Identifying municipal bond securities exposed to external events

Assessing municipal bond exposure to corporate bankruptcies

- ICE Climate’s geospatial library enables us to identify the municipal bond issuers and securities exposed to geographically defined events — including the closure of Bed Bath & Beyond retail stores across the U.S. in 2023.

- We identify over 100,000 individual securities obligated to the communities affected by store closures.

External events — like the bankruptcy of a major employer, a natural hazard, or the spill of an environmental hazard — can have dramatic effects on the financial stability of nearby populations and governments. In this series, ICE uses our geospatial library for the municipal bond market to analyze municipal bond exposure to several different kinds of geographically defined events.

Here we start with an assessment of municipal bond exposure to the high-profile corporate bankruptcy of Bed Bath & Beyond.

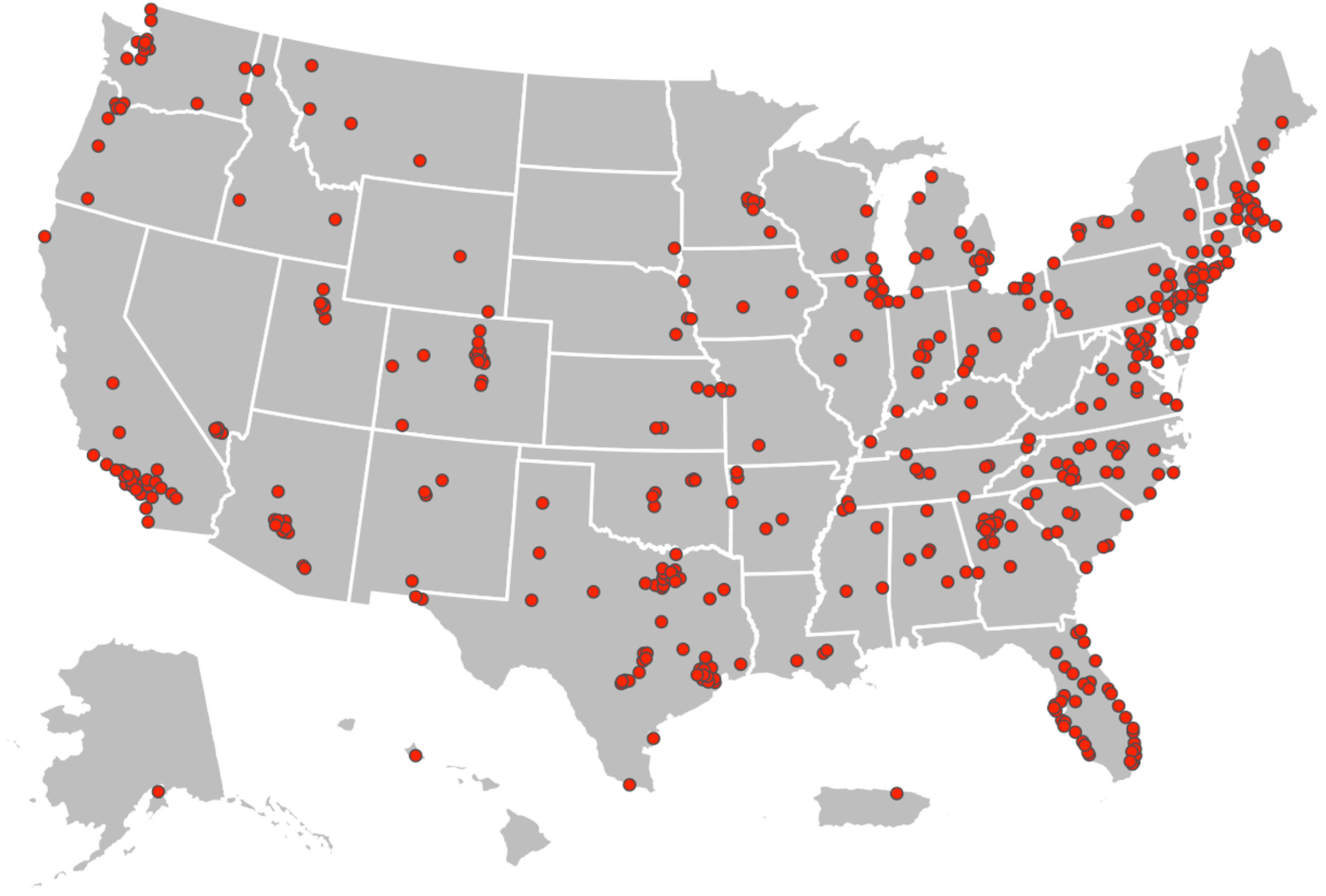

In April 2023, the retailer Bed Bath & Beyond announced that it was filing for Chapter 11 bankruptcy and shuttering over 350 brick-and-mortar stores across the country, affecting thousands of employees. According to ICE corporation location records, there was a Bed Bath & Beyond location in every state except North Dakota and West Virginia (Figure 1). Despite much of the vacant retail space being quickly snapped up, these kinds of store closures can reduce tax revenues for local municipalities.1

Figure 1. Map of all Bed Bath & Beyond stores in ICE corporate location records within the United States. Source: ICE as of 12/01/2024.

ICE Climate’s geospatial library for the municipal bond market allows us to link individual securities to the locations of the obligated municipalities, utilities, hospital systems, and districts across the country. Because we know the locations of Bed Bath & Beyond stores, we can also use this geospatial library to identify the municipal bond issuers, obligors, and individual securities that may be exposed to the impacts of store closures.

