Why join?

Our market-leading data, insights and technology can be integrated into your services to help deliver greater flexibility and faster time-to-market for your clients.

What is the ICE Strategic Alliances program?

Content to help drive your business

- High quality fixed income evaluated pricing, analytics, and reference data

- Sustainable Finance content across the full E, S and G spectrum including granular climate data

- Cross-asset OTC derivatives content and analytics

- Cross-asset indices

- 600+ exchange and other third-party sources

Delivery solutions tailored for your technology

- High throughput streaming normalized market data APIs, including via direct cloud connectivity

- Interactive and intuitive historical, snapshot and functional APIs

- Delivery of flat file data through SFTP push, SFTP pull and directly to cloud storage

- HTML5 display widgets

Engagement with your business model in mind

- Direct and/or indirect licensing

- Vendor of Record services

- Range of contractual and commercial structures

Access to expertise and global support

- Global developer support and product teams

- Close collaboration with our global sales organization

- Relationship management catered to your business size

- Potential joint marketing opportunities and sales lead incentives

Content to help drive your business

- High quality fixed income evaluated pricing, analytics, and reference data

- Sustainable Finance content across the full E, S and G spectrum including granular climate data

- Cross-asset OTC derivatives content and analytics

- Cross-asset indices

- 600+ exchange and other third-party sources

Delivery solutions tailored for your technology

- High throughput streaming normalized market data APIs, including via direct cloud connectivity

- Interactive and intuitive historical, snapshot and functional APIs

- Delivery of flat file data through SFTP push, SFTP pull and directly to cloud storage

- HTML5 display widgets

Engagement with your business model in mind

- Direct and/or indirect licensing

- Vendor of Record services

- Range of contractual and commercial structures

Access to expertise and global support

- Global developer support and product teams

- Close collaboration with our global sales organization

- Relationship management catered to your business size

- Potential joint marketing opportunities and sales lead incentives

Explore our Content Catalog to discover ICE's broad universe of financial data and analytics

The Fixed Income and Data Services Content Catalog is a centralized, searchable application that showcases ICE's extensive universe of financial data and analytics, making it easier for you to discover and understand the content you need. Designed to support transparency, consistency, and usability, the catalog provides detailed descriptions, use cases, and delivery options across asset classes and data types.

