Wildfires, flooding, and increased insurance costs are driving integration of climate physical risk and transition risk into the assessment of portfolios and assets. Climate risks such as extreme weather events can impact the value of portfolios, while also serving as an additional input into identifying investment opportunities. ICE provides data and analytics that can help investors to quantify the impacts their portfolios and investments face from transition risks as well as physical climate risks posed by extreme weather events.

Reflecting our core focus on Fixed Income, ICE offers an array of climate metrics across several fixed income asset classes, including corporates, munis, sovereigns, MBS and more.

Our climate data and analytics solutions

Climate Risk

Integrated physical and transition climate data, scores, and tools designed to help organizations manage climate-related risks and opportunities

Avoided Emissions

Life-Cycle Assessment (LCA) based avoided emissions for 50+ climate solutions including company, sector and portfolio-level analytics.

Sustainable Bonds

Green, social, and sustainable bonds sourced from authoritative agencies and issuer documentation from our terms & conditions data service.

Mortgage & Climate Solutions

Climate and affordability insights at the loan, property, and security level.

Social Impact

A range of datasets to help investors measure social factors and integrate social impact data.

Regulatory Solutions

Data supporting the implementation of climate related regulation and frameworks.

Sustainability Indices

A range of fixed income sustainable benchmarks that account for ESG factors in addition to other criteria.

Nature & Biodiversity

A comprehensive suite of data products that help investors to quantify their nature-related risks.

* ICE Data Indices in providing these Sustainability Indices is not intending to interpret or give guidelines on the EU Taxonomy disclosures nor the EU criteria for environmentally sustainable investments. Please refer to the methodology for each of the ICE Sustainability Indices for additional information: ESG indices, Green Bond indices and Carbon Reduction indices.

The climate related benchmarks are proposed indices and not currently live. Publication of any index is subject to completion of necessary regulatory and compliance processes.

Climate Data & Analytics

Our data, analytics and geospatial intelligence platform enable the assessment and linkage of physical climate risk, climate transition risk and alternative data sets to fixed income securities and real estate assets. Our geospatial platform allows us to link these risks to a wide range of asset classes, including:

Municipals

Securitized products (MBS)

Sovereigns

Entities (public and private corporates)

Real estate

Our solutions help enable market participants to identify and quantify risk exposures and assist with strategy development. Our data can help asset managers and asset owners manage their portfolios, the risk they face, and devise appropriate investment strategies to create and protect value.

Environmental Markets

Explore our Content Catalog to discover ICE's broad universe of financial data and analytics

The Fixed Income and Data Services Content Catalog is a centralized, searchable application that showcases ICE's extensive universe of financial data and analytics, making it easier for you to discover and understand the content you need. Designed to support transparency, consistency, and usability, the catalog provides detailed descriptions, use cases, and delivery options across asset classes and data types.

Resources

Explore our curated collection of climate data and analytics resources to help you find the information, tools and support you need. Have questions? Contact us to speak to our team: [email protected]

Climate Spotlight

Join Evan Kodra, Head of R&D for ICE Climate, in conversation with thought leaders in the investing community to discuss the latest global trends in climate data, risk and impact.

ICE Climate Analytics for Municipal Debt

According to a report by Municipal Market Analytics in March 2024, the need for climate adaptation investment could lead to a 100% increase in annual municipal bond issuance by the mid-2030s.

Climate Risk Data

ICE delivers cross-asset data and analytics to help you understand and manage climate-related risks and exposures. Our solutions support smarter risk management, portfolio resilience, and transparent reporting for your clients.

ICE Climate Monthly Report

This report provides key insights, trends, and data on climate-related developments, market impacts, and regulatory updates, offering a comprehensive overview of emerging risks, opportunities, and industry shifts.

Insights and Research

Our sustainable finance data experts analyze the risks and opportunities in markets, and the extent to which physical and transition risk is being priced into portfolios and assets.

Code of Conduct

The Code of Conduct will improve transparency and trust in ESG data and ratings used by investors and financial market participants.

