The clearing threshold is determined by the gross notional value. For Euribor and ESTR futures, we understand this value is calculated by multiplying the number of lots by €2,500 and the settlement price. For example, a 100-lot position in a future which settled at 98.00 would have a gross notional value of €24,500,000.

What is it?

EMIR 3.0, introduced on 24 December 2024, aims to boost clearing activity in the EU by requiring certain market participants to maintain active accounts with EU-based CCPs.

What is an active clearing account?

A clearing account refers to any account held at an EU CCP. It is deemed active when specific requirements are met, including IT connectivity, internal operational processes, and legal documentation. Additionally, the account must be capable of handling a substantial increase in transaction volume at short notice.

Which products are in scope?

- Polish Zloty OTC (IRS & FRA)

- Euro OTC (IRS & FRA)

- Euro STIRs (Euribor & ESTR futures) - these are traded at ICE

Note: Options are not in scope

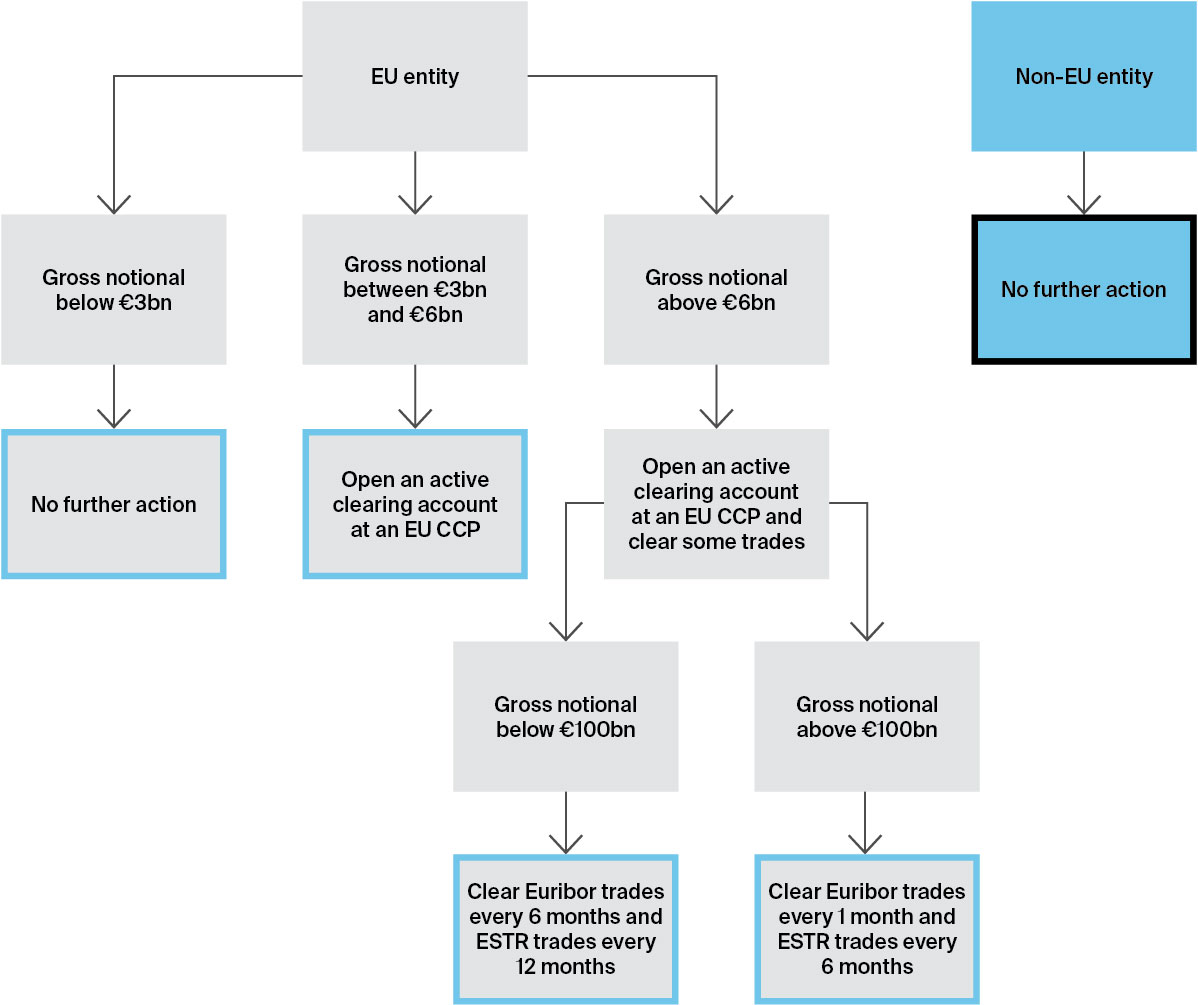

Who does it affect?

