ICE Fixed Income monthly report

What do metrics indicate about the outlook for riskier segments of the bond market? Amid interest rate volatility, how can asset owners best manage their risk? And how does a veteran-owned investment bank see the geopolitical risks impacting financial markets? Access these insights and more, in this month’s Fixed Income monthly.

Join our mailing list to receive the newsletter and ICE Fixed Income team updates

For riskier bonds, metrics suggest a bright outlook

During a year when markets were stalked by uncertainty, it’s been interesting to see some riskier bonds outperform their investment grade counterparts. While many point to reasons for caution, a closer examination of the high yield bond segment may instead provide broader cause for optimism.

First, a few relevant stats. High yield corporate bonds have returned 4.68% for the year through to October, according to the ICE BofA US High Yield Index, versus a 1.38% loss for investment grade bonds as represented by the ICE BofA US Corporate Index over the same period.

Key metrics within the high yield space are heartening. Twelve-month trailing high yield defaults stand at 3.1%, a contrast to nearly 8% in 2021, after peaking at 9% in August 2020. The recent upgrade of Ford Motors from high yield to investment grade, for the first time since March 2020, is also somewhat of a bellwether: rising stars (companies obtaining credit upgrades) have outpaced fallen angels (companies receiving credit downgrades) this year by more than 6-to-1 in the U.S. market at $140.9 billion versus just $21.9 billion, respectively.

A high-rate backdrop has piqued some concern about refinancing needs. Yet 0-18 month near-term financing for the U.S. high yield segment sits at ~5%, in-line with average figures over the last 12 years. In other words, companies knew the era of low rates would end, and there is no looming maturity wall with higher borrowing costs on the foreseeable horizon.

Basic supply-demand dynamics are also favorable. Back in 2021, high yield bond issuance stood at over $400 billion as companies rushed to refinance amid a low-rate backdrop. Now, with rates at their highest level in decades, high yield issuance sits at just ~$150 billion for 2023 and is expected to reach ~$170 billion by year end. A dynamic of low supply and steady demand is supported by investment mandates from vehicles like pension funds, insurers, and trading in the secondary market.

Of course, all performance is relative. For the investment grade segment, losses for the year through to October were due in large part to banks, which suffered amid fallout from the regional banking crisis and subsequent credit downgrades. Alongside this, the continuation of an aggressive rate hike cycle saw a dichotomy where investors either flocked to the (perceived) safety of Treasuries with decent yield – or sought far richer returns in high yield bonds.

All in, while it would be naïve to dismiss lingering risks to growth, the recent uptick in market sentiment is well-supported by indicators in the high yield debt market. And as the holiday season kicks off, it’s a reprieve for which market participants can be grateful.

Insights

For asset owners, a better way to manage rate volatility

Asset owners such as insurers and pension plans, have traditionally held a sizeable portion of their portfolios in fixed income securities. They employ duration-matching to align cash flows of these securities with the projected future obligations to policyholders and pension beneficiaries. This means the rapid rise in yields and uptick in rate volatility has presented valuation and asset-liability matching challenges.