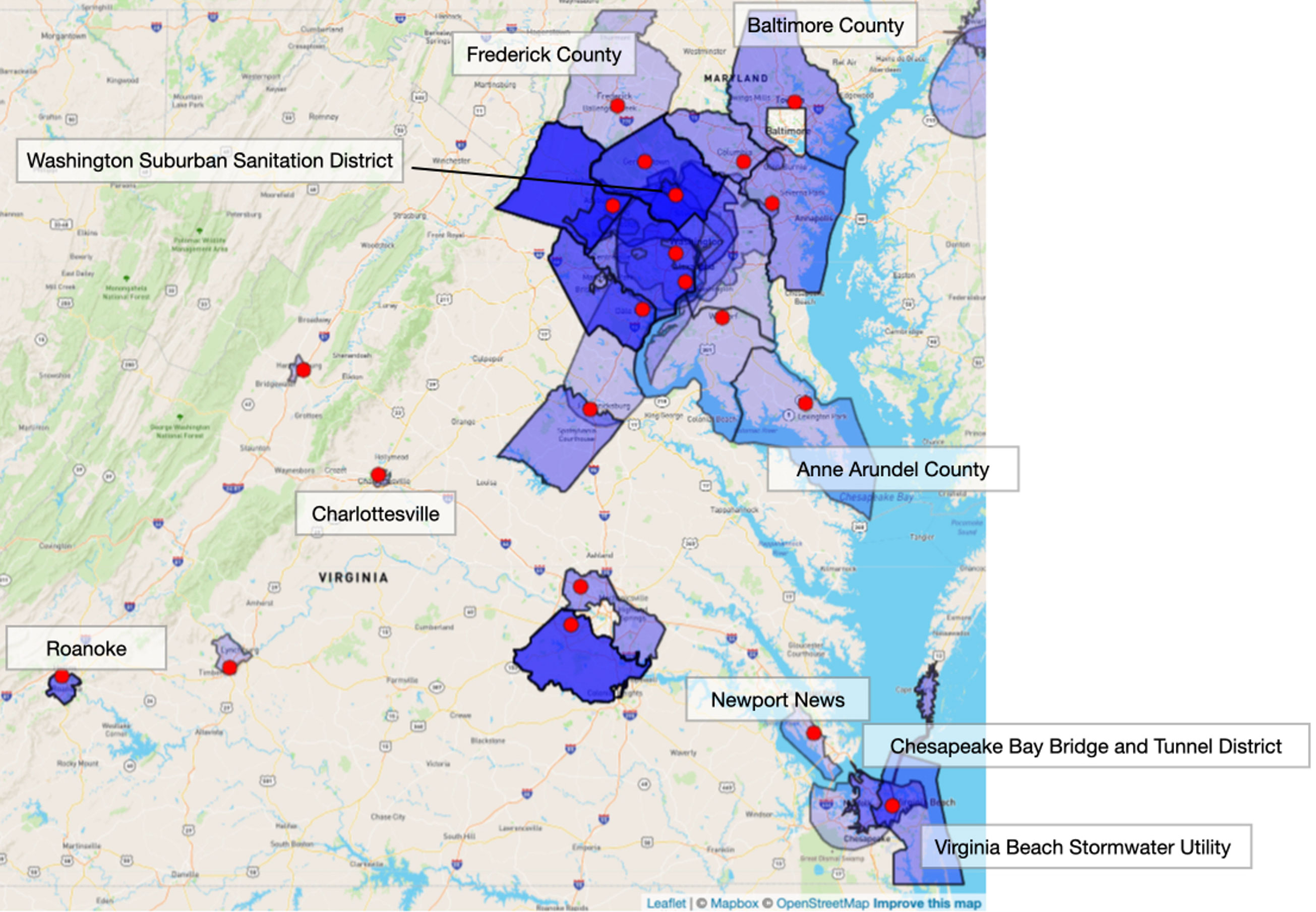

For example, at the regional level, across Maryland and Virginia, there were 21 Bed Bath & Beyond locations in ICE records (Figure 2). In total, the boundaries associated with about 100 unique municipal bond issuers overlap with these store locations. These obligors have over 6,900 individual securities totaling over $35 billion in outstanding debt.

Figure 2. Bed Bath & Beyond locations in Maryland and Virginia, with all overlapping municipal bond obligor boundaries with areas less than 2,000 square miles in blue. Source: ICE as of 12/01/2024.2

