What's next for bond ETFs?

What market influences will ETFs be subject to in coming months? Which asset classes and strategies are commanding attention? ICE’s Varun Pawar and BlackRock’s Gargi Pal Chaudhuri unpack these topics and the drivers behind explosive ETF growth.

The proof is in the AUM

ICE indices are the benchmark for $2.0 trillion in AUM. Over $150 billion in ETP AUM from over five different ETP sponsors has transitioned to ICE indices, including some of the largest Fixed Income and, Equity and Preferred ETPs in the market.

$2.0T

in AUM benchmarked to ICE indices

Over $7T

in ETP AUM supported by iNAV calculations

2nd ranked

globally by passive fund AUM in fixed income

6th ranked

Index provider by AUM globally

375 ETPs globally

Index benchmark provider for over

$775B

In passive fund AUM

Source: Morningstar as of October 31, 2025

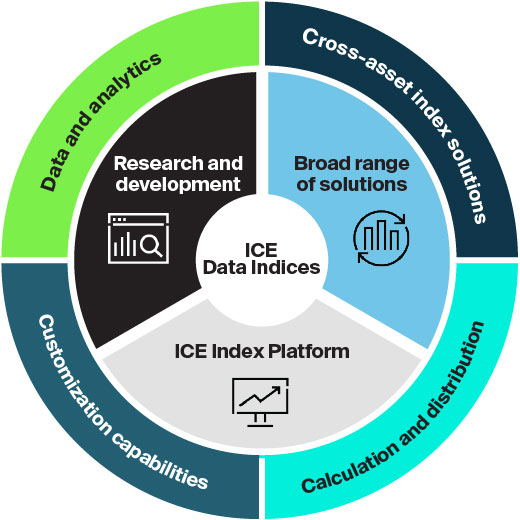

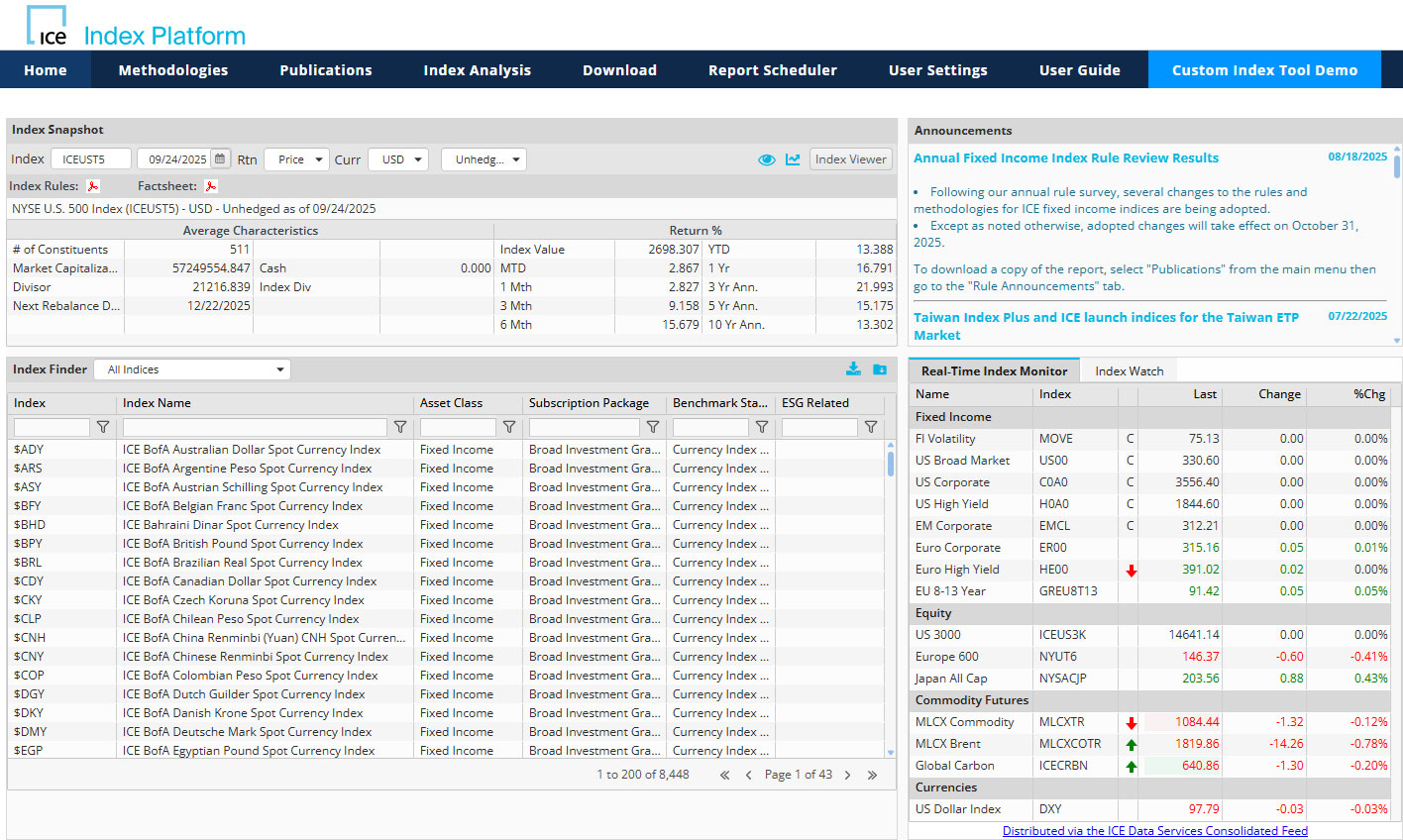

ICE Index Platform

Gain full access to top-level and constituent index data for the complete universe of the ICE Data Indices. The ICE Index Platform has extensive functionality that allows you to access current and historic index and security level performance data and statistics.

Index families

Our extensive global index offering includes over 8,500 fixed income, equity, currency, and commodity and mortgage indices that are trusted by market participants around the world and backed by a 60-year track record in index provisioning.

ICE Custom Index Tool

Design and backtest ideas for fixed income and equity indices. Build simple or complex indices - from basic blends and filtering to custom segments, caps, target weights and currency blends.

Index History Data on Snowflake Marketplace

Unlock 50 years of market data ICE provides premium cross-asset market data, including unique datasets spanning 50 years, which are now available in Snowflake, a leading marketplace. Easily access comprehensive datasets from ICE Data Indices (IDI) – historical and ongoing.

ICE Liquidity Data

ICE’s Liquidity Metrics provide a deeper understanding of tradability across fixed income segments and can be used to inform index design.

ICE iNAV calculation services

ICE iNAV (also known as IOPV or iiv) calculation service provides quality, transparent information so ETP investors can efficiently evaluate their positions, make better-informed trading decisions, and enhance their TCA.

ETP & Index Solutions