Learn more in this article from ICE's Patrick Ge and Neil Patel

Insights

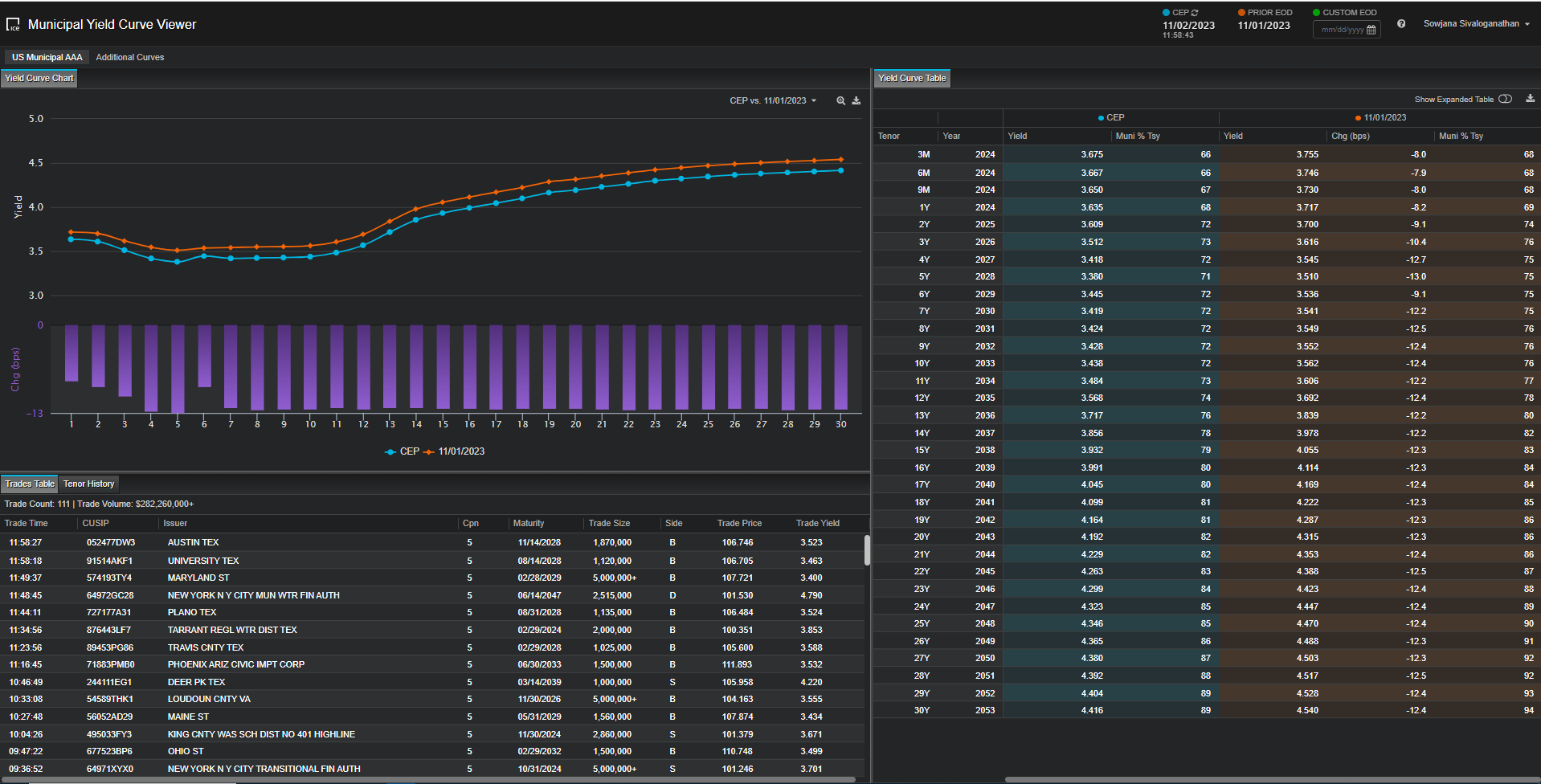

How meaningful data can transform the muni market

For municipal bond markets, quality data can create a clear distinction around issuance costs, reliable evaluations, and fair pricing. ICE’s Senior Director and Head of Municipal Bond Evaluations Patrick Smith and Senior Director of Fixed Income Product Sowjana Sivaloganathan explore the evolution of the muni market in this article with Bond Buyer.

Fixed Income in Focus

Geopolitical risk and execution management systems

In our latest episodes, Academy Asset Management’s Chance Mins and Seth Rosenthal give a perspective from a veteran-owned and operated investment bank on how they see geopolitical risks playing out in financial markets.

Separately, FlexTrade CEO Vijay Kedia discusses how execution management systems can help meet the rapidly evolving needs of fixed income markets.

News

ICE transfers CDS positions from Europe

This October, ICE closed out the final open interest in credit default swaps at ICE Clear Europe and re-established positions in the US at ICE Clear Credit. The process involved developing a new matching algorithm at ICE Link, a post-trade affirmation platform for buy-side and sell-side CDS market participants, in just three months.

Learn more in this Markets Media Article with ICE's Stan Ivanov, Ian Springle and Hester Serafini

Events

ICE Fixed Income Forum

The ICE Fixed Income Forum gathered financial experts and thought leaders to address industry challenges and opportunities, and sought to uncover solutions to help advance financial markets.

Led by a keynote discussion with BlackRock's Co-Head of Global Trading Dan Veiner, this event featured panel discussions that explored a range of topics, from electronification of trading workflows and advancements in AI/cloud technology to indexing & ETF strategies and valuation best practices.

The event also featured a fire-side chat with McLaren Racing CEO Zak Brown about the importance of data in racing.

Fixed Income

Manage risk, uncover opportunities, and make informed decisions in real-time with ICE’s end-to-end fixed income solutions. Reimagine your fixed income workflow from price transparency & discovery and efficient execution through to performance analysis.

This material contains information that is confidential and the proprietary property and/or a trade secret of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”), is not to be published, reproduced, copied, modified, disclosed or used in any way without the express written consent of the ICE Group. This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between the ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, or other professional advice.

The information contained herein is provided “as is” and the ICE Group makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. The ICE Group makes no representation or warranty that any data or information (including but not limited to evaluated pricing) supplied to or by it are complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall the ICE Group have any liability for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits) in connection with any use of and/or reliance on the content of this document even if advised of the possibility of such damages.

This document is not an offer of advisory services and is not meant to be a solicitation, or recommendation to buy, sell or hold securities. This document represents ICE Group’s observations of general market movements. Trades and/or quotes for individual securities may or may not move in the same direction or to the same degree as indicated in this document. Please note that the information may have become outdated since its publication.

Trading analytics available from ICE Data Pricing & Reference Data are a point in time output and as such dependent on and take into account the information available to ICE Data Pricing & Reference Data at the time of calculation. ICE Data Pricing & Reference Data does not have access to all relevant trade-related data or dealer quotes, and the utility of the output may diminish depending upon amount of available data underlying the analysis. The inputs utilized in each of the trading analytics services described herein depend on the methodologies employed by each such service and may not be the same as the inputs used in the other trading analytics services. There are many methodologies (including computer-based analytical modelling) available to calculate and determine information such as Trading Analytics described herein. ICE Data Pricing & Reference Data’s trading analytics may not generate results that correlate to actual outcomes, and/or actual behavior of the market, such as with regard to the purchase and sale of instruments. There may be errors or defects in ICE Data Pricing & Reference Data’s software, databases, or methodologies that may cause resultant data to be inappropriate for use for certain purposes or use cases, and/or within certain applications. Certain historical data may be subject to periodic updates over time due to recalibration processes, including, without limitation enhancement of ICE Data Pricing & Reference Data’s models and increased coverage of instruments. Although ICE Data Pricing & Reference Data may elect to update the data it uses from time to time, it has no obligation to do so.

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model-based curves, market sentiment scores, and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

Trademarks of the ICE Group include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data, and New York Stock Exchange,. Information regarding additional trademarks and intellectual property rights of the ICE Group is located at www.ice.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.