ICE NGX acts as the central counterparty for all cleared transactions, acting as the buyer to every seller, and the seller to every buyer.

This provides full cycle anonymity for virtually all transactions and introduces a neutral third party that ensures performance on both sides. There is no mutualized or legal relationship amongst counterparties and all collateral provided by or for a Contracting Party is used only for that Contracting Party and its Contracting Party Affiliates, and is segregated from the assets of ICE NGX and each other Contracting Party except its Contracting Party Affiliates.

ICE NGX does not currently offer customer clearing and Contracting Party collateral is therefore not subject to the CFTC requirements in respect of segregation of customer funds.

ICE NGX is committed to ensuring the security and integrity of the clearing operation and has a robust risk management plan to identify and manage risks to the ongoing operation of the clearinghouse. ICE NGX does not enter into transactions nor take positions in energy products for any reason other than to provide clearing services.

Clearing Operations & Structure

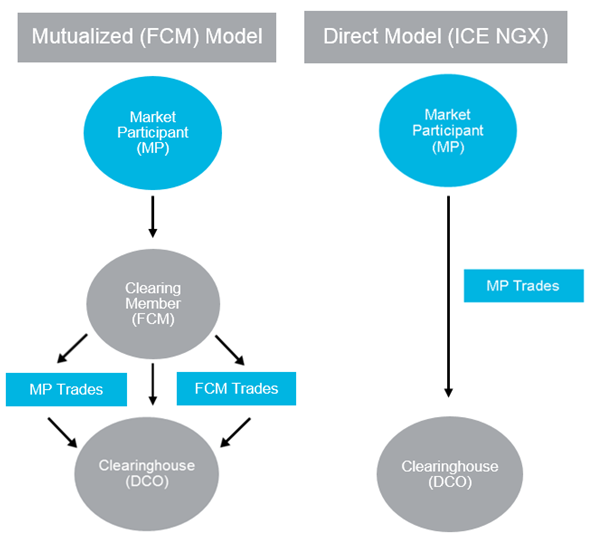

ICE NGX operates a non-mutualized, direct clearing operation, whereby all market participants clear directly without the mediation of a third party clearing member. In order to secure the clearing operation against the failure of one or more Contracting Parties, several contingencies make up ICE NGX’s clearing structure.

Margin requirements are calculated to determine the estimated cost of liquidating a Contracting Party portfolio if required in a default scenario. Margin requirements include unpaid receivables for delivered product, mark-to-market and initial margin on forward positions, as well as additional margin as deemed necessary to ensure that the clearinghouse can effectively manage a Contracting Party’s failure to perform their obligations if ever required.

In the event of a failure to perform on physical delivery, ICE NGX has the ability to backstop and provide alternate supplies or markets for physical natural gas.

In the event of a failure to perform financially, ICE NGX may draw on collateral that has been deposited by the defaulting party in support of their margin requirement. Collateral deposited by Contracting Parties may only be used to remedy a performance failure on the part of the Contracting Party who failed to perform. ICE NGX does not mutualize this performance risk across the collective group of Contracting Parties.

Guarantee Fund and Liquidity Resources

ICE NGX fully self-funds its Financial Resources, which comprises

- Guarantee Fund, default insurance provided by Export Development Canada, with USD 200 million coverage after the first loss amount of USD 15 million, plus

- ICE NGX capital, as set out in the table below (updated quarterly).

Liquidity for the guarantee fund is provided by

- a USD 200 million letter of credit issued by Royal Bank of Canada and held in trust by Royal Trust Corporation for the benefit of Contracting Parties, accessible by Contracting Parties in accordance with the Contracting Party Agreement (“CPA”)

- USD 15 million held on deposit as restricted cash to fund the first loss amount under the default insurance policy, and

- USD 30 million ICE NGX Cash

ICE NGX also maintains credit facilities and additional liquid resources to ensure that, at a minimum, all regulatory financial resources and liquidity provisions are maintained.

| Funds Available for DCO Default Waterfall (in million): | ||

|---|---|---|

| A) Guarantee Fund | $215.0 | USD |

| B) ICE NGX Capital | $40.9 | USD |

| Total Financial Resources | $255.9 |

As of November 1, 2025

2026-2027

| Financial Transactions Delivery Month | Daily Indexed Products Settlement Dates | 7A Index / Financial ERCOT Products Delivery Month | 7A Index / Financial ERCOT Products Settlement Date | Alberta Environmental Delivery Month | Alberta Environmental Settlement Date |

|---|---|---|---|---|---|

| 25/Nov | Monday, December 8, 2025 | 25/Nov | Monday, December 8, 2025 | 25/Dec | Monday, December 22, 2025 |

