| Custom Index Tool | Activate Key Capabilities | Unlock Strategic Benefits |

|---|---|---|

| Fixed Income |

|

|

| Equities |

|

|

Design and backtest ideas for fixed income and equity indices

Prototype indices with varying degrees of complexity, from basic blends and filtering to custom segments, caps, target weights and currency blends.

With ICE Custom Index Tool, you can:

Prototype simple or complex indices - from basic blends and filtering to custom segments, caps, target weights and currency blends

Perform historical research, daily production tasks and backtesting

Prototype and request activation of custom indices

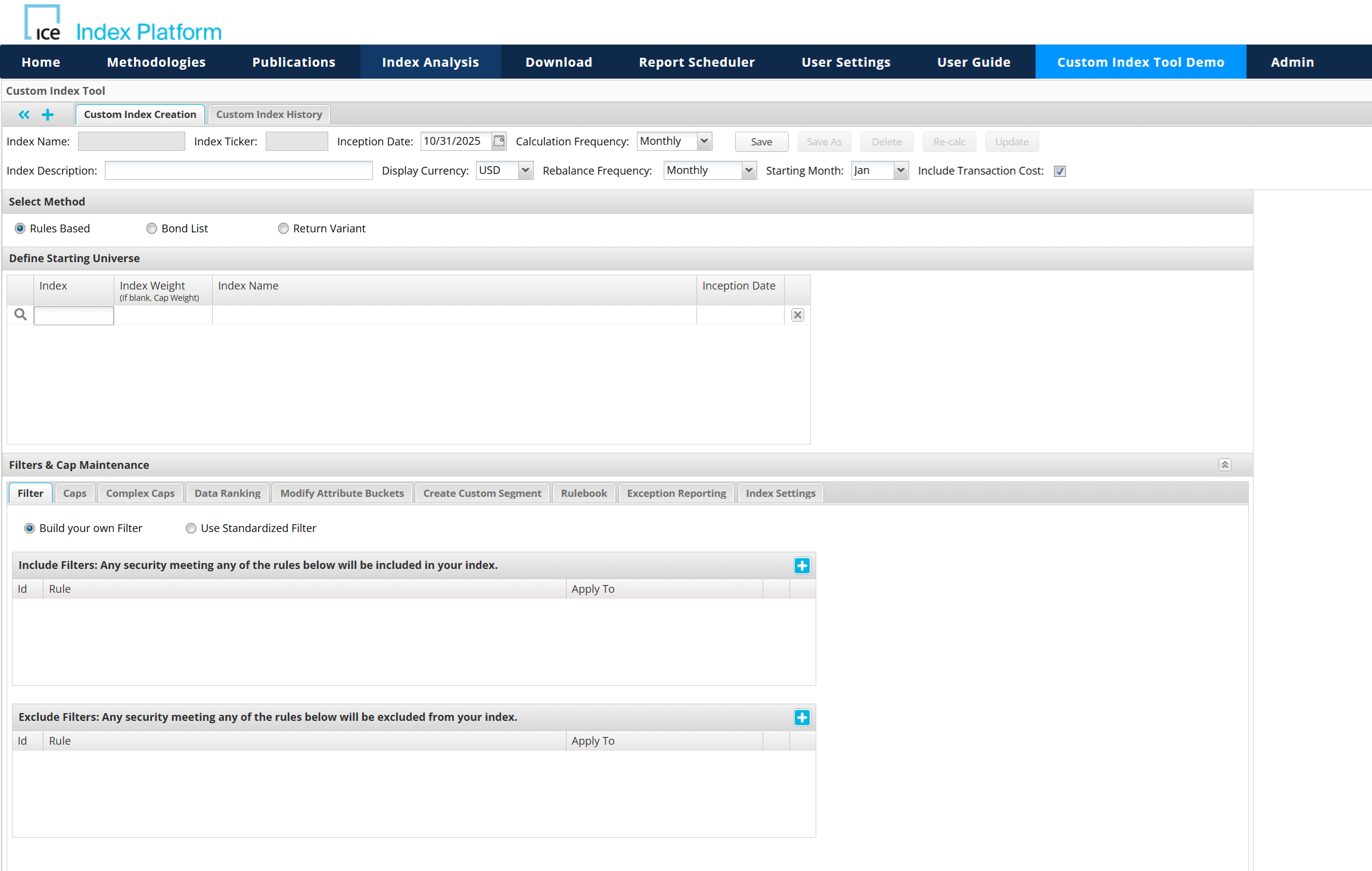

Custom Index Tool – Fixed Income

Prototype indices from basic blends and filters to highly custom segments, caps, targeted weights, and currency-adjusted strategies.

