quantitative trading is having on credit markets, and how investors can view opportunities in municipal bonds for the remainder of the year.

Join our mailing list to receive the newsletter and ICE Fixed Income team updates

The future of investing, AI, and all the big themes for bond markets

As we navigate uncertain yet opportunistic times for bond markets, it was timely to gather some of the industry’s brightest minds at ICE’s Fixed Income Forum to discuss the big questions: What role does the AI revolution play in fixed income markets? How do we keep pace with new product and investment strategies via digital transformation? And what’s the future of fixed income investing?

Some ideas discussed that caught my attention include:

*An explosion of generative AI applications will likely become available for the finance sector, as it becomes cheaper, more efficient and easier to deploy models. Some of the areas that require further research include training large language models (LLMs) on sensitive data, training LLMs to generate results that abide by human principles, and developing LLMs that can self-correct and improve.

*The safe-haven status of Treasuries has been thrown into question, given the realized volatility in long Treasuries has exceeded that of the VIX for some time now. Technical dynamics for the asset class have changed significantly: foreign reserves in Treasuries are declining, the Fed has changed from a net buyer to net seller, and the regulatory regime (Basel III) has been hurtful to liquidity.

*The popularity of ETFs means they’re increasingly seen as a leading indicator for fund flows, and look set to play a larger role in asset allocation. Bonds that are ETF constituents typically have better pricing and liquidity, given the more frequent trading of these instruments. Some speakers predicted that the rise of model portfolios would fuel even greater appetite for ETFs in coming years.

*The ongoing rise of electronic trading and different avenues for execution, means traders and portfolio managers are spending more time on value-add activities, versus executing a long list of trades. This has clear implications for the skillsets needed in those roles, as evidenced by the rise of data scientists in the sector.

*Rather than a clear move from voice to electronic trading, many market participants are using a combination of protocols over the life of the trade. While the use of streaming prices is popular in Europe, RFQ remains the dominant protocol in the U.S. Several non-traditional entrants are also looking to implement equity infrastructure in the credit space, helping to innovate the market.

*Attractive fundamentals for muni bonds mean retail investors are returning to the asset class for the first time, in a long time. For the industry, negative net new issuance means the question of how to put money to work is a key challenge - a dynamic expected to persist for the next few years. Access to accurate pricing and limited liquidity are also major hurdles.

*We’re seeing the rise of custom indexing, supported by new technology that allows customization at scale. As an early participant in index customization, ICE offers a custom index tool that allows clients to move easily from concept to prototype and express their preferences using thousands of individual fields.

Insights

Muni bonds are back: navigating the marketplace in a rising rate environment

A recent webinar gathered ICE’s municipal bond experts to answer key questions about product development, amid a volatile time for the asset class:

- How are municipal bond evaluations developed and how have they been impacted by recent market trends?

- How is ICE's Data Science team enhancing the use of market data in the evaluation process?

- What's new in ICE's municipal bond curve product?

- How is ICE bringing new intraday insights to muni market participants?