| 25/Dec | Friday, January 9, 2026 | 25/Dec | Friday, January 9, 2026 | 26/Jan | Tuesday, January 20, 2026 |

| 26/Jan | Monday, February 9, 2026 | 26/Jan | Monday, February 9, 2026 | 26/Feb | Friday, February 20, 2026 |

| 26/Feb | Monday, March 9, 2026 | 26/Feb | Monday, March 9, 2026 | 26/Mar | Friday, March 20, 2026 |

| 26/Mar | Thursday, April 9, 2026 | 26/Mar | Thursday, April 9, 2026 | 26/Apr | Monday, April 20, 2026 |

| 26/Apr | Friday, May 8, 2026 | 26/Apr | Friday, May 8, 2026 | 26/May | Wednesday, May 20, 2026 |

| 26/May | Monday, June 8, 2026 | 26/May | Monday, June 8, 2026 | 26/Jun | Monday, June 22, 2026 |

| 26/Jun | Thursday, July 9, 2026 | 26/Jun | Thursday, July 9, 2026 | 26/Jul | Monday, July 20, 2026 |

| 26/Jul | Tuesday, August 11, 2026 | 26/Jul | Tuesday, August 11, 2026 | 26/Aug | Thursday, August 20, 2026 |

| 26/Aug | Wednesday, September 9, 2026 | 26/Aug | Wednesday, September 9, 2026 | 26/Sep | Monday, September 21, 2026 |

| 26/Sep | Thursday, October 8, 2026 | 26/Sep | Thursday, October 8, 2026 | 26/Oct | Tuesday, October 20, 2026 |

| 26/Oct | Monday, November 9, 2026 | 26/Oct | Monday, November 9, 2026 | 26/Nov | Friday, November 20, 2026 |

| 26/Nov | Tuesday, December 8, 2026 | 26/Dec | Tuesday, December 8, 2026 | 26/Dec | Monday, December 21, 2026 |

| 26/Dec | Monday, January 11, 2027 | 27/Jan | Monday, January 11, 2027 | 27/Jan | Wednesday, January 20, 2027 |

| 27/Jan | Monday, February 8, 2027 | 27/Feb | Monday, February 8, 2027 | 27/Feb | Monday, February 22, 2027 |

Physical Transactions

Settlement Dates

2026-2027

| Calendar Month | Holiday | Holiday Observed | Physical Products Delivery Month | Physical Gas and Electricity Transactions Settlement Date |

|---|---|---|---|---|

| 25/Dec | Christmas Day | Thursday, December 25, 2025 | 25/Nov | Monday, December 29, 2025 |

| Boxing Day | Friday, December 26, 2025 | |||

| 26/Jan | New Years Day | Thursday, January 1, 2026 | 25/Dec | Monday, January 26, 2026 |

| 26/Feb | Family Day | Monday, February 16, 2026 | 26/Jan | Wednesday, February 25, 2026 |

| 26/Mar | 26/Feb | Wednesday, March 25, 2026 | ||

| 26/Apr | Good Friday | Friday, April 3, 2026 | 26/Mar | Monday, April 27, 2026 |

| 26/May | Victoria Day | Monday, May 18, 2026 | 26/Apr | Tuesday, May 26, 2026 |

| 26/Jun | 25/May | Thursday, June 25, 2026 | ||

| 26/Jul | Canada Day | Wednesday, July 1, 2026 | 26/Jun | Monday, July 27, 2026 |

| 26/Aug | Civic Day | Monday, August 3, 2026 | 26/Jul | Tuesday, August 25, 2026 |

| 26/Sep | Labour Day | Monday, September 7, 2026 | 26/Aug | Friday, September 25, 2026 |

| National Day for Truth and Reconciliation | Wednesday, September 30, 2026 | |||

| 26/Oct | Thanksgiving Day | Monday, October 12, 2026 | 26/Sep | Monday, October 26, 2026 |

| 26/Nov | Remembrance Day | Wednesday, November 11, 2026 | 26/Oct | Wednesday, November 25, 2026 |

| 26/Dec | Christmas Day | Friday, December 25, 2026 | 26/Nov | Tuesday, December 29, 2026 |

| Boxing Day | Monday, December 28, 2026 | |||

| 27/Jan | New Years Day | Thursday, January 1, 2026 | 26/Dec | Monday, January 25, 2027 |

| 27/Feb | Family Day | Monday, February 15, 2027 | 27/Jan | Thursday, February 25, 2027 |

NOTE: Daily Cash Settlement invoices will not be processed on weekends or holidays listed above. Payments will be deferred to the following business day.