Latest channel partner news

Events

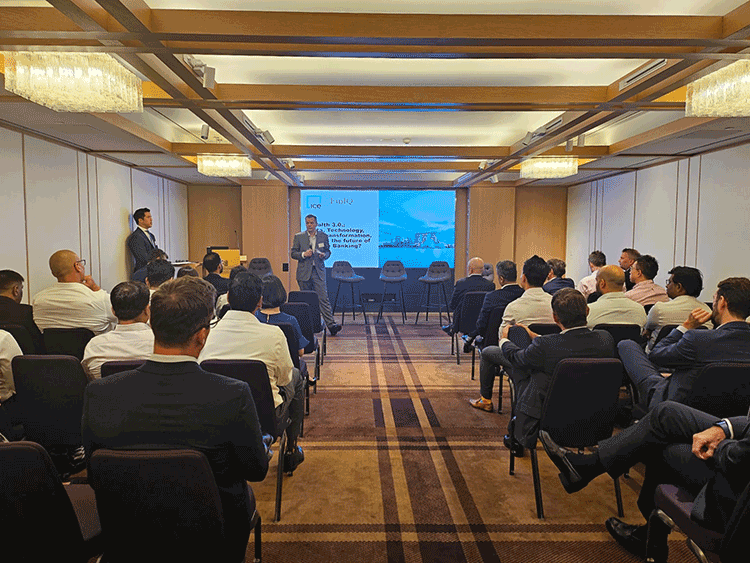

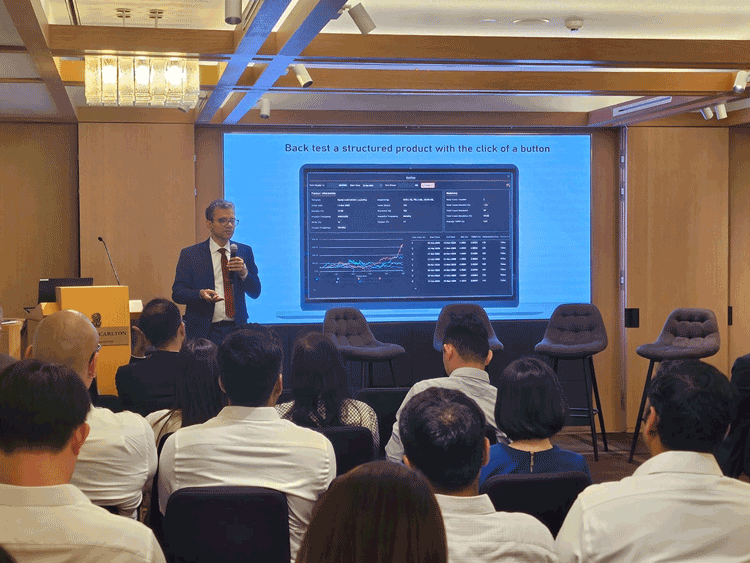

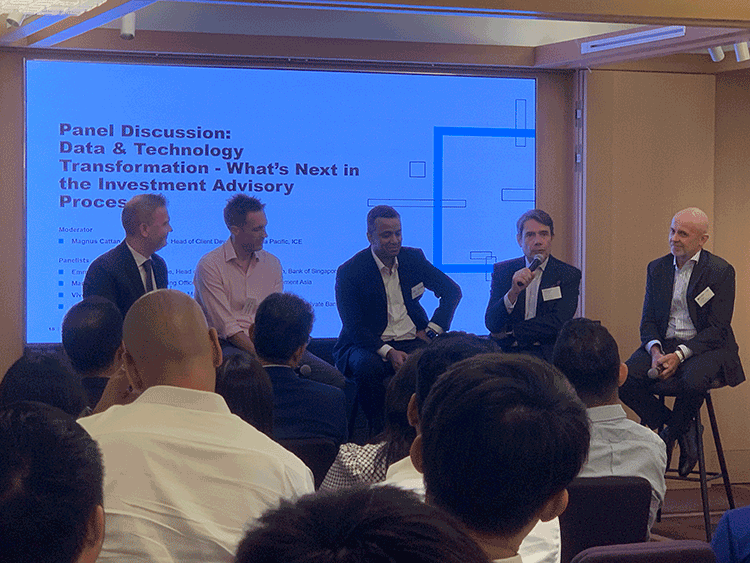

Wealth 3.0: Data, Technology and Transformation, What's the future of private banking?

ICE and FinIQ hosted a joint event for private banking professionals in Singapore on April 18, 2024, as we explored how technology can better harness the power of market data to drive more value creation in the investment advisory process and operations. The panelists, coming from a diverse group of private banks, discussed the traits of key transformation / product innovation projects that they thought were successful and value-adding to their business and clients. As the speed of data and analytics become more real-time and faster with data volumes only continuing to explode and regulations tightening, the participants further acknowledged that the industry will continue to benefit from agile workflow solutions that can integrate reliable and timely market data seamlessly as well as be able to build on it with various analytics quickly, to enrich and expand the various functions managed by private banks.

Horizon Trading Solutions & Partners - Product Roadmaps to help Malaysian Clients

ICE, together with Scila co-sponsored Horizon Trading Solutions’ event in Kuala Lumpur, Malaysia, on May 9, 2024. We discussed the latest market data and tools that can support the Malaysian financial community. Malaysia is a dynamic and growing market, and we’re pleased to provide solutions to support its continuous growth journey along with our partners.

Related insights

ICE Strategic Alliance Forum 2025

Industry leaders will share insights on the impact of economic changes, innovative technologies, and ICE's strategic direction for the future.

Insights

ICE Strategic Alliance Forum 2025

Industry leaders will share insights on the impact of economic changes, innovative technologies, and ICE's strategic direction for the future.