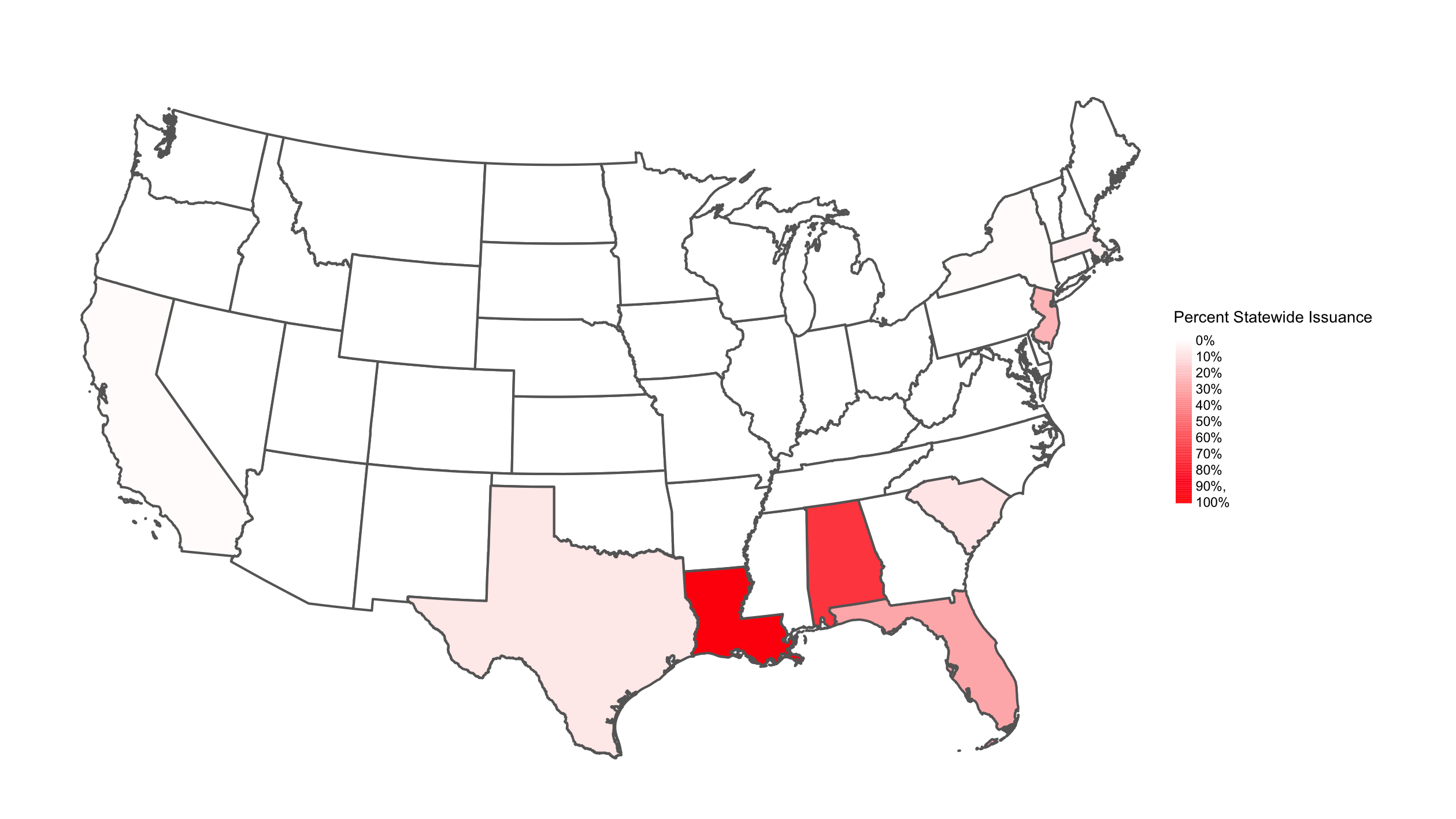

Also in munis, check out our new Muni Bonds Monthly Report, which applies ICE’s data and scores to present analysis on sustainability risks and opportunities for impact investing. In September, there was over $1.9B in high physical climate risk municipal issuance across the 48 contiguous states, the majority concentrated across Alabama, Louisiana, and Florida.

Fixed Income in Focus

Quantitative trading and municipal bond opportunities

What impact is quantitative trading having on credit markets today? And how should investors view the opportunities in municipal bonds for the remainder of the year?

Learn more from the latest Fixed Income in Focus guests: Citigroup’s Head of Global Spread Products Quantitative Trading in North America Britni Ilhe, and PGIM’s Head of Municipal Bonds, Jason Appleson.

Events

ICE Fixed Income Forum

The ICE Fixed Income Forum gathered financial experts and thought leaders to address industry challenges and opportunities, and sought to uncover solutions to help advance financial markets.

Led by a keynote discussion with BlackRock's Co-Head of Global Trading Dan Veiner, this event featured panel discussions that explored a range of topics, from electronification of trading workflows and advancements in AI/cloud technology to indexing & ETF strategies and valuation best practices.

The event also featured a fire-side chat with McLaren Racing CEO Zak Brown about the importance of data in racing.

Fixed Income

Manage risk, uncover opportunities, and make informed decisions in real-time with ICE’s end-to-end fixed income solutions. Reimagine your fixed income workflow from price transparency & discovery and efficient execution through to performance analysis.

This material contains information that is confidential and the proprietary property and/or a trade secret of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”), is not to be published, reproduced, copied, modified, disclosed or used in any way without the express written consent of the ICE Group. This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between the ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, or other professional advice.

The information contained herein is provided “as is” and the ICE Group makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. The ICE Group makes no representation or warranty that any data or information (including but not limited to evaluated pricing) supplied to or by it are complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall the ICE Group have any liability for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits) in connection with any use of and/or reliance on the content of this document even if advised of the possibility of such damages.

This document is not an offer of advisory services and is not meant to be a solicitation, or recommendation to buy, sell or hold securities. This document represents ICE Group’s observations of general market movements. Trades and/or quotes for individual securities may or may not move in the same direction or to the same degree as indicated in this document. Please note that the information may have become outdated since its publication.

Trading analytics available from ICE Data Pricing & Reference Data are a point in time output and as such dependent on and take into account the information available to ICE Data Pricing & Reference Data at the time of calculation. ICE Data Pricing & Reference Data does not have access to all relevant trade-related data or dealer quotes, and the utility of the output may diminish depending upon amount of available data underlying the analysis. The inputs utilized in each of the trading analytics services described herein depend on the methodologies employed by each such service and may not be the same as the inputs used in the other trading analytics services. There are many methodologies (including computer-based analytical modelling) available to calculate and determine information such as Trading Analytics described herein. ICE Data Pricing & Reference Data’s trading analytics may not generate results that correlate to actual outcomes, and/or actual behavior of the market, such as with regard to the purchase and sale of instruments. There may be errors or defects in ICE Data Pricing & Reference Data’s software, databases, or methodologies that may cause resultant data to be inappropriate for use for certain purposes or use cases, and/or within certain applications. Certain historical data may be subject to periodic updates over time due to recalibration processes, including, without limitation enhancement of ICE Data Pricing & Reference Data’s models and increased coverage of instruments. Although ICE Data Pricing & Reference Data may elect to update the data it uses from time to time, it has no obligation to do so.

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model-based curves, market sentiment scores, and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

Trademarks of the ICE Group include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data, and New York Stock Exchange,. Information regarding additional trademarks and intellectual property rights of the ICE Group is located at www.ice.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.