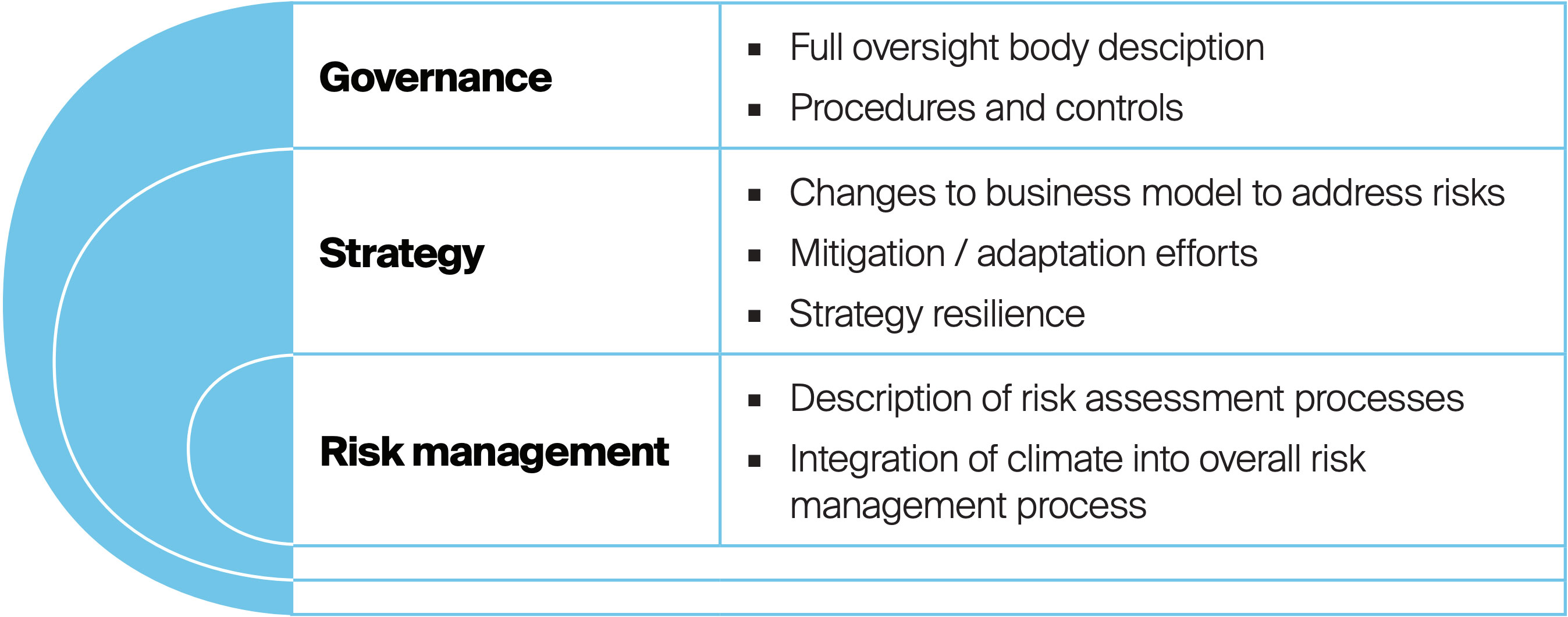

Obligations for the Climate Risk Management Report

As well as a range of metrics and targets+, which are to be rolled out in reporting across the next few years.

Key dates

Phase 1

Domestic Systemically Important Banks (D-SIBs) and Internationally Active Insurance Groups (IAGs) headquartered in Canada:

- To produce Climate Risk Management Report for fiscal year 2024

- To produce Climate-related Risk Returns for FY 2024 effective on/after 31 Oct

Phase 2

Small and medium-sized banks and all other Federally Regulated Insurers:

- To produce Climate Risk Management Report for FY 2025

- To produce Climate-related Risk Returns on/after 31 Oct. 2025

Applicable in year 1 of reporting

- Scope 1 and Scope 2 (location based) absolute gross emissions for FRFI

- Reporting standards used

- Quantitative & qualitative climate-related targets including objective, duration, baseline & any revisions with explanations

- Details of offsets used

- Overview of review process

- Disclose performance updates against targets, trend analysis

Applicable in year 2 of reporting

- % of assets / business activities:

- CapEx deployed towards climate-related risks and opps

- Use of an internal carbon price

- % of senior management remuneration linked to climate objectives

Applicable in 2028 and beyond

- Scope 3 emissions (15 categories) for value chain, including category 15; financed emissions

- Assumptions and standards used to calculate emissions

- Disaggregated financed emissions by:

- Explain exclusions from financed emissions calculations

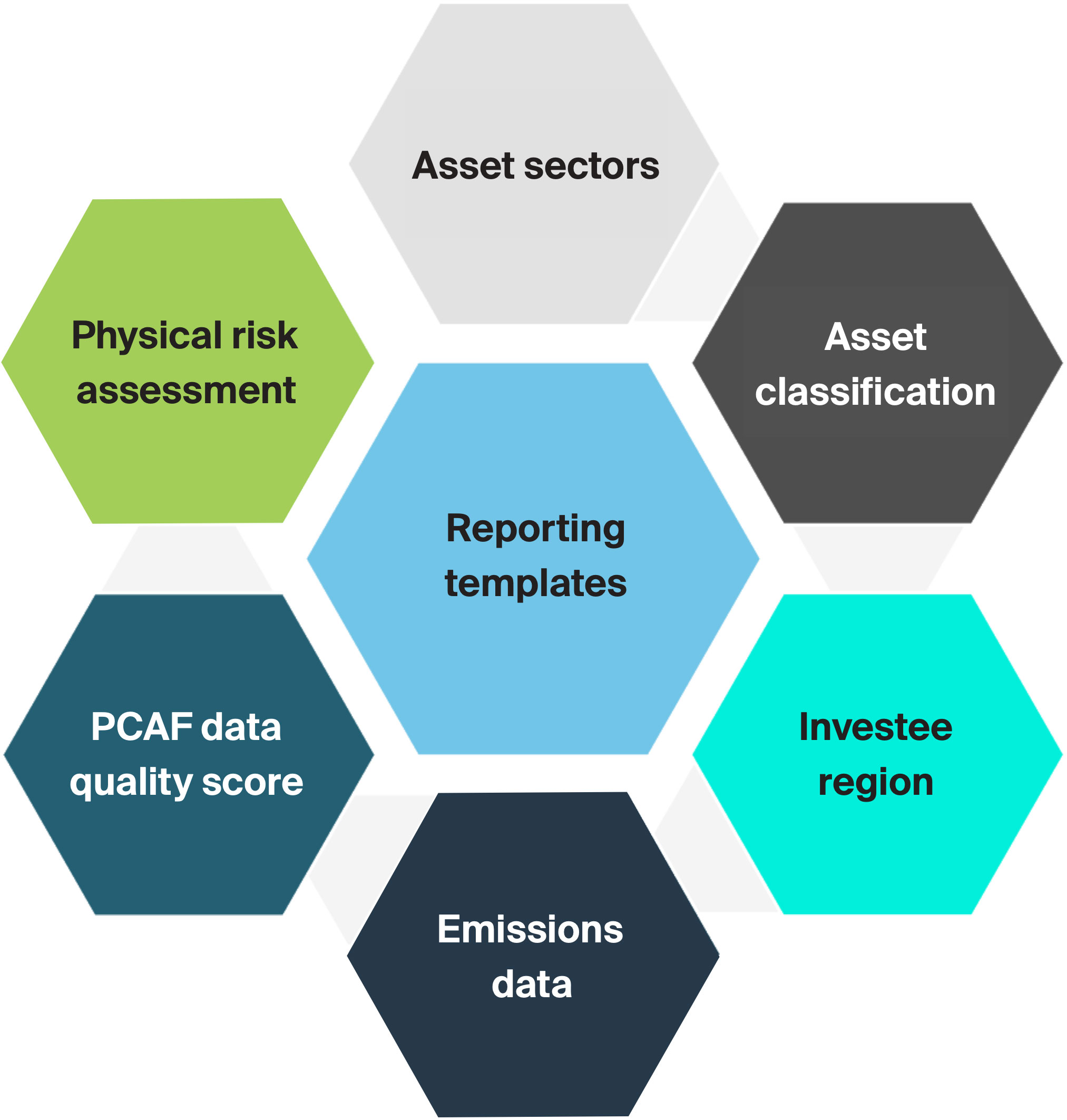

Climate-related Risk Return Templates

OSFI require additional standardized climate related emissions and exposure data from institutions which utilize the B-15 requirements and help monitor how climate risks are being managed in practice. The returns for deposit-taking institutions (DC1-A /-B and DC2-A /-B) and insurance firms (IC1-A/-B and IC2-A /-B/-C) will collect data on asset exposures subject to physical risk by geophysical location and absolute greenhouse gas emissions (Scopes 1, 2 and 3).

Climate-related perils

To be considered in risk exposure assessment are:

- Wildfire

- Flood

- Hurricane

- Severe convective storms*

*Future enhancement

Transition risks

To be considered in risk exposure assessment are:

- Own GHG emissions (Scope 1, 2 & 3)

- Conterparty financed emissions (Scope 1 & 2)

- Policyholder insurance associated emissions (Scope 1 & 2)

- PCAF emissions data quality score

Asset class availability

ICE data is available to assess climate risks for the following asset classes:

- Corporate Public instruments (Equities, bonds...)

- Private Placement (Private Equity, Private Credit…)

- Real Estate

- Sovereign

- Municipal Bonds

- Mortgage-Backed Securities

OSFI B-15 Unpacked:

From policy to climate risk management practice webinar

Watch panelists from ICE, CanDeal, Foresters Financial and TD as they unpack the regulation, shared practical implementation strategies, and discuss potential ways to overcome the real-world challenges of B-15 reporting.

ICE Solutions

Leveraging ICE’s extensive Regulatory Solutions suite and Climate data suite across both physical and transition risks, ICE can help with:

Provision of Scope 1, 2 and 3 emissions data for holdings and investments and corresponding PCAF Data Quality Score.

Aggregation to the template’s disclosure level (i.e. up to 25 different asset classes), region (Canadian territory, or beyond), insurance classes, NAICS sector codes.

Assessment of physical and transition risk exposure as well as with tools to embed robust climate risk management into firm strategy.

Accelerate reporting process by utilizing the ICE dedicated output formats aligned with OSFI’s templates.