ICE delivers a comprehensive ETP offering in the marketplace supporting the needs of investors, issuers, APs, liquidity providers and custodians. From research, data, pricing and portfolio management to trading, risk analysis and performance attribution, we aim to support asset managers of all types to help design solutions within the ETP wrapper. Our product expertise, technology and data services assist you in designing and managing effective ETP solutions across the ETP lifecycle including:

NYSE

The New York Stock Exchange offers the world’s premier venue for listing and trading ETPs. Our platform is built on industry-leading technology that facilitates primary trading in nearly 75% of U.S. ETP assets and 2400 ETPs.

ICE ETF Hub

Access the ETF primary markets through the ICE ETF Hub which offers standards to simplify the creation and redemption process for all market participants.

Discover the ultimate destination for the ETP community. Search, compare, and learn about all things ETP.

Update

ICE Data Indices, LLC completes Independent Assurance of its adherence to the IOSCO Principles for Financial Benchmarks. A copy of IDI’s Management Statement of Adherence to the IOSCO Principles along with the independent accountant’s assurance report can be accessed on IDI’s Regulation page.

Resources

Related insights

Indexing: the next evolution

Varun Pawar, ICE Fixed Income & Data Services’ Chief Product Officer, spoke with The DESK about the latest trends in funds management, the use of AI, and how index providers are keeping pace with growing demand for customisation.

What’s driving the Asia-Pacific boom in ETPs

Greater appetite for fixed income ETPs and products with exposure to forces that could reshape the world economy - like artificial intelligence and automation - are underpinning demand.

ICE Custom Index Tool: Prototype and backtest custom indices

Watch this webinar on demand where we demonstrate how the ICE custom index tool will help.

Indexing: the next evolution

Varun Pawar, ICE Fixed Income & Data Services’ Chief Product Officer, spoke with The DESK about the latest trends in funds management, the use of AI, and how index providers are keeping pace with growing demand for customisation.

What’s driving the Asia-Pacific boom in ETPs

Greater appetite for fixed income ETPs and products with exposure to forces that could reshape the world economy - like artificial intelligence and automation - are underpinning demand.

ICE Custom Index Tool: Prototype and backtest custom indices

Watch this webinar on demand where we demonstrate how the ICE custom index tool will help.