EU entities subject to the clearing obligation are impacted. For interest rate derivatives, this applies to firms whose gross notional exceeds a specified clearing threshold (e.g. €3 billion).

Additionally, some EU entities with gross notional more than €6bn may be required to meet the representation requirement. (i.e. an amount of their trades for products in scope are cleared through an EU CCP).

How ICE can help

Does ICE have an EU CCP?

Yes, ICE Clear Netherlands which is an authorised CCP licenced under EMIR. It is supervised by DNB and AFM and is recognised as a 3rd country CCP under the UK EMIR Temporary Recognition Regime.

ICE Futures Europe + ICE Clear Netherlands

Trade on the world’s most liquid EU STIRs listed exchange and satisfy EMIR 3.0 requirements. ICE Futures Europe [IFEU] is the home of EU STIRs, with highly liquid futures & options markets and substantial open interest held by a wide spectrum of financial institutions from around the globe. Continue to execute your trades with IFEU while also clearing specific products through ICE Clear Netherlands [ICNL].

How to get started

Contact your clearing broker or ICE rates team, let them know that on occasion you may need to meet the active account requirements.

Trading Euribor & ESTR and need to meet EMIR 3.0 requirements? Contact us

Key considerations

How is the clearing threshold determined for STIR futures?

When is the gross notional calculated?

At month end, each January and July.

How to assess what futures trades need to be cleared

ESMA has identified four subcategories within each Euro STIR future, based on maturity. Firms are required to assess which contracts and categories they operate in and clear 5 trades in each during every reference period.

For instance, a firm with a gross notional between €6 billion and €100 billion, active only in the 0–6 month and 6–12-month Euribor maturities, must clear 10 trades of any size every six months—resulting in 5 trades in each of the affected subcategories.

Some reduced reporting requirements apply to firms who trade less frequently.

| Contracts | Subcategories (months) | Trades Required | Gross notional < €100bn | Gross notional > €100bn |

|---|---|---|---|---|

| Euribor | 0-6 6-12 12-24 24+ | 5 trades of any size 5 trades of any size 5 trades of any size 5 trades of any size | Every 6 months Every 6 months Every 6 months Every 6 months | Every 1 month Every 1 month Every 1 month Every 1 month |

| ESTR | 0-6 6-12 12-24 24+ | 5 trades of any size 5 trades of any size 5 trades of any size 5 trades of any size | Every 12 months Every 12 months Every 12 months Every 12 months | Every 6 month Every 6 month Every 6 month Every 6 month |

Source: ESMA

Timelines

| 24 December 2024 | EMIR 3.0 enters into force |

|---|---|

| 25 June 2025 | AAR enters into force |

| 25 June 2026 | ESMA to review AAR |

| 31 July 2026 | First reporting requirement of AAR |

| 25 December 2026 | EU Commission review of ESMA’s AAR recommendation |

Per our understanding of the ESMA guidance

Liquidity matters

ICE Euribor futures market share

- Open interest: 92%

- Volume in 2025: 93%

- Top of book score ratio: 96%

ICE ESTR futures market share

- Open interest: 66%

- Volume in 2025: 53%

- Top of book score ratio: 79%

ICE evaluates top of book (TOB) quality by analyzing the total size available at the best bid and offer relative to the tick width. A tighter top of book reflects a more liquid market, with deeper size and narrower spreads. As an example, ICE tracks Euribor liquidity by monitoring the front eight contracts at five-minute intervals.

This method captures both quoted sizes and spread widths throughout the trading day, providing a consistent view of market conditions. The resulting ratio allows for comparison of TOB quality across exchanges, helping identify where liquidity is strongest and pricing is most competitive.

Euribor futures top of book score

Note: Euribor futures top of book on Oct 8, 2025

Related insights

EU Clearing Obligation

EMIR includes the obligation to centrally clear certain classes of over-the-counter (OTC) derivative contracts through Central Counterparty Clearing (CCPs). For non-centrally cleared OTC derivative contracts, EMIR establishes risk mitigation techniques.

ICE Clear Netherlands

ICE Clear Netherlands®, our continental European clearing house, offers secure and capital-efficient clearing services for European equity derivatives products. It combines a transparent pricing structure with robust risk management systems.

Financial Derivatives Markets

Caterina Caramaschi discusses the deep liquidity ICE offers in our financial derivatives markets and how we are expanding our offerings.