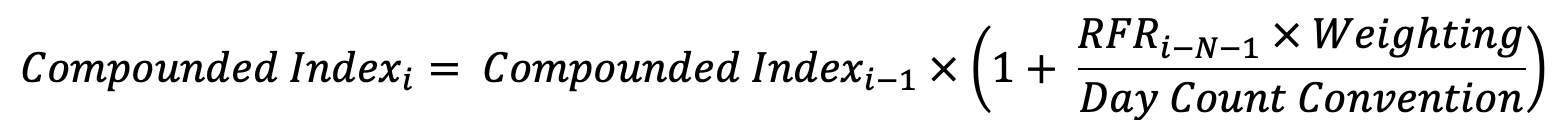

All ICE RFR Indexes use the same underlying calculation Methodology for determining index values for business days.1

Where:

| Compounded Indexi | = |

The index value for day i. All published ICE RFR Index values are rounded to 8 decimal places. Compound Index1 = 100. Day 1 for each of the ICE RFR Indexes without a lookback matches the official RFR index and is as follows:

|

||||||||||

| Compound Indexi-1 | = | The index value calculated on business day i-1. While the published value of the index is always rounded to 8 decimal places, the underlying calculation uses the previous day’s index value that has been rounded to 18 decimal places. | ||||||||||

| RFRi-N-1 | = |

Calculated and published by the relevant official body on business day i-N, where N is the number of business days lookback for the ICE RFR Index. For indexes without any lookback, N=0, and this equates to the RFR value with an effective date of i-1, i.e. the ICE RFR Index calculation on day i uses the RFR value for the previous business day, which is published on day i. For indexes with a lookback the ICE RFR Index calculation for day i uses the RFR value for N business days earlier. |

||||||||||

| Indexes using a Floor | = |

For an index with a floor, if the RFR value on the relevant business day

is below the floor value, then the floor value will be used within the

index calculation instead of the actual RFR value. For an index with a

floor the rate used in a calculation is as follows.

Maximum(floor value,RFRi-N-1) |

||||||||||

| Weighting | = |

For the calculation of ICE RFR Index values for business day i, the weighting to apply to the RFR level for business day i-N-1. The Weighting will equal the number of calendar days from business day i-1 to business day i, i.e. the number of calendar days between the previous business day and the current business day. For a typical week with no holidays, the weighting will be 1 where the previous business day is Monday through to Thursday and 3 where it is a Friday. For the calculation of ICE RFR Index values for non-business day i, the weighting to apply to the RFR for business day i-N-1 is the number of calendar days from business day i-1 to day i. For example, for an index with no lookback, if Friday is a business day then the ICE RFR Index value for Saturday is calculated using the RFR rate for Friday with a weighting of 1 and the ICE RFR Index value for Sunday is calculated using the RFR rate for Friday with a weighting of 2 |

||||||||||

| Day Count Convention | = |

360 for SOFR and €STR indexes 365 for SONIA and TONA indexes |