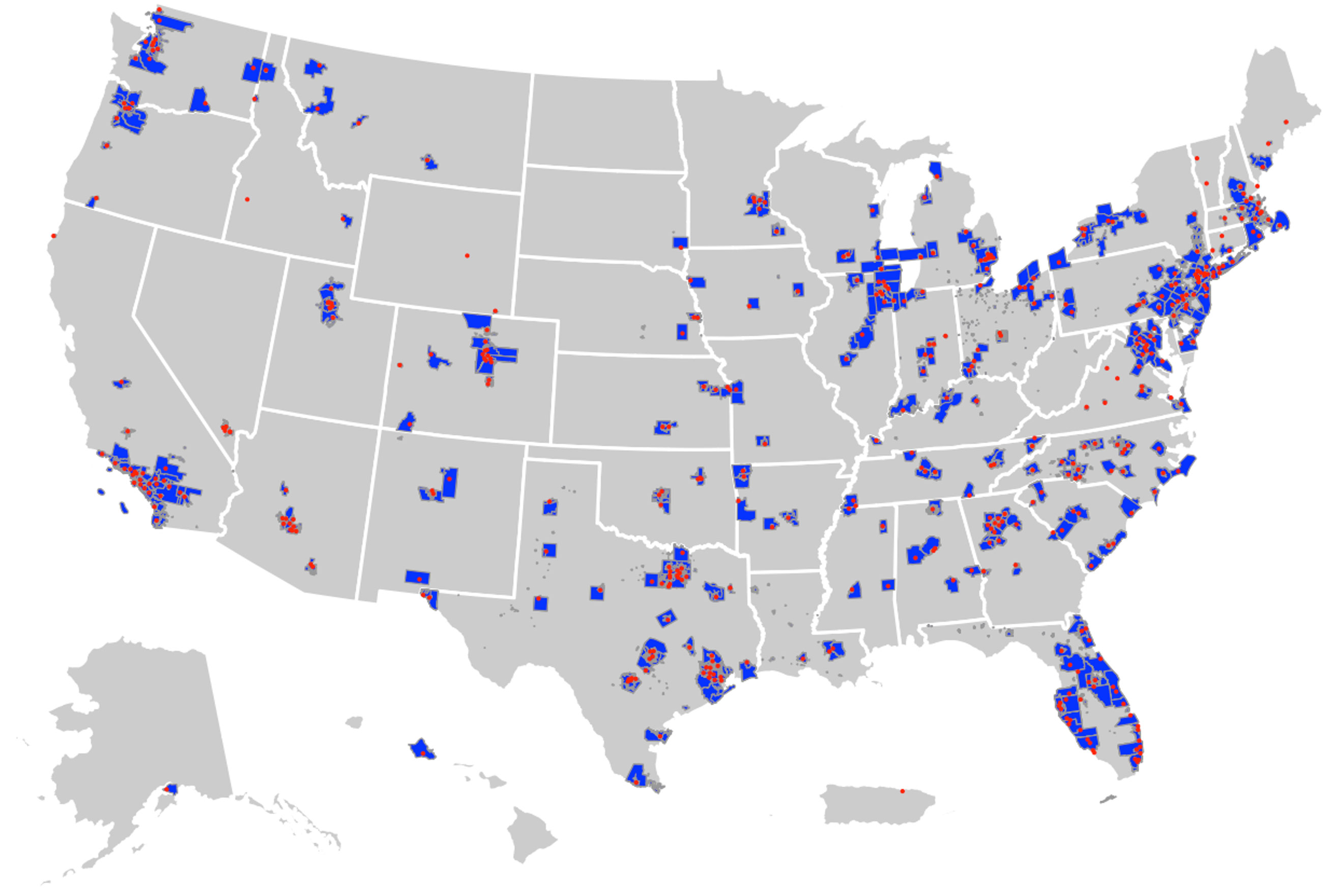

We can do the same exposure analysis at the national level (Figure 3). Across the United States, the total amount of outstanding debt associated with obligors that overlap with Bed Bath & Beyond locations was almost $900 billion (over 130,000 individual securities) for obligors with areas less than 2,000 square miles. If we include geographically larger obligors — all those with areas less than 10,000 square miles — the number of securities increases to over 150,000 and the value of outstanding debt exposed increases to over $1.2 trillion, or roughly one-fourth of the entire municipal bond market.

Figure 3. The geospatial footprints of municipal bond obligors (blue) in the ICE geospatial library (only obligors with areas less than 2,000 square miles are included here) that overlap with Bed Bath & Beyond locations within the United States and are currently carrying outstanding debt. Source: ICE as of 12/01/2024.