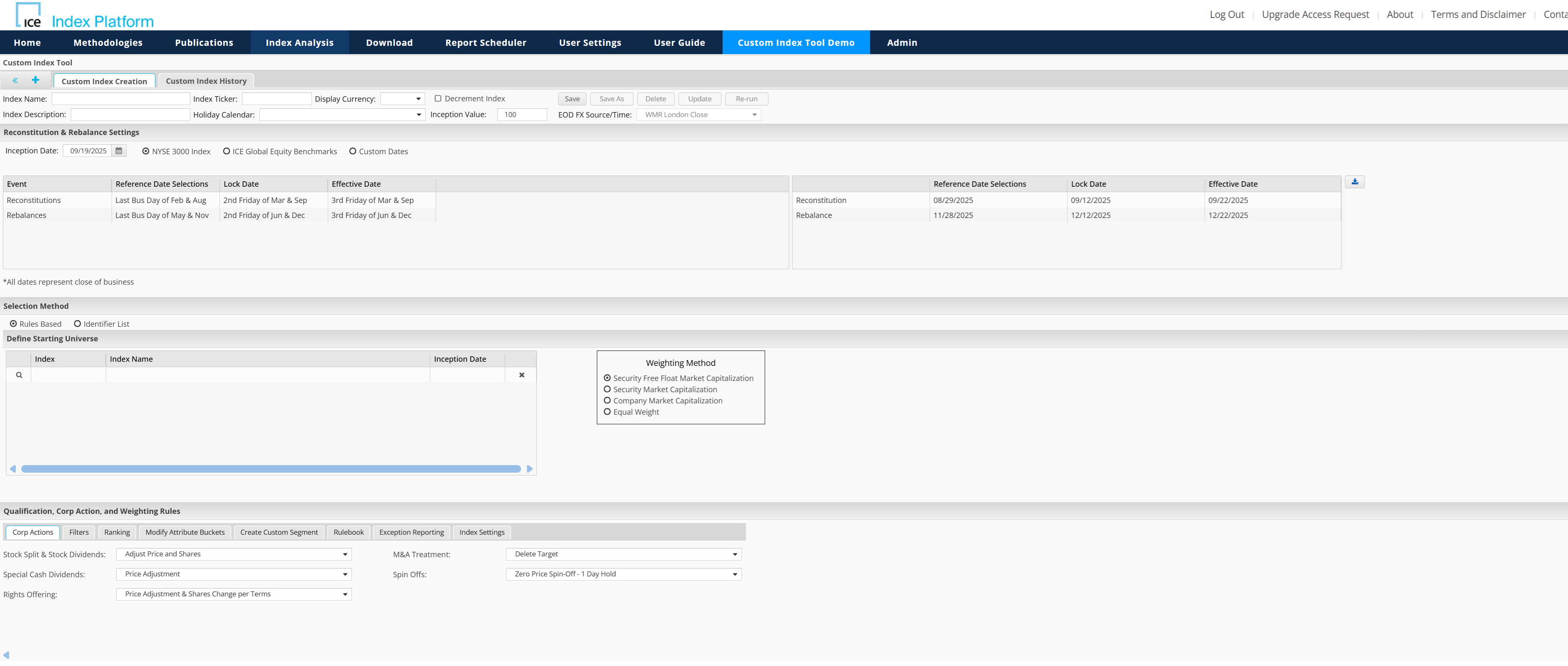

Custom Index Tool - Equities

Design equity indices — ranging from simple to complex — and blend them with fixed income, to prototype a multi-asset strategy.

Custom index tool — Fixed income

Full spectrum fixed income construction

Cash reinvestment & absolute flexibility

Holistic backtesting & production tools

Robust infrastructure for complex assets

Fair value pricing integration

ESG and thematic filtering

Benefits for fixed income

- Benchmarking for portfolios

- Operational efficiency

- Scalable management of complex data

- Climate-related benchmarks

Custom index tool — Equities

Custom index building for equities

Extensive customization fields

Access to thousands of data fields, enabling users to apply granular filters, thematic exposures (e.g., ESG, megatrend), and custom weighting rules.Shared and collaborative prototyping

Shared and collaborative prototyping

Indices requested to be externally activated can be accessed on third-party platforms

Rapid equity deployment

Ability to prototype new custom equity indices with an easy-to-use web-based solution

Comprehensive analytics & backtesting

Includes tools for return, risk-return and other analytics

Benefits for equities

- Precision-Aligned Investment Strategies

- Enhanced R&D Efficiency

- Scalability & Self-Service

- Seamless Integration for Prototyping Multi-Asset Strategies

Custom Index Tool at a Glance

Custom Index Tool - On demand webinar

Learn about

- Index Construction: From basic blends and filters to advanced custom segments, caps, target weights, and currency blends.

- Backtesting Capabilities: Historical performance analysis of custom indices.

- Research & Production Support: Tools for both exploratory research and operational index management.

Related insights

Custom indexing: a powerful way to express unique investment ideas

The application of custom indices is expanding beyond research and analysis, allowing users to address specific investment goals.

Disrupting the index sector with a stronghold in customization

Varun Pawar outlines ICE’s approach as published in ETF Stream.