For fixed income asset managers, a new way to reduce tracking error

Combining data science with proprietary pricing models can help meaningfully reduce tracking error

President, Fixed Income & Data Services

ICE

As someone with a long career in fixed income, some seismic events have shaped my thinking about the asset class. The market upheaval of COVID-19, and more dramatically, the credit crisis of 2008-09, each underscored what many see as a shortcoming of fixed income: a lack of transparency. It’s a characteristic which reflects the sheer complexity and size of the market, where many securities are thinly traded, and risk can be hard to assess. On a systemic level, a dynamic which underpinned the 2008 credit crisis was this: people couldn’t manage their risk, because they couldn’t see the risk which was there. Part of the answer to this challenge is providing access to quality data.

Join our mailing list to receive the newsletter and ICE Fixed Income team updates

At ICE, we combine quality fixed income data with proprietary models that help asset managers to manage risk in their portfolios. In fixed income, reducing risk is often judged through big industry shifts - like regulatory reform, or the adoption of new trading technology. But equally critical, is the progress made by chipping away at long-accepted market practices.

For example, bond ETF managers have long been forced to accept a certain level of tracking error for their funds. As vehicles which straddle both bond and equity markets, these funds can be challenged to accurately track an underlying bond index. In addition, on 5-6 days a year, bond markets close early while equities trade until 4 p.m. This early close for bonds translates to decreased trading activity after 1 p.m. - a dynamic which further challenges the ability for a fund which trades on equity markets to track a fixed income index.

Since late last year, our fixed income indices have applied an evaluation produced by ICE Data Pricing & Reference Data. This Fair Value Information Service utilizes proprietary models to reflect market movement between 1 p.m. and 4 p.m. In this article, our analysis shows that ICE’s Fair Value Information Service can help asset managers to meaningfully reduce their tracking error. It’s another step toward managing risk in fixed income, and ultimately encouraging broader market participation.

WHITEPAPER

The changing face of municipal bond markets

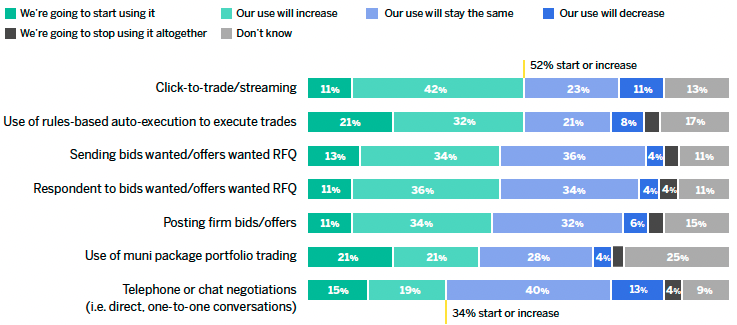

Firms plan to increase their use of electronic protocols over the next three to five years

Source: Arizent/The Bond Buyer 2023

ICE Bonds, together with The Bond Buyer and Arizent, surveyed municipal market bond participants about where they find liquidity and the protocols they use. Results suggest that barriers to adopting electronic trading for municipal bonds have receded, as the industry recognizes the ways in which digitization can enhance relationship-style trading that has dominated the asset class.

REPORT

Impact bond analysis

Global issuance of impact bonds started strongly in 2023 but fell significantly towards the end of the year, ending with US$811 billion of issuance, just 2% lower than 2022. In addition, a shift in issuance from Europe to the Asia Pacific continues. In terms of use of proceeds, biodiversity projects are gaining popularity, with afforestation and forest management receiving particular attention.

Impact bond issuance

WEBINAR

Managing asset repricing risk in mortgage credit

The rising cost and diminished availability of hazard insurance is pressuring mortgage borrowers’ ability to repay. Residential and commercial MBS investors are now tasked with projecting how this can impact future asset prices and collateral performance. In the webinar we discuss why the ability to quantify and manage mortgage climate credit risk has become more paramount than ever before.

Fixed Income

Manage risk, uncover opportunities, and make informed decisions in real-time with ICE’s end-to-end fixed income solutions. Reimagine your fixed income workflow from price transparency & discovery and efficient execution through to performance analysis.

This material contains information that is confidential and the proprietary property and/or a trade secret of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”), is not to be published, reproduced, copied, modified, disclosed or used in any way without the express written consent of the ICE Group. This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between the ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, or other professional advice.

The information contained herein is provided “as is” and the ICE Group makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. The ICE Group makes no representation or warranty that any data or information (including but not limited to evaluated pricing) supplied to or by it are complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall the ICE Group have any liability for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits) in connection with any use of and/or reliance on the content of this document even if advised of the possibility of such damages.

This document is not an offer of advisory services and is not meant to be a solicitation, or recommendation to buy, sell or hold securities. This document represents ICE Group’s observations of general market movements. Trades and/or quotes for individual securities may or may not move in the same direction or to the same degree as indicated in this document. Please note that the information may have become outdated since its publication.

Trading analytics available from ICE Data Pricing & Reference Data are a point in time output and as such dependent on and take into account the information available to ICE Data Pricing & Reference Data at the time of calculation. ICE Data Pricing & Reference Data does not have access to all relevant trade-related data or dealer quotes, and the utility of the output may diminish depending upon amount of available data underlying the analysis. The inputs utilized in each of the trading analytics services described herein depend on the methodologies employed by each such service and may not be the same as the inputs used in the other trading analytics services. There are many methodologies (including computer-based analytical modelling) available to calculate and determine information such as Trading Analytics described herein. ICE Data Pricing & Reference Data’s trading analytics may not generate results that correlate to actual outcomes, and/or actual behavior of the market, such as with regard to the purchase and sale of instruments. There may be errors or defects in ICE Data Pricing & Reference Data’s software, databases, or methodologies that may cause resultant data to be inappropriate for use for certain purposes or use cases, and/or within certain applications. Certain historical data may be subject to periodic updates over time due to recalibration processes, including, without limitation enhancement of ICE Data Pricing & Reference Data’s models and increased coverage of instruments. Although ICE Data Pricing & Reference Data may elect to update the data it uses from time to time, it has no obligation to do so.

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model-based curves, market sentiment scores, and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

Trademarks of the ICE Group include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data, and New York Stock Exchange,. Information regarding additional trademarks and intellectual property rights of the ICE Group is located at www.ice.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.