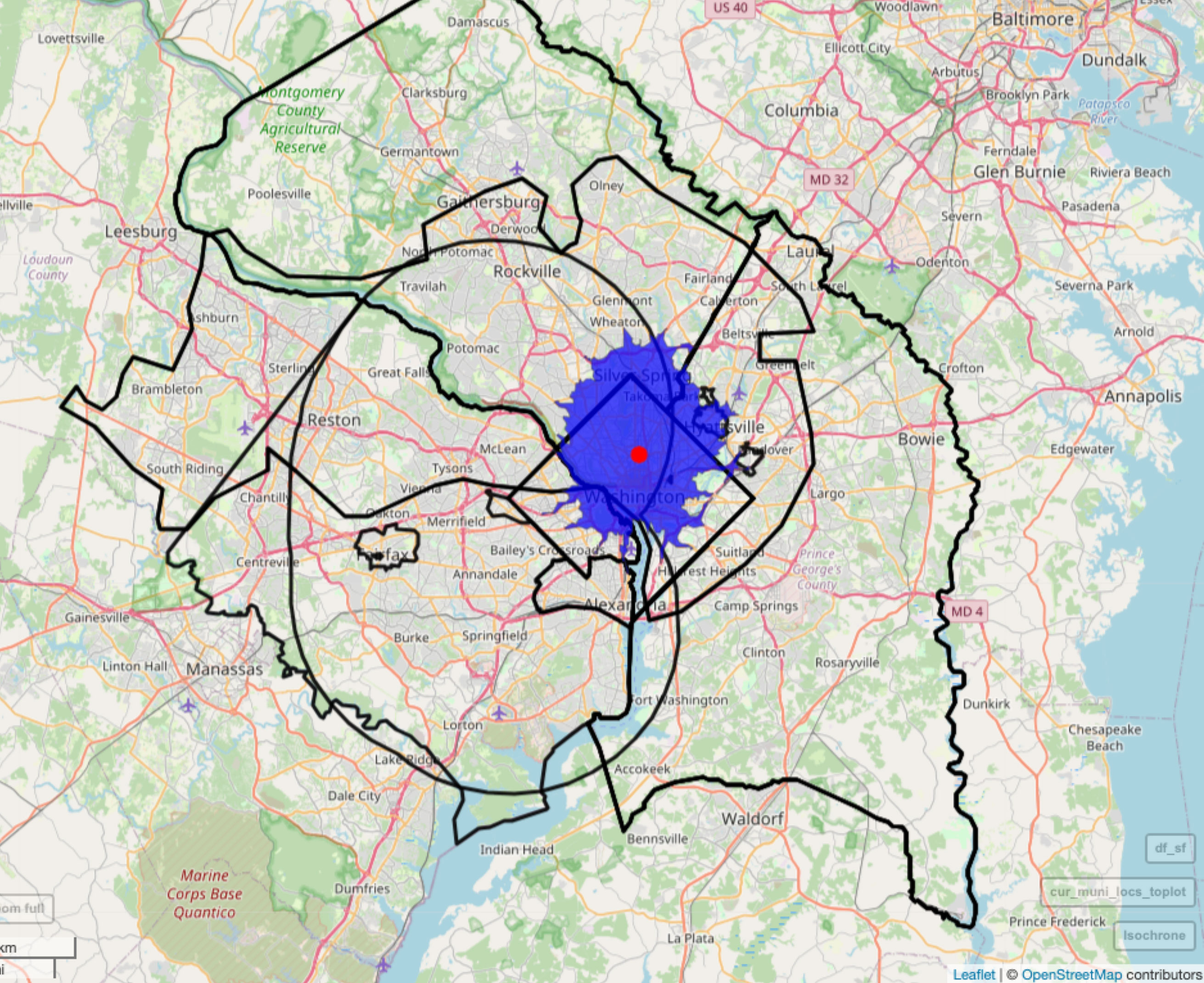

In Figure 3, we looked at the obligor boundaries that overlap with Bed Bath & Beyond locations. However, in many cases, it may be more appropriate to examine the debt overlapping with business catchments around locations inferred via isochrones (areas of equal drive time). The closure of a major store may not only impact its specific mall or retail location, but the surrounding community — whether through the loss of local sales taxes or property taxes, the loss of jobs, or the loss of shoppers who might be drawn into the area by the store. According to one estimate, mall and shopping centers are responsible for over $400 billion in local tax revenue every year.3

Figure 4. The geospatial footprints of municipal bond obligors (blue) in the ICE geospatial library (only obligors with areas less than 1,000 square miles are included here) that overlap with the area within a 20-minute drive of an example Bed Bath & Beyond location in the greater District of Columbia region. For visual simplicity, transit authorities are excluded. Source: ICE as of 6/21/2024.4

ICE Climate can also identify exposed municipal bond obligors based on this approach. For example, the region within a 20-minute drive time from one Bed Bath & Beyond store in the Washington D.C. metro area overlapped with 22 distinct obligor boundaries with areas less than 1,000 square miles. In total there are over 3,000 securities and over $30 billion in outstanding debt associated with these exposed municipal entities.

Depending on the context, the time horizon, and the details of any given event, the reasons that an investor or asset manager might wish to identify exposed municipal obligors are likely to vary. We will continue this series with several other examples of municipal bond exposure to other kinds of geographically defined events.

1 Meyesohn, N (24 April 2023). Bed Bath & Beyond is closing hundreds of stores. But they won’t be empty for long. CNN Business. Available at: https://www.cnn.com/2023/04/24/business/bed-bath-beyond-stores-bankruptcy-real-estate/index.html

2 Here we look at only securities associated with obligor footprints that are less than 2,000 square miles, on the assumption that the closure of several retail stores would have the greatest potential effects for small municipalities and districts, and state-level finances would likely be minimally impacted.

3 Thomas, L. (20 Jun. 2020). CNBC. The demise of America’s malls can deal a blow to the towns that depend on them. Available at: https://www.cnbc.com/2020/06/20/how-mall-closings-in-america-hurt-the-towns-depending-on-them.html

4 Issuers defined by point locations, like hospital and charter schools, are not included in these numbers.