Property, mortgage and geospatial data

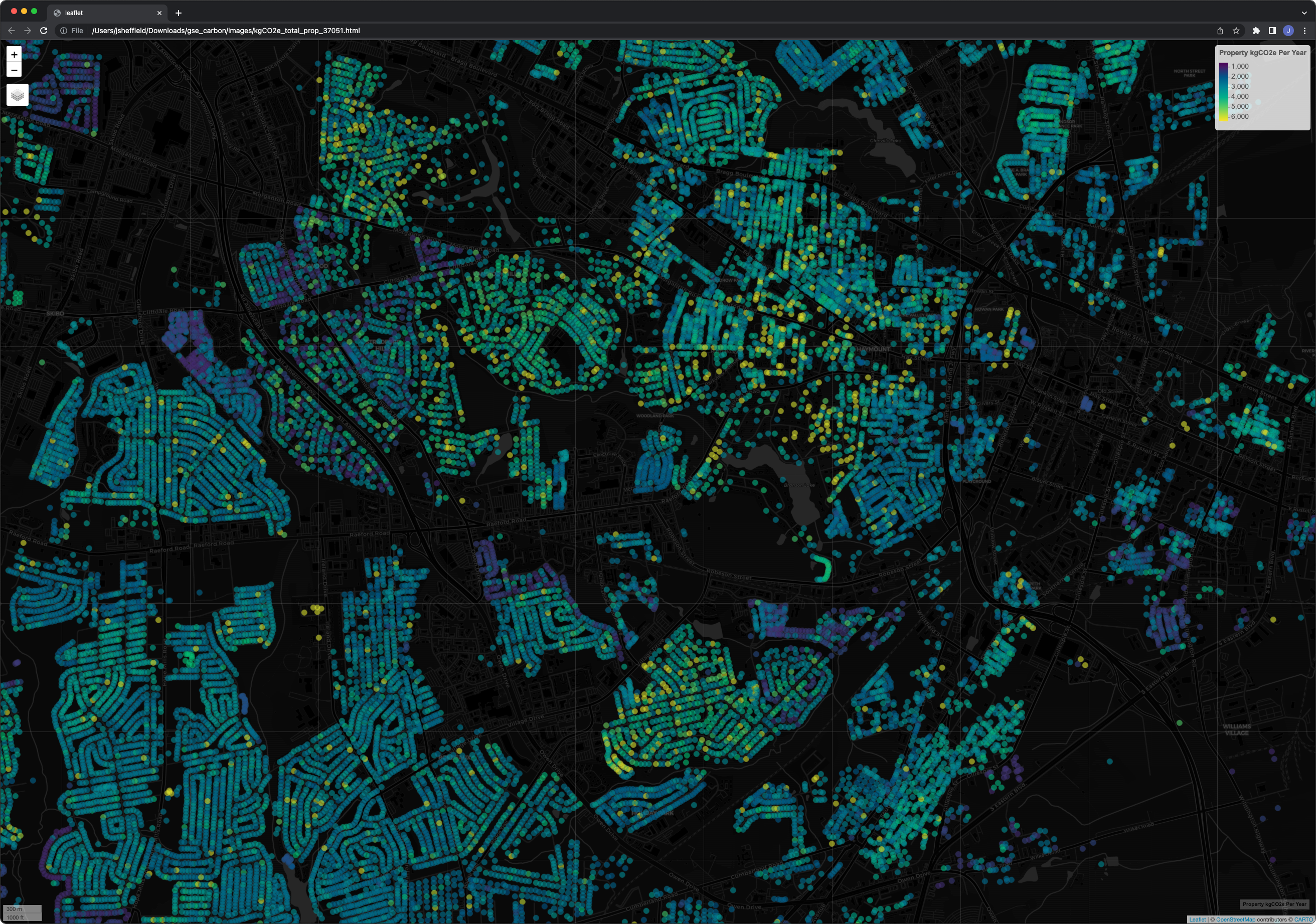

ICE's property-level climate risk metrics cover more than 100 million U.S. homes and can help improve transparency and risk understanding throughout the housing finance sector. With our dynamic geospatial intelligence platform, users can apply ICE's climate metrics to individual loans, properties, and entire portfolios.

Building on our recent acquisition of Black Knight to advance data solutions in real estate and mortgages, ICE is leveraging the combined insight across its mortgage and climate risk metrics and is integrating this insight into existing municipal bond and mortgage-backed securities products to help investors get enhanced transparency into climate-related exposures.

Related insights

Climate & Capital Conference Session Replays

As part of NYC Climate Week 2024, we held the third annual Climate & Capital Conference brought together industry leaders from the investment, business, and climate communities.

Could a credit downgrade be worth it?

In the upcoming decades, municipalities across the country may have to take on large amounts of debt to build climate mitigation and adaptation infrastructure.

Measuring and managing climate risk in debt markets

Larry Lawrence, head of sustainable finance group, ICE Climate, explains how market participants can use climate data to manage their risk profile in a fast-changing world.

How are home insurance costs changing across the United States?

Access insights from ICE's 10-year study into the forces propelling rising insurance costs across the U.S. since 2014.

Climate & Capital Conference Session Replays

As part of NYC Climate Week 2024, we held the third annual Climate & Capital Conference brought together industry leaders from the investment, business, and climate communities.

Could a credit downgrade be worth it?

In the upcoming decades, municipalities across the country may have to take on large amounts of debt to build climate mitigation and adaptation infrastructure.

Measuring and managing climate risk in debt markets

Larry Lawrence, head of sustainable finance group, ICE Climate, explains how market participants can use climate data to manage their risk profile in a fast-changing world.

How are home insurance costs changing across the United States?

Access insights from ICE's 10-year study into the forces propelling rising insurance costs across the U.